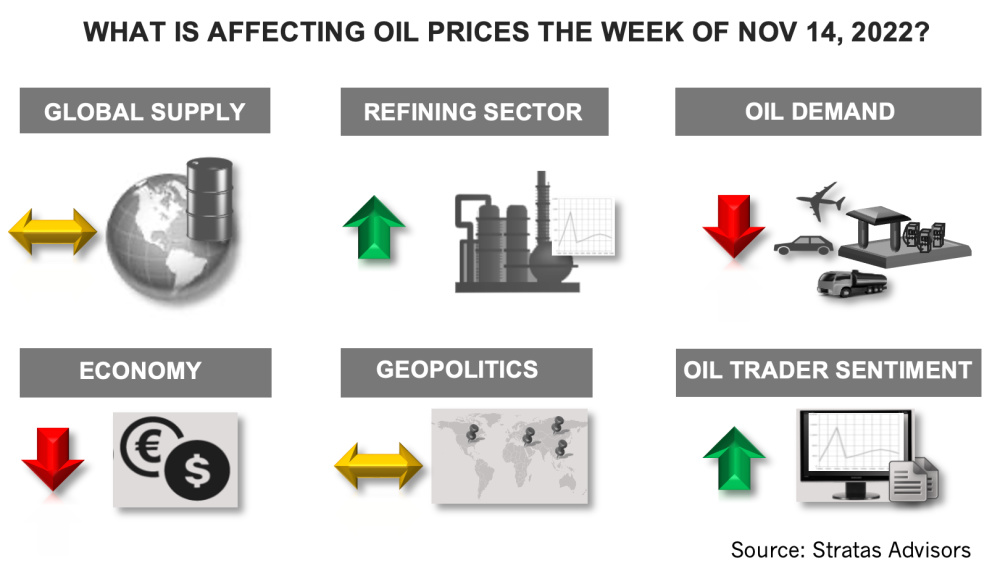

Last week in its oil price forecast Stratas Advisors highlighted that there were still several factors that are hindering oil prices from moving higher—and after last week, these factors remain relevant and, in the firm’s view, unchanged. (Source: Shutterstock.com)

Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

The price of Brent crude ended the week at $95.99 after closing the previous week at $98.75. The price of WTI ended the week at $88.96 after closing the previous week $92.61. Crude prices fell in comparison to the previous week even after bouncing upwards in response to the favorable inflation report for the U.S. coupled with health authorities in China announcing some minor loosening of COVID-19 restrictions. The price of Brent crude remains below the upper resistance level of $98 and the 200-day moving average.

Last week we highlighted that there were still several factors that are hindering oil prices from moving higher—and after last week, these factors remain relevant and, in our view, unchanged.

Weakening Economic Conditions

The latest release from the Bureau of Labor of indicated that the consumer price index (CPI) increased by 0.4% during October and 7.7% in comparison with the previous year. The core CPI, which excludes food and energy, increased by 0.3% during October and 6.3% in comparison with the previous year. Both indexes increase less than during September and continues the downward trend that began after June of this year when the CPI increased by 9.0% on a year-on-year basis. In response to the better-than-expected report the market is anticipating that the Federal Reserve will become less aggressive in implementing a tighter monetary policy and that the Federal Reserve is close to ending interest rate increases. The U.S. dollar also weakened with the U.S. Dollar Index decreasing from 110.79 to 106.42 which is the lowest level since mid-August of this year. While we expect that the inflation will trend downward, the inflation remains well above the 2.0% target set by the Federal Reserve. As such, we still hold to our view that the Federal Reserve will continue to raise interest rates including at its next meeting which is to be held on Dec. 13. We expect at least another rate increase of 50 basis points or more even though there are increasing concerns that U.S. economy will move into a recession during the fourth quarter.

European economies continue to struggle, and the European Commission is forecasting that the EU will have negative economic growth in the fourth quarter and the first quarter of next year. Three countries are expected to have negative economic growth in 2023 (Germany, by 0.6%, Latvia, by 0.3%, and Sweden, by 0.6%). Inflation is expected to be 8.5% in 2022 and 6.1% in 2023, which is significantly higher than the previous forecast of 7.6% and 4% respectively. Unemployment is expected to reach 6.5% in the EU in 2023.

While some believe that China is planning to loosen COVID-related restrictions in a major way, we are still holding to our position that China will keep COVID-related restrictions in place through at least March of next year. The recent developments in China offer a mixed picture with cases in China increasing at record levels in Beijing, Guangzhou, and Zhengzhou, while Chinese health authorities reduced the quarantine times for close contacts of cases and inbound travelers by two days and eliminated a penalty on airlines for bringing in infected passengers.

Muted Demand Growth

The latest weekly report from the Energy Information Administration (EIA) indicates that gasoline demand in the U.S. increased to 9.01 million bbl/d from the previous week of 8.66 million bbl/d. In comparison, for the same period of the previous year, gasoline demand was 9.26 million bbl/d. Based on the four-week average, current gasoline demand is running 648,000 bbl/d less than for the same period of 2019, which represents a difference of 6.84%. Diesel demand in the U.S. decreased to 4.16 million bbl/d from the previous week of 4.26 million bbl/d. In comparison, for the same period of the previous year, diesel demand was 4.28 million bbl/d. Based on the four-week average diesel demand is running 158,000 bbl/d less than in same period of 2019, which represents a difference of 3.7%. Jet fuel demand increased to 1.55 million bbl/d from the previous week of 1.31 million bbl/d. In comparison, for the same period of the previous year, jet fuel demand was 1.5 million bbl/d. Based on the four-week average, jet fuel demand is running 348,000 bbl/d less than in 2019, which is 19% less.

On average, we are forecasting that global demand will increase by 2.2 million bbl/d in 2022. For the fourth quarter, we are forecasting that demand will increase by 1.1 million bbl/d in comparison to the third quarter.

Adequate Oil Supply

From a global perspective, we are forecasting the oil demand will slightly outpace oil supply in the fourth quarter (by around 240,000 bbl/d, excluding any changes pertaining to inventories held in strategic reserves) but will shift to a slight surplus with supply outpacing demand in the first quarter of 2023 and continue to do so throughout 2023. As part of this forecast is the expectation that OPEC+ will continue to manage supply to align with demand considering the production capabilities of OPEC+ members. Recently there has been some positive news with respect to OPEC+ production including Nigeria’s production increasing above 1 million bbl/d for the first time since July of this year. Additionally, Libya’s production has risen to 1.2 million bbl/d which is a doubling of production of three months ago. Furthermore, Iraq has been indicating the intention to increase its production to secure an increased share of OPEC’s oil production. The Iraqi Prime Minister also stated that Iraq wants to keep oil prices below the $100 level.

As we have previously highlighted, U.S. and its G7 allies continue to contemplate the implementation of a price cap on Russia’s oil exports. The cap is planned to take effect Dec. 5 with respect to seaborne oil shipments and on Feb. 5 with respect to oil products. It has been reported that the G7 allies have agreed to setting a fixed price on Russia oil exports in the range of the mid-$60s. The plan also includes the ban on western oil transport services (insurance, finance and brokering) for oil cargoes priced above the fixed price.

We continue to hold to the view that the price cap is not practical for several reasons:

- There is sufficient capacity in the tanker fleet to allow Russia to bypass the use of vessels that would be affected by price cap. Additionally, it is being reported that some other ships are changing their countries of origin so as not be affected by the price cap.

- While 90% of protection and indemnity (P&I) insurance is provided by EU-based entities, the vessels that will be used to avoid the price cap can be self-insured or obtain insurance from Russian P&I providers—or P&I providers based in Asia.

- Additionally, oil trading involving Russian oil is increasingly shifting from Europe to the Middle East and Asia.

- Collectively, the above developments will undermine the western control of the oil markets, which is a structural shift.

In addition to the above factors, the biggest factor that is undermining the price cap is that major importers of crude oil, such as India and China, cannot afford to put their economies in jeopardy by risking the potential of not being able to access their required imports of oil. Consequently, we are still holding to our view that price cap and other sanctions will have limited impact on Russian oil exports and that Russia’s oil production will average only around 400,000 bbl/d less in 2023 than in 2022.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Kimmeridge Fast Forwards on SilverBow with Takeover Bid

2024-03-13 - Investment firm Kimmeridge Energy Management, which first asked for additional SilverBow Resources board seats, has followed up with a buyout offer. A deal would make a nearly 1 Bcfe/d Eagle Ford pureplay.

Laredo Oil Subsidiary, Erehwon Enter Into Drilling Agreement with Texakoma

2024-03-14 - The agreement with Lustre Oil and Erehwon Oil & Gas would allow Texakoma to participate in the development of 7,375 net acres of mineral rights in Valley County, Montana.

SLB’s ChampionX Acquisition Key to Production Recovery Market

2024-04-19 - During a quarterly earnings call, SLB CEO Olivier Le Peuch highlighted the production recovery market as a key part of the company’s growth strategy.

NOV's AI, Edge Offerings Find Traction—Despite Crowded Field

2024-02-02 - NOV’s CEO Clay Williams is bullish on the company’s digital future, highlighting value-driven adoption of tech by customers.

Hess Corp. Boosts Bakken Output, Drilling Ahead of Chevron Merger

2024-01-31 - Hess Corp. increased its drilling activity and output from the Bakken play of North Dakota during the fourth quarter, the E&P reported in its latest earnings.