Another factor Stratas Advisors says is affecting the oil market are statements coming from Iran’s president, Hassan Rouhani, implying that the removal of sanctions by the U.S. was a done deal. (Source: Hart Energy)

[Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

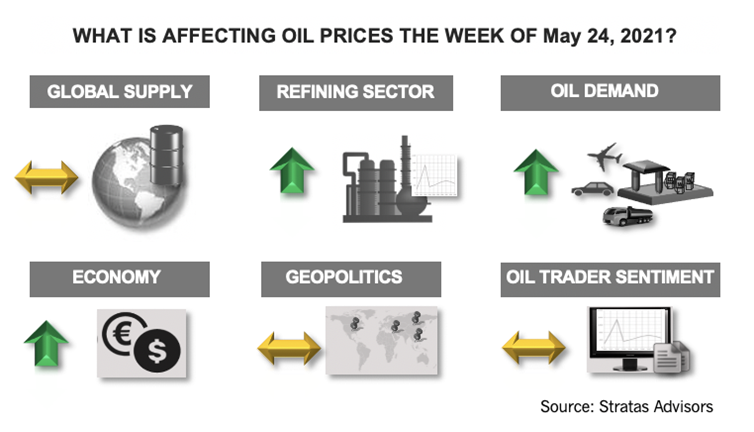

The price of Brent crude oil ended the week at $66.73 after closing the previous week at $68.83. During the week there was significant volatility with the price of Brent crude oil reaching $69.46 on May 17, then falling to $65.11 on May 20, before rebounding on May 21. The price of WTI ended the week at $63.88 after closing the previous week at $65.57 after going through similar price gyrations.

One factor affecting the oil market were statements coming from the president of Iran (Hassan Rouhani) during the middle of the week implying that the removal of sanctions was a done deal. However, western sources have indicated that there are still hurdles to overcome and that once these are cleared it is more likely that the sanctions will be lifted in phases.

There are also concerns about demand because of the recent uptick in COVID-19 in countries throughout Asia. However, while there still are uncertainties it appears that the region is moving forward, including India as indicated by the announcement that New Delhi will be easing restrictions with the number of COVID-19 cases declining. Additionally, the economy of U.S.—and now the economies of the eurozone—are seeing accelerated growth. With the economic growth oil demand is also picking up. The latest weekly report from the Energy Information Administration indicates that gasoline demand in the U.S. averaged 9.22 million bbl/d, which compares to 8.80 million bbl/d of the previous week. The level of 9.22 million bbl/d is the highest level since December 2019 during the holiday season. Additionally, the gasoline demand is only 205,000 bbl//d (about 2%) less than in than for the same period in 2019. U.S. diesel demand continues to remain strong at 4.06 million bbl/d—and greater than demand for the same period of 2019 (3.79 million bbl/d).

Another development that occurred last week was the International Energy Agency (IEA) issuing on May 17 a report providing a pathway for reaching net zero emissions by 2050, which included the recommendation that investors should not fund new oil and gas projects. The pathway put forward by IEA, if adopted, would have significant consequences for the oil markets—both in the short-term and long-term—including intended consequences and unintended consequences. We will address the IEA in a separate analysis in the upcoming days.

RELATED:

IEA Report: Achieving Net-Zero Necessitates Huge Job, Investment Cuts for Fossil Fuels

One economic factor we are watching closely is the U.S. Dollar Index. As we highlighted last week, when the U.S. Dollar Index falls below 85 oil prices are pushed up toward $100 and beyond. Last week, the U.S. Dollar Index declined from 90.32 to 90.03. Currently, the US Dollar Index is very near the key support level of 90.0. If the U.S. Dollar Index breaks through the support level, the next support level is at 80. However, the U.S. Dollar Index has recently touched this level three times before last week—in the second half of February, early January, and the middle of December 2020—and each time the U.S. Dollar Index did not break through the support. With the U.S. economy continuing to strengthen we think the most likely scenario is that the US Dollar Index will stabilize and then move higher as the year goes on.

Before last week, the price of Brent crude has been holding above the trendline since the end of January with the price of Brent moving upward through that period. However, the price of Brent crude broke through the trendline on May 19, but then ended the week essentially on the trendline.

For the upcoming week, we are expecting that oil prices will move upwards with traders moving back to a more bullish posture after the prior two weeks during which traders reduced their net long positions to the lowest level since the end of last year.

About the Author:

John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Equitrans Delays WV-VA Mountain Valley Natgas Pipe Again, Boosts Cost

2024-02-20 - U.S. energy firm Equitrans Midstream delayed the estimated completion of its Mountain Valley natural gas pipeline from West Virginia to Virginia to the second quarter from the first quarter due in part to adverse weather in January.

Hess Midstream Announces 10 Million Share Secondary Offering

2024-02-07 - Global Infrastructure Partners, a Hess Midstream affiliate, will act as the selling shareholder and Hess Midstream will not receive proceeds from the public offering of shares.

EQT CEO: Biden's LNG Pause Mirrors Midstream ‘Playbook’ of Delay, Doubt

2024-02-06 - At a Congressional hearing, EQT CEO Toby Rice blasted the Biden administration and said the same tactics used to stifle pipeline construction—by introducing delays and uncertainty—appear to be behind President Joe Biden’s pause on LNG terminal permitting.

TC Energy’s Keystone Back Online After Temporary Service Halt

2024-03-10 - As Canada’s pipeline network runs full, producers are anxious for the Trans Mountain Expansion to come online.

Enbridge Announces $500MM Investment in Gulf Coast Facilities

2024-03-06 - Enbridge’s 2024 budget will go primarily towards crude export and storage, advancing plans that see continued growth in power generated by natural gas.