One favorable factor for oil prices is the refining sector with refining margins remaining elevated with tight supplies and declining inventories, Stratas Advisors said in its latest price forecast. (Source: Shutterstock.com)

Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

The price of Brent crude ended the week at $111.33 after closing the previous week at $112.36. The price of WTI ended the week at $110.49 after closing the previous week at $109.77. The price movement aligned with our expectations that oil prices would move sideways if the EU did not reach an agreement to ban imports of Russian oil without a completed breakdown in the negotiations.

Since February 25, the price of Brent crude (and WTI) has been going through cycles of lower highs before the price retreats to the lower support level. The question remains—when will the price of oil break out of this pattern and which way will it break—below the lower support level or upwards to new highs?

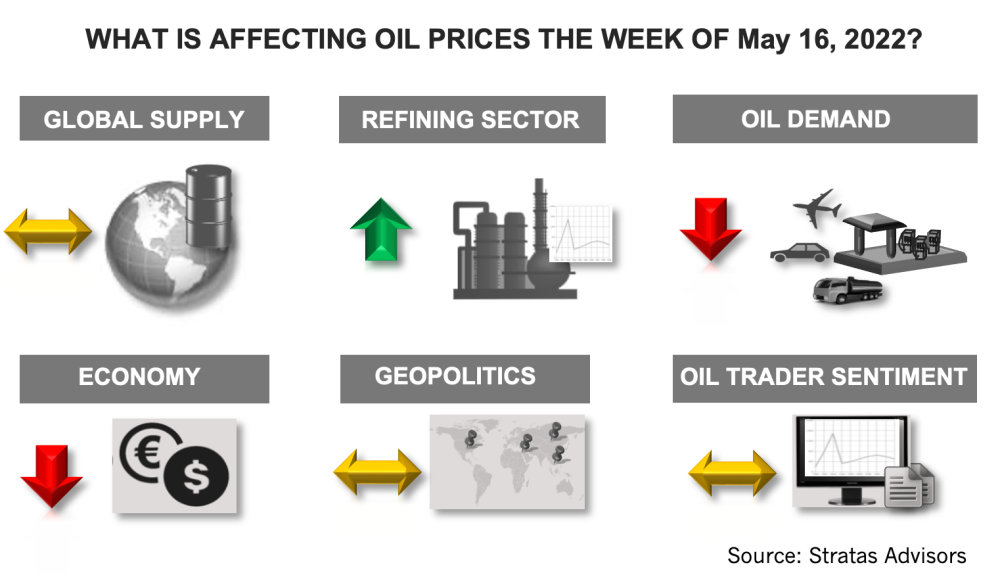

The current supply situation is neutral for oil prices with the additional withdrawals from the Strategic Petroleum Reserve (SPR), relatively moderate declines in Russian supply coupled with some other OPEC+ members underproducing. We are holding to our view from March that Russian exports of crude oil will decline by a net 1.5 million bbl/d once Europe institutes a formal ban with a portion of the lost volumes to Europe being offset by increased exports to Asia and other markets. In contrast, the International Energy Agency (IEA) has reduced its initial forecast for lost supply associated with Russia. In April, the IEA expected that Russia’s supply to fall by 3 million bbl/d in April, but now IEA is not forecasting that to happen until July. It has also been our view that OPEC+ will not increase production to replace the missing barrels from Russia and recent statements from OPEC+ members continue to provide support for our view. Besides Russia’s declines, Libya’s oil production remains at around 600,000 bbl/d, after being cut in half in April by the Libyan National Army led by Khalifa Haftar in protest of oil revenue being transferred from the eastern producing region to the western Libya. On May 14, the U.S. government announced that it supports a temporary freeze of Libya’s oil revenues until an agreement on a revenue sharing is reached by the different stakeholders with the hope that once an agreement is in place, Libya will be able to stabilize its oil production. Other African oil producers—Nigeria and Angola—also are producing well below past levels. Nigeria’s production is off by about 700,000 bbl/d with production at around 1.2 million bbl/d and Angola’s production is off by about 300,000 bbl/d with production at around 900,000 bbl/d.

The outlook for oil demand is negative for oil prices. The IEA put out a new forecast for oil demand last week with 1.9 million bbl/d growth in the second quarter and 1.2 million in the third quarter. The independent research arm of OPEC also released a new demand forecast last week with global demand for 2022 expected to average 100.2 million bbl/d. For 2022, we are expecting that global oil demand will average 99.8 million bbl/d. However, there is further downward risk to the demand forecast because of the possibility of a significant economic downturn. A growing concern (besides inflation and COVID-19, including lockdowns in China), which we have highlighted previously, pertains to the impact of the Russia-Ukraine conflict on the agricultural sector and distribution of foodstuff. Obviously, disruptions to foodstuff (as well as energy), in conjunction with high prices, is likely to lead to political unrest and protests, which will further undermine the economies of the affected countries. While the developing countries are most at risk, these risks will affect all countries to some degree.

One favorable factor for oil prices is the refining sector with refining margins remaining elevated with tight supplies and declining inventories. The supply and demand of diesel is the most fragile with loss of diesel volumes from Russia, in part, from Europe decreasing Russia imports. Further stress is put on diesel supply because of the refineries that were rationalized in the wake of COVID-19. The impact is illustrated by the situation in the U.S. Current refining capacity in the U.S. stands at 17.94 million b/d of crude distillation capacity, which compares to 18.79 million bbl/d in 2019. During the last four weeks, U.S. demand for diesel is averaging 3.85 million bbl/d, which is slightly more than in 2019. At the same time, U.S. exports of diesel averaged 1.33 million bbl/d, which compares to 1.44 million bbl/d in 2019, a difference of only 114,000 bbl/d. Consequently, U.S. inventories of diesel have dropped significantly in the last year and are now 21.53 million less than for the same period in 2019—and are likely to decline further in the coming months.

For the upcoming week, we are expecting that the price of Brent crude oil will continue to drift sideways with a downside bias and that it will be at least another week before the inflection point is reached.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

BP: Gimi FLNG Vessel Arrival Marks GTA Project Milestone

2024-02-15 - The BP-operated Greater Tortue Ahmeyim project on the Mauritania and Senegal maritime border is expected to produce 2.3 million tonnes per annum during it’s initial phase.

Deepwater Roundup 2024: Offshore Africa

2024-04-02 - Offshore Africa, new projects are progressing, with a number of high-reserve offshore developments being planned in countries not typically known for deepwater activity, such as Phase 2 of the Baleine project on the Ivory Coast.

Deepwater Roundup 2024: Offshore Australasia, Surrounding Areas

2024-04-09 - Projects in Australia and Asia are progressing in part two of Hart Energy's 2024 Deepwater Roundup. Deepwater projects in Vietnam and Australia look to yield high reserves, while a project offshore Malaysia looks to will be developed by an solar panel powered FPSO.

E&P Highlights: April 1, 2024

2024-04-01 - Here’s a roundup of the latest E&P headlines, including new contract awards.

Deepwater Roundup 2024: Offshore Europe, Middle East

2024-04-16 - Part three of Hart Energy’s 2024 Deepwater Roundup takes a look at Europe and the Middle East. Aphrodite, Cyprus’ first offshore project looks to come online in 2027 and Phase 2 of TPAO-operated Sakarya Field looks to come onstream the following year.