[Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

There are three additional variables which oil markets are not used to deal with in the fourth quarter: the current infections uptick in Europe, the U.S. presidential transition and announcements about new vaccines, all of them adding bearish or bullish pressure to prices over the next few months.

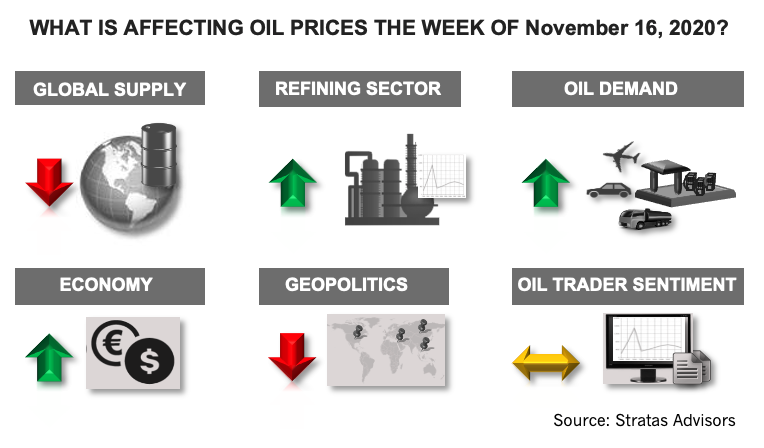

Global Supply—Negative

For this week we see a negative factor for oil prices is the soaring Libya crude production, which could exceed 1.1 million b/d. On the other hand, compliance with the OPEC+ agreement appears to be above 100% in total, even when taking into consideration the few countries that are not fulfilling their obligations.

Therefore, for the upcoming week, we expect this variable will be negative for oil prices.

Geopolitics—Negative

As expected, concerns about geopolitics will be heightened until the U.S. presidential transition can be settled. The current U.S. administration signed an executive order this week to impose restrictions on investments in private companies that are allegedly doing business with the Chinese military.

For the upcoming week, we expect this variable to be a negative factor for oil prices because of the impact of further tension between the U.S. and China on the equity markets.

Economy—Positive

In spite of the ongoing pandemic, the most recent unemployment numbers in the U.S. signal an unequivocal recovery trend. Less people are filing for unemployment benefits, which is evidence that jobs market continue to heal.

For the upcoming week, we see this variable providing a positive contribution to oil prices.

Oil Demand—Positive

In one of the most positive weeks of the year so far, U.S. domestic consumption was reported to reach 20.18 million bbl/d, which puts U.S. consumption within the five-year average, a jaw-dropping achievement when considering the ongoing concerns from the pandemic.

While consumption in the European market is poised to be challenging during the upcoming weeks, we expect oil demand to be a positive contribution to oil prices this week, given the relatively strong demand associated with the U.S. and Asian markets.

Refining sector—Positive

Global refining margins in general improved last week when compared to the prior week, even in Europe, despite Brent price increases. Robust demand for diesel fuel and gasoil underpinned product prices, which is a trend we expect to continue.

For the upcoming week we see this variable as a positive for crude prices.

Oil Trader Sentiment—Neutral

Activity in the oil trading community was impacted last week by both the positive news about the vaccination and the negative perspective that the new mobility restrictions in Europe will have for oil demand and prices. Because of this we consider this a neutral variable for this week.

As of this morning, the CFTC has not updated the Nov. 10 Commitment of Traders Report, so we will flesh out the latest open interest movements next week.

About the Author:

Jaime Brito is vice president at Stratas Advisors with over 24 years of experience on refining economics and market strategies for the oil industry. He is responsible for managing the refining and crude-related services, as well as completing consulting.

Recommended Reading

BP Restructures, Reduces Executive Team to 10

2024-04-18 - BP said the organizational changes will reduce duplication and reporting line complexity.

Matador Resources Announces Quarterly Cash Dividend

2024-04-18 - Matador Resources’ dividend is payable on June 7 to shareholders of record by May 17.

EQT Declares Quarterly Dividend

2024-04-18 - EQT Corp.’s dividend is payable June 1 to shareholders of record by May 8.

Daniel Berenbaum Joins Bloom Energy as CFO

2024-04-17 - Berenbaum succeeds CFO Greg Cameron, who is staying with Bloom until mid-May to facilitate the transition.

Equinor Releases Overview of Share Buyback Program

2024-04-17 - Equinor said the maximum shares to be repurchased is 16.8 million, of which up to 7.4 million shares can be acquired until May 15 and up to 9.4 million shares until Jan. 15, 2025 — the program’s end date.