The week ahead will be driven by sentiment more than fundamentals, with funds likely to continue unwinding bullish positions. Ideally, a reasonable floor will be quickly found but more likely prices will fluctuate throughout the next two weeks as markets seek a price that balances potential disruptions against current production.

Topic Of Interest

The supply problems dominating headlines last week are now old news, although many of the actual outages persist. Venezuela, Iran, Libya and even Russia, all have very real on-the-ground issues. All of these problems were forgotten when United States production posted another record breaking weekly number, with EIA estimates placing production at 12.3 MMbbl/d in the week ended April 26.

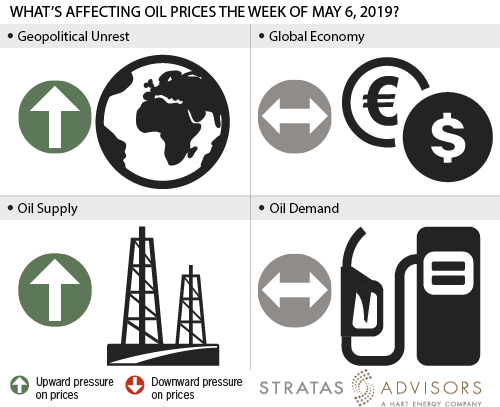

Geopolitics: Positive

Geopolitics will be a positive factor in the week ahead. The end of Iran sanctions waivers officially came into effect, meaning any shipments transiting the region will be under a microscope as markets attempt to assess compliance levels. Fighting in Libya continues, and without international intervention, could continue through the summer, impeding flows.

Global Economy: Neutral

The global economy will be a neutral factor in the week ahead. The U.S. dollar is at a nearly two-year high supported by strong US capital goods orders and strong GDP. Although a strong dollar can weigh on crude prices, the overall healthy numbers bode well for demand.

Oil Supply: Negative

Supply will be a negative factor in the week ahead as markets suddenly remembered the juggernaut that is US production. While supply issues persist, their impact will be seen in differentials more than headline Brent in the week ahead.

Oil Demand: Neutral

While strong, oil demand is likely to be a neutral factor in the week ahead. Demand in India and surrounding countries could be impacted by Cyclone Fani, but this will be temporary. Elsewhere, demand remains generally healthy, but mixed. The U.S. saw distillate demand drop, although stocks continued to fall, likely due to heavy refinery maintenance. In Europe, total product stocks have bumped above the five-year average, due to builds in jet fuel and gasoil, although these builds appear to be slowing.

Recommended Reading

Shell Taps Bloom Energy’s SOEC Technology for Clean Hydrogen Projects

2024-03-07 - Shell and Bloom Energy’s partnership will investigate decarbonization solutions with the goal of developing large-scale, solid oxide electrolyzer systems for use at Shell’s assets.

Baker Hughes Marks Hydrogen Milestones

2024-01-29 - The energy technology company is involved with several hydrogen projects as it works to accelerate the hydrogen economy.

Tangled Up in Blue: Few Developers Take FID on Hydrogen Projects

2024-04-03 - SLB, Linde and Energy Impact Partners discuss hydrogen’s future and the role natural gas will play in producing it.

John Cockerill Americas President Talks Hydrogen, Electrolyzers

2024-03-06 - Nicolas de Coignac, president of Americas for John Cockerill, recently spoke with Hart Energy about the company’s role in scaling electrolytic hydrogen in the U.S.

Mitsubishi, Chevron Overcome Hydrogen, Storage Project Woes

2024-03-21 - ACES Delta developers say the project remains on track for 2025 startup, despite previous supply chain obstacles.