The price of Brent crude ended the week at $75.38 and the price of WTI ended the week at $71.55. (Source: Shutterstock.com)

The price of Brent crude ended the week at $75.38 after closing the previous week at $74.17. The price of WTI ended the week at $71.55 after closing the previous week at $70.33.

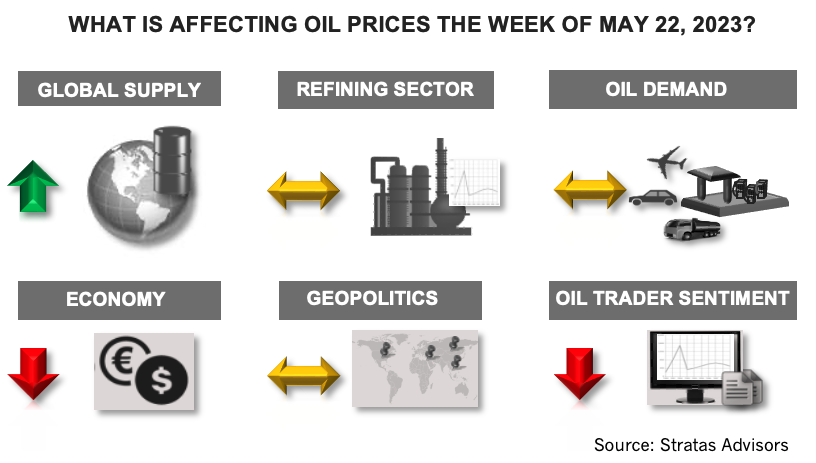

Oil prices increased despite several developments that are negative for oil prices:

- The U.S. debt limit is still not resolved and negotiations between the Republicans and the Biden Administration broke off during the last week.

- Commercial crude inventories in the U.S. increased by 5.04 million barrels.

- The level of inventories in the Strategic Petroleum Reserve (SPR) decreased by 2.43 million, which represents the seven consecutive weeks of releases from the SPR

We are still holding our view that the price of Brent crude oil will move toward $90 during the second half of the year based on our reference forecast of supply/demand and other factors – with the caveat that there is more downside risk than upside risk associated with the forecast.

These risks are associated mainly with the demand side of the equation and recent data continues to highlight these risks.

- The U.S. consumer is still facing the combination of falling wages, high debt levels and inflation. The extent of the latter is illustrated by food prices having increased by more than 20% over the last two years, according to the CEO of Walmart, the U.S.’ largest retailer.

- The U.S. 10-year treasury ended last week at 3.658%. In comparison, the 10 year was at 4.073% at the beginning of March and 4.226% on October 19, 2022. The yield curve remains inverted with 2-year treasury at 4.252% and the 1-year treasury at 5.008%. An inverted yield curve is seen as a sign of the economy being on the verge of a recession.

- The EU commission is forecasting that Germany’s economic growth will only be 0.2%, while the entire EU is forecasted to grow at around 0.8% during 2023.

- With respect to China, foreign direct investment in China decreased by 3.3% during the January through April. China’s economic growth continues to be hampered by weak domestic demand and weak demand for exports. Additionally, China’s youth jobless rate (age 16 – 24) has reached 20%, which is an all-time high.

The supply-side of the equation, however, looks more supportive. Last week, the number of operating oil rigs in the U.S. decreased by 11 and now stands at 575 rigs, which compares to the pre-COVID level of 683 that occurred during the week of March 13, 2020. The number of operating oil rigs in Canada increased by 2 and now stands at 39, which compares to 40 operating rigs for the same period of the previous year.

The additional supply cuts of 1.16 MMbbl/d that were previously announced by OPEC+ appear to have been initiated with the combined exports from Saudi Arabia, UAE, Kuwait, Iraq, Algeria, and Gabon decreasing by 1.0 MMbbl/d during the last two weeks according to shiptracking data. Further support for the supply reductions comes from the oil minister of Iraq and the minister of energy from Russia stating last Friday their mutual commitment to oil production cuts and the OPEC+ agreement.

Based on the production cuts along with our forecast demand, the oil supply/demand balance will shift into a deficit during the second half of the year.

For the upcoming week, we are expecting that the U.S. debt limit will continue to be a source of uncertainty and the equity markets as well as the oil market will be affected by the ongoing developments. As such, signs of a positive resolution to the debt limit will provide upward support for oil prices. At this time, however, it appears that both sides are willing to continue with the negotiating process up until the final days before the U.S. Treasury starts to run out of money, which the U.S. Treasury Department says will occur on June 1. Current sticking points include adding work requirements to benefit programs, spending reductions, tax policies and a provision to ease the federal permitting process associated with energy projects.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Battalion in Compliance with NYSE American after 2023 Meeting

2024-02-13 - Previously, Battalion Oil was not in compliance with the NYSE after failing to hold an annual meeting of stockholders during the fiscal year ending Dec. 31.

SilverBow Rejects Kimmeridge’s Latest Offer, ‘Sets the Record Straight’

2024-03-28 - In a letter to SilverBow shareholders, the E&P said Kimmeridge’s offer “substantially undervalues SilverBow” and that Kimmeridge’s own South Texas gas asset values are “overstated.”

enCore Energy Appoints Robert Willette as Chief Legal Officer

2024-02-01 - enCore Energy’s new chief legal officer Robert Willette has over 29 years of corporate legal experience.

Magnolia Appoints David Khani to Board

2024-02-08 - David Khani’s appointment to Magnolia Oil & Gas’ board as an independent director brings the board’s size to eight members.

W&T Offshore Adds John D. Buchanan to Board

2024-04-12 - W&T Offshore’s appointment of John D. Buchanan brings the number of company directors to six.