[Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

The world witnessed the long-waited announcements related to successful trial results of several vaccines, which are the preliminary requisite for quick regulatory approvals that will then translate into mass production and distribution. During the last weeks of 2020 and most of 2021 oil markets will move into this new stage (related to “vaccines production and distribution”). It is likely the oil market in this new stage will respond more to news about production and distribution challenges, rather than focusing on news of infection upticks and lockdowns.

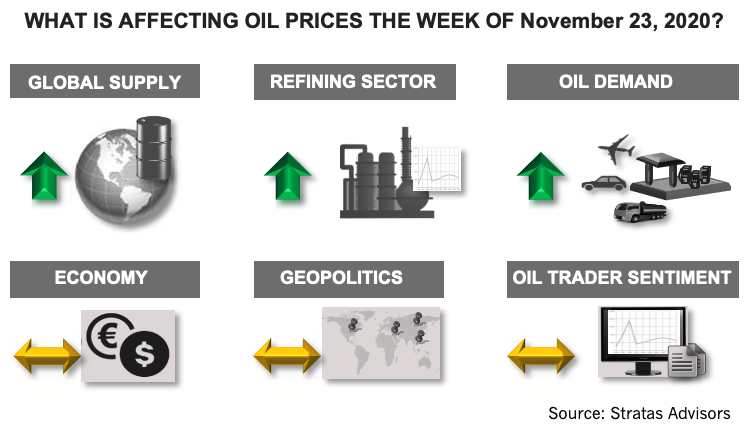

Global Supply—Positive

We are expecting that OPEC+ will announce a delay on its crude production hike originally scheduled for January 2021. Otherwise, the resulting 2 million bbl/d of crude supply would have a major negative impact on crude prices—especially in the context of a potential worldwide infection uptick resulting from the upcoming December holidays and social gatherings.

In the context of such potential announcement and the current compliance level, we see this variable as positive for this week.

Geopolitics—Neutral

Last week saw a glimpse of how the global economy is realigning with the members of the Regional Comprehensive Economic Partnership (RCEP) signing the most comprehensive free trade agreement, encompassing major oil markets like China, Japan, Singapore and Korea. It is possible that from longer-term perspective that the agreement will be supportive of greater economic growth for the region but does not have much impact in the short-term.

For the upcoming week, we expect this variable to have a neutral contribution to oil prices.

Economy—Neutral

Unemployment benefit claims increased in the U.S. for the first time in several weeks, which provides a glimpse of how the labor sector is being impacted by the additional COVID-19 infections and the renewal of localized mobility restrictions throughout the country. The lack of an additional economic stimulus approval amid the election transition bodes ill for the short-term.

For the upcoming week, we expect the economy to be neutral for oil prices.

Oil Demand—Positive

Oil consumption continues to be supportive for oil prices when considering contributions from Asia and the Americas, although Europe is a challenged demand region because of the latest lockdown measures.

Asian consumption is also underpinning prices with these economies being able to reopen their economies in a more stable manner than Europe. China particularly is importing crude at levels that have supported price differentials worldwide.

For the upcoming week, we expect this variable to be positive for oil prices, despite jitters with regards to rising infections in the U.S. and Europe.

Refining sector—Positive

While crude prices rose last week with the momentum provided by news of the successful results of different vaccines and with the likelihood of upcoming regulatory approval and worldwide production, renewed mobility restrictions in Europe made a dent on demand. The resulting weakness in the European distillates market (especially in the Mediterranean) is indicated by reports of trans-Atlantic diesel flows from Europe to the U.S.

For the upcoming week, we see this variable as positive for crude prices, in part, because of the expected additional demand for gasoline and jet fuel demand associated with the Thanksgiving weekend.

Oil Trader Sentiment—Neutral

Financial traders see improving conditions for oil markets in the short-term, as indicated by the increased Managed Net statistics for both the NYMEX and ICE crude contracts. The spread between long and short positions widened, by 10% for the U.S. light sweet contract and by a whopping 39% for the European contract versus the week prior, which is clearly a reaction to the positive announcements about vaccines.

For the upcoming week, we see this variable being neutral for oil prices with no pending economic or financial news.

About the Author:

Jaime Brito is vice president at Stratas Advisors with over 24 years of experience on refining economics and market strategies for the oil industry. He is responsible for managing the refining and crude-related services, as well as completing consulting.

Recommended Reading

US Orders Most Companies to Wind Down Operations in Venezuela by May

2024-04-17 - The U.S. Office of Foreign Assets Control issued a new license related to Venezuela that gives companies until the end of May to wind down operations following a lack of progress on national elections.

EU Expected to Sue Germany Over Gas Tariff, Sources Say

2024-04-17 - The German tariff is a legacy of the European energy crisis that peaked in 2022 after Moscow slashed gas flows to Europe and an undersea explosion shut down the Nord Stream pipeline.

Pemex to Remain Fiscally Challenged for Mexico’s Next President

2024-04-16 - S&P Global Ratings said Pemex will remain a fiscal challenge for the country’s next president, adding that continued cautious macroeconomic management was key in its ratings on both Mexico and Pemex.

Yellen Expects Further Sanctions on Iran, Oil Exports Possible Target

2024-04-16 - U.S. Treasury Secretary Janet Yellen intends to hit Iran with new sanctions in coming days due to its unprecedented attack on Israel.