Given the negative news about global economy and the pessimism about future economic growth, it is possible that the price of Brent crude will break below the support level of $98 and then continue to fall below $90, according to Stratas Advisors. (Source: Shutterstock.com)

Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

The price of Brent crude ended the week at $107.22 after closing the previous week at $106.65. The price of WTI ended the week at $104.69 after closing the previous week at $102.07.

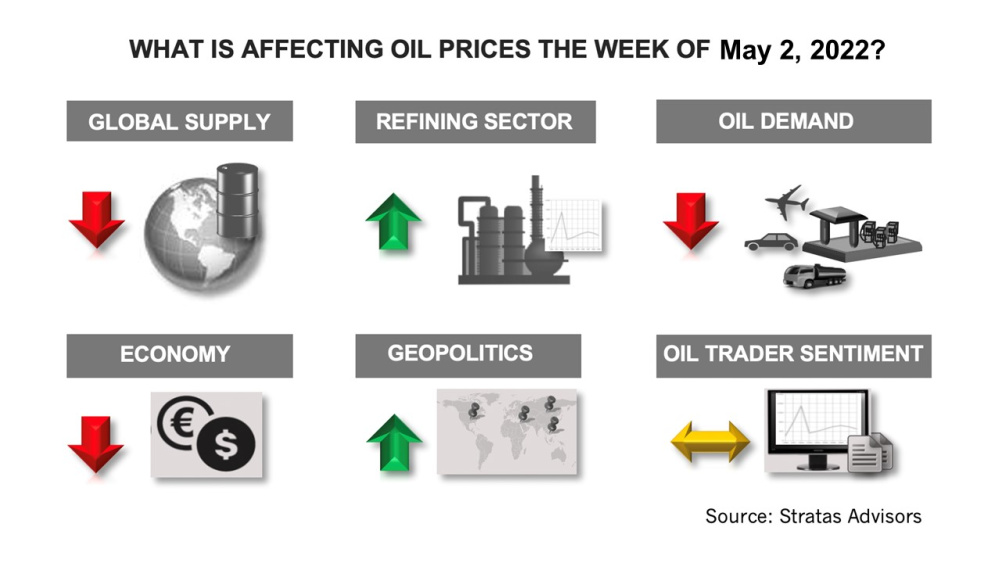

Since Feb. 25, the price of Brent crude continues to go through cycles of lower highs before the price of Brent crude retreats to the lower support level, and it appears that a similar pattern has happened for the fourth such cycle. Given the negative news about global economy and the pessimism about future economic growth, it is possible that the price of Brent crude will break below the support level of $98 and then continue to fall below $90. The likelihood of this occurring continues to grow the longer there is no actual fundamental change in the supply picture for crude oil.

Furthermore, there continue to be downside risks associated with oil demand because of the possibility of an economic slowdown:

- During the first quarter of 2022, the U.S. economy declined by 1.4% on an annualized basis and shrunk by 0.4% from the previous quarter. Economic growth was affected by decreases in inventory investments and defense spending coupled with a record-level trade deficit. These negative factors outweighed the increase in consumer spending, which grew by 2.7%. In addition to the negative growth, the GDP price index deflator increased by 8.0% and the personal consumption expenditures price index, excluding food and energy, increased by 5.2%.

- The economies of the Eurozone grew by only 0.2% during first-quarter 2022. Additionally, future growth will be hampered by higher energy prices and supply disruptions.

- China’s economy is also showing weakness with the official manufacturing Purchasing Managers' Index (PMI) declining to 47.4 in April from 49.5 in March. The reported PMI is the second consecutive month of declines with China’s economy being negatively affected by a troubled real estate sector and lockdowns associated with COVID-19.

Further downward pressure is placed on the oil price by the strength of the U.S. dollar, which is indicated by the U.S. Dollar Index reaching 102.96. This is the highest level for the U.S. Dollar Index since the second half of 2002 when the price of Brent crude was around $25.

There are also increasing risks associated with food supply, which is highlighted by the elevated costs of agricultural commodities. The price of corn has increased to more than $8 per bushel, which is near a record high. In comparison, from mid-2014 through 2020, the price of corn remained between $3.25 and $4.25. The price of soybeans is also extremely high with the price reaching $1.685.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

E&P Earnings Season Proves Up Stronger Efficiencies, Profits

2024-04-04 - The 2024 outlook for E&Ps largely surprises to the upside with conservative budgets and steady volumes.

Hess Corp. Boosts Bakken Output, Drilling Ahead of Chevron Merger

2024-01-31 - Hess Corp. increased its drilling activity and output from the Bakken play of North Dakota during the fourth quarter, the E&P reported in its latest earnings.

Petrie Partners: A Small Wonder

2024-02-01 - Petrie Partners may not be the biggest or flashiest investment bank on the block, but after over two decades, its executives have been around the block more than most.

CEO: Coterra ‘Deeply Curious’ on M&A Amid E&P Consolidation Wave

2024-02-26 - Coterra Energy has yet to get in on the large-scale M&A wave sweeping across the Lower 48—but CEO Tom Jorden said Coterra is keeping an eye on acquisition opportunities.

Endeavor Integration Brings Capital Efficiency, Durability to Diamondback

2024-02-22 - The combined Diamondback-Endeavor deal is expected to realize $3 billion in synergies and have 12 years of sub-$40/bbl breakeven inventory.