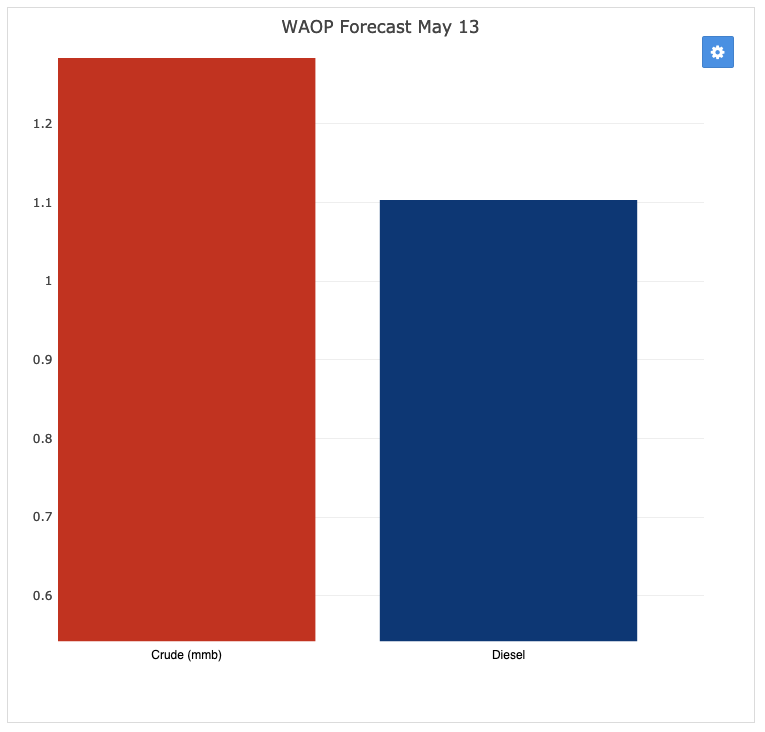

Brent fell $1.19/bbl to average $70.54 last week while WTI fell $1.12/bbl to average $61.84/bbl. For the week ahead we expect Brent and WTI to be range-bound with Brent averaging $70/bbl.

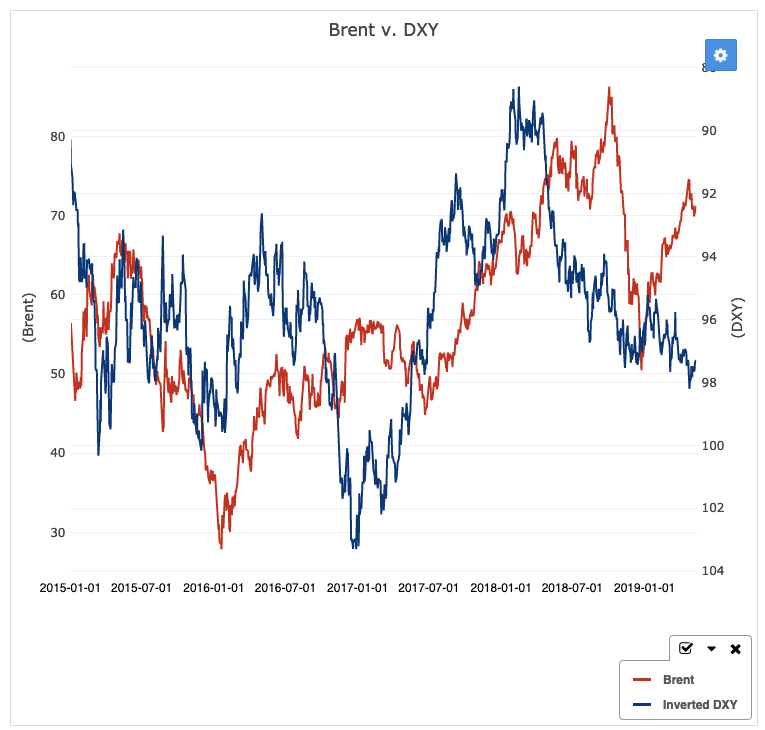

Stock markets largely shook off President Trump increasing tariffs on China after China agreed to continue trade negotiations. However, with no substantive progress made by the end of the day Friday increased tariffs have taken effect. Oil markets remain cautious but were pressured by concerns about overall economic health if the trade wars drags on.

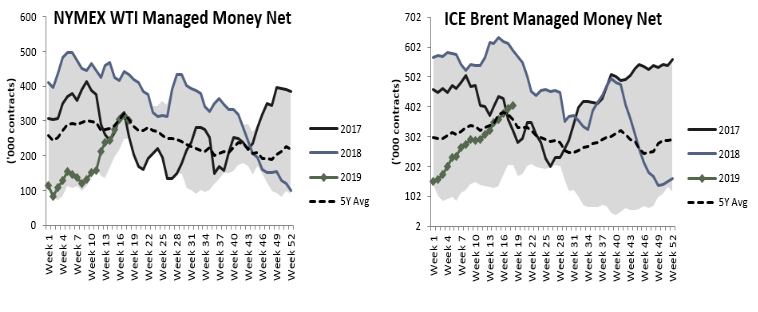

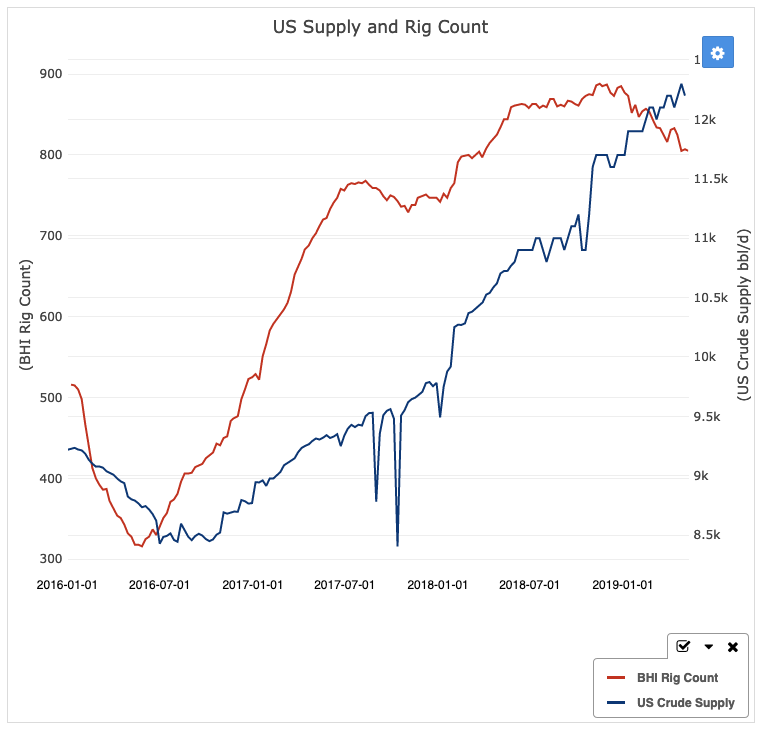

Hedge funds took divergent positions on Brent and WTI last week, in an indication that supply was of greater concern than future demand. In the US, funds remain concerned about the pace of U.S. shale growth, with recent weekly data indicating a fresh high. Internationally however, a medley of issues continue to threaten volumes. The weeks ahead are likely to see similar positioning trends as tensions mount around Iran and Venezuela. At the same time, refiners are returning from maintenance in the US. If crude runs increase and crude stocks continue to build, markets will quickly turn bearish.

Global Economy: Neutral

Oil Supply: Neutral

Recommended Reading

US Orders Most Companies to Wind Down Operations in Venezuela by May

2024-04-17 - The U.S. Office of Foreign Assets Control issued a new license related to Venezuela that gives companies until the end of May to wind down operations following a lack of progress on national elections.

EU Expected to Sue Germany Over Gas Tariff, Sources Say

2024-04-17 - The German tariff is a legacy of the European energy crisis that peaked in 2022 after Moscow slashed gas flows to Europe and an undersea explosion shut down the Nord Stream pipeline.

Pemex to Remain Fiscally Challenged for Mexico’s Next President

2024-04-16 - S&P Global Ratings said Pemex will remain a fiscal challenge for the country’s next president, adding that continued cautious macroeconomic management was key in its ratings on both Mexico and Pemex.

Yellen Expects Further Sanctions on Iran, Oil Exports Possible Target

2024-04-16 - U.S. Treasury Secretary Janet Yellen intends to hit Iran with new sanctions in coming days due to its unprecedented attack on Israel.