(Source: Shutterstock.com; image of 2020 U.S. presidential debate courtesy of Devi Bones / Shutterstock.com)

[Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

Oil prices might have overreacted last week, as strictly speaking, there were no additional variables deterring consumption. The main concern for oil market participants was the new wave of mobility restrictions imposed in several European countries. This week could be just as volatile, but for different reasons: in case the results of the U.S. election are atypically late and financial markets decide to focus on uncertainty and instability rather on waiting for the winner to be announced.

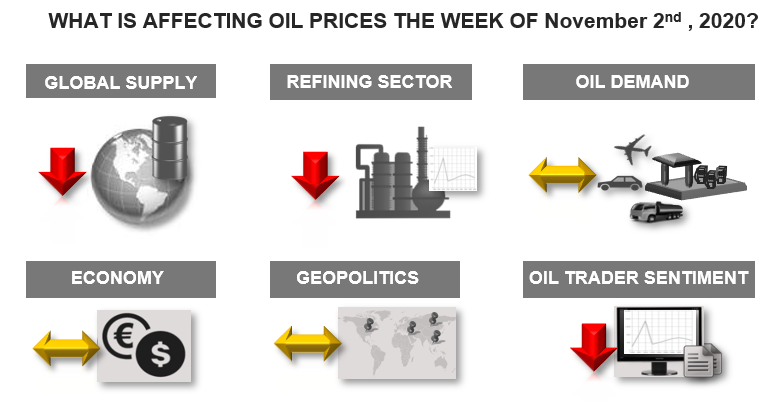

Global Supply—Negative

The most recent report by the U.S. Energy Information Administration provided evidence that U.S. crude supply increased by a whopping 1.2 million bbl/d vs. the prior week, which bring the absolute production number to 11.1 million bbl/d.

All this, paired with the marginal consumption impact of the recent European lockdowns, provide a pessimistic perspective for this variable.

Geopolitics—Neutral

The beginning of the week saw an important development unfolding, as Secretary Pompeo announced a new round of sanctions pertaining to Iran. This announcement, however, was overshadowed by coverage of the Presidential election, and did not have much impact on oil prices.

For the upcoming week, we expect this variable to have a neutral impact on oil prices.

Economy—Neutral

Economic results released last week showed that the US economy grew substantially in the third quarter (33.1% versus second-quarter), but this growth was not enough to offset the losses from the second quarter, when the full impact of COVID was felt by the world’s largest economy. The rebound in growth, however, can be interpreted as positive news because it indicates that the economic stimulus package and partial re-openings across the U.S. have allowed many economic sectors to gain momentum, which underpinned demand for refined products.

For the upcoming week, we see this variable as neutral.

Oil Demand—Neutral

The most recent crude price adjustment has been related to economic and financial jitters on the back of the European COVID situation, and the potential effect in global demand.

For the upcoming week, we see oil demand as a neutral factor for oil prices. There is the risk, however, that the financial markets could have a more bearish view than warranted by the fundamentals.

Refining sector—Negative

As crude prices gradually trended downward last week, refining margins showed a moderate increase, particularly in the U.S., thanks to the relative stability of product prices. Asian refining margins have improved over the last week as well, thanks to stronger product prices and cheaper feedstock

For the upcoming week, we expect this variable to have a negative contribution to crude prices with reduced utilization rates in Europe.

Oil Trader Sentiment—Negative

Trading sentiment was particularly bearish last week, which saw one of the largest declines in open interest for refined products. Participation in the RBOB contract was down by -3% and for the ULSD contract -7%.

For the upcoming week, we expect this variable will be negative, in part, because of the uncertainty associated with the U.S. elections.

About the Author:

Jaime Brito is vice president at Stratas Advisors with over 24 years of experience on refining economics and market strategies for the oil industry. He is responsible for managing the refining and crude-related services, as well as completing consulting.

Recommended Reading

The OGInterview: Petrie Partners a Big Deal Among Investment Banks

2024-02-01 - In this OGInterview, Hart Energy's Chris Mathews sat down with Petrie Partners—perhaps not the biggest or flashiest investment bank around, but after over two decades, the firm has been around the block more than most.

Kissler: OPEC+ Likely to Buoy Crude Prices—At Least Somewhat

2024-03-18 - By keeping its voluntary production cuts, OPEC+ is sending a clear signal that oil prices need to be sustainable for both producers and consumers.

Petrie Partners: A Small Wonder

2024-02-01 - Petrie Partners may not be the biggest or flashiest investment bank on the block, but after over two decades, its executives have been around the block more than most.

Buffett: ‘No Interest’ in Occidental Takeover, Praises 'Hallelujah!' Shale

2024-02-27 - Berkshire Hathaway’s Warren Buffett added that the U.S. electric power situation is “ominous.”

BP Restructures, Reduces Executive Team to 10

2024-04-18 - BP said the organizational changes will reduce duplication and reporting line complexity.