(Source: Shutterstock)

The price of Brent crude ended the week at $74.17 after closing the previous week at $75.30. The price of WTI ended the week at $70.33 after closing the previous week at $71.34.

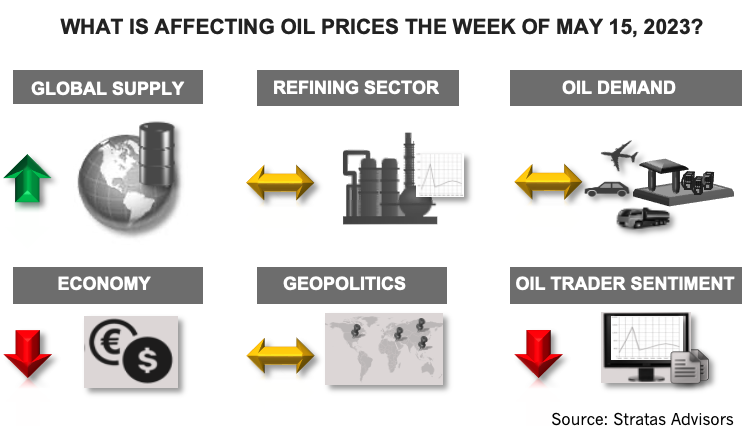

Last week, we reiterated our view that the price of Brent crude oil will move toward $90 during the second half of the year based on our reference forecast of supply/demand and other factors – with the caveat that is more downside risk than upside risk associated with the forecast. The price of oil is facing headwinds from several factors, including concerns about the regional banking sector in the U.S. with PacWest Bancorp emerging as the next bank under severe pressure. The impending U.S. debt limit is getting plenty of attention, with the Treasury Department saying the U.S. government will run out of money by June 1. Oil prices are also not being helped by the ongoing releases from the Strategic Petroleum Reserve (SPR), which decreased by 2.95 million during the previous week. Weekly withdrawals have been averaging 1.53 MMbbl during the last six weeks. Additionally, recent data releases pertaining to the U.S. economy raise further concerns. Last week, the U.S. Labor Department reported that the CPI index was 4.9% in April, just slightly below the 5.0% in March, but core inflation (excluding food and energy prices) was 5.5%. Also last week, the University of Michigan reported that U.S. consumer sentiment decreased by 9.1% in May from April. One reason for the decreasing consumer sentiment is that real wages in the U.S. have fallen for 25 consecutive months.

On the other hand, our view that there is limited risk associated with supply being greater than our forecast is being supported by the muted response from non-OPEC producers (including U.S. shale). Last week, the number of operating oil rigs in the U.S. decreased by 2 and now stands at 586 rigs, which compares to the pre-COVID level of 683 that occurred during the week of March 13, 2020.

The sentiment of oil traders continues to be pessimistic. The net long positions of traders of Brent decreased last week with another significant increase (36%) in short positions and the net long positions of traders of WTI remain well below the level of mid-April.

Consequently, the path of oil prices will continue to be bumpy until there is some clarity on the economic outlook – not only in the U.S., but also with respect to other economies, including China. We are still expecting that oil prices will move upwards in the second half of the year. We think that deal will be reached with the Speaker of the House Kevin McCarthy getting enough concessions pertaining to limits on government spending to bring along his right flank, and the Biden Administration being able to represent the deal as not having caved to the demands and threats from the Republicans. It is likely, however, that there will more drama to come before the deal is reached, which will provide the markets with more uncertainty. Because of the math, the headline inflation numbers will improve, and the Federal Reserve is likely to pause its rate increases. We also are expecting that the Chinese economy will show better numbers, in part, because China is not facing an inflation problem, which provides flexibility for less restrictive monetary policy. It is worth noting, however, that there are wildcards that could result in unexpected disruption. We are expecting that the U.S. regional banking sector will stabilized, but U.S. banks are still holding significant unrealized losses from treasuries and bonds that have lost value. The deterioration of the commercial real estate market represents another source of risk for banks, especially regional banks for which loans on commercial real estate represents a significant portion of their assets.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Summit Midstream Launches Double E Pipeline Open Season

2024-04-02 - The Double E pipeline is set to deliver gas to the Waha Hub before the Matterhorn Express pipeline provides sorely needed takeaway capacity, an analyst said.

Kinder Morgan Sees Need for Another Permian NatGas Pipeline

2024-04-18 - Negative prices, tight capacity and upcoming demand are driving natural gas leaders at Kinder Morgan to think about more takeaway capacity.

Post $7.1B Crestwood Deal, Energy Transfer ‘Ready to Roll’ on M&A—CEO

2024-02-15 - Energy Transfer co-CEO Tom Long said the company is continuing to evaluate deal opportunities following the acquisitions of Lotus and Crestwood Equity Partners in 2023.

Summit Midstream Sells Utica Interests to MPLX for $625MM

2024-03-22 - Summit Midstream is selling Utica assets to MPLX, which include a natural gas and condensate pipeline network and storage.

Midstream Operators See Strong NGL Performance in Q4

2024-02-20 - Export demand drives a record fourth quarter as companies including Enterprise Products Partners, MPLX and Williams look to expand in the NGL market.