The price of Brent crude ended the week at $79.54 and the price of WTI ended the week at $76.51. (Source: Shutterstock)

The price of Brent crude ended the week at $79.54 after closing the previous week at $81.58. The price of WTI ended the week at $76.51 after closing the previous week at $77.87.

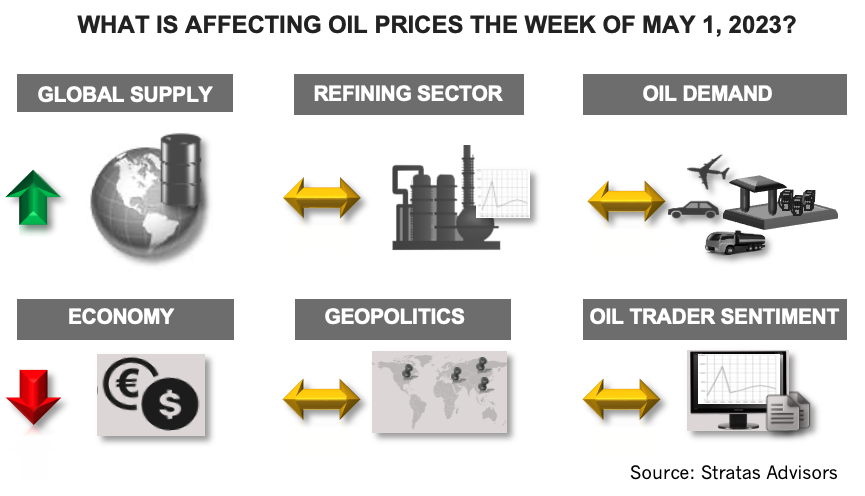

We are still forecasting that the price of Brent crude oil will move above $90 during the second half of the year after the additional production cuts of 1.16 MMbbl/d associated with OPEC+ start in May, coupled with our outlook for oil demand growth. However, as we have been highlighting, there is more downside risk than upside risk associated with the demand forecast because of uncertainty about the global economies and the major economies – U.S., EU and China.

- Last week, the U.S. Commerce Department reported that the GDP of the U.S. increased by 1.1% during 1Q on an annualized basis. Growth in 1Q was significantly less than in 4Q when the U.S. GDP increased by 2.6%. The slowdown in growth was the result of decreasing inventory and nonresidential fixed investment. The slow growth came with disappointing inflation data with personal consumption expenditures price index (PCE) increasing by 4.2%. Even more troublesome, the core PCE (excluding food and energy) increased by 4.9% in comparison to 4.4% in 4Q.

- EU’s GDP for 1Q grew by only 0.3%, and the GDP of Eurozone countries grew by only 0.1% in comparison to 4Q. While growth in 1Q was limited, the growth was better than in 4Q during which EU’s GDP decreased by 0.1% and growth in the Eurozone was flat.

- There are more signs that China’s economy is growing only moderately since the removal of the zero-COVID policies. The official manufacturing purchasing managers index (PMI) from the National Bureau of Statistics decreased in April to 49.2 from 51.9 in March. (A reading below 50 indicates a contraction while a reading above 50 indicates growth). China’s manufacturing sector is being negatively affected by weakness in export markets, as indicated by the PMI for new export orders falling to 47.6 from 50.4 in March.

From a supply-side perspective – similar to demand – there is more downside risk than upside risks, including supply associated with African producers. For example, Nigeria produced 1.27 MMbbl/d in March, which is significantly below its OPEC target of 1.8 MMbbl/d and its 2023 budget target of 1.6 MMbbl/d. We are also not expecting any major ramp up in U.S. production. Consequently, OPEC+ should have the ability to manage supply in a manner that supports oil prices, as long as demand holds up relatively well.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Analyst: Chevron Duvernay Shale Assets May Sell in $900MM Range

2024-01-29 - E&Ps are turning north toward Canadian shale plays as Lower 48 M&A opportunities shrink, and Chevron aims to monetize its footprint in Alberta’s Duvernay play.