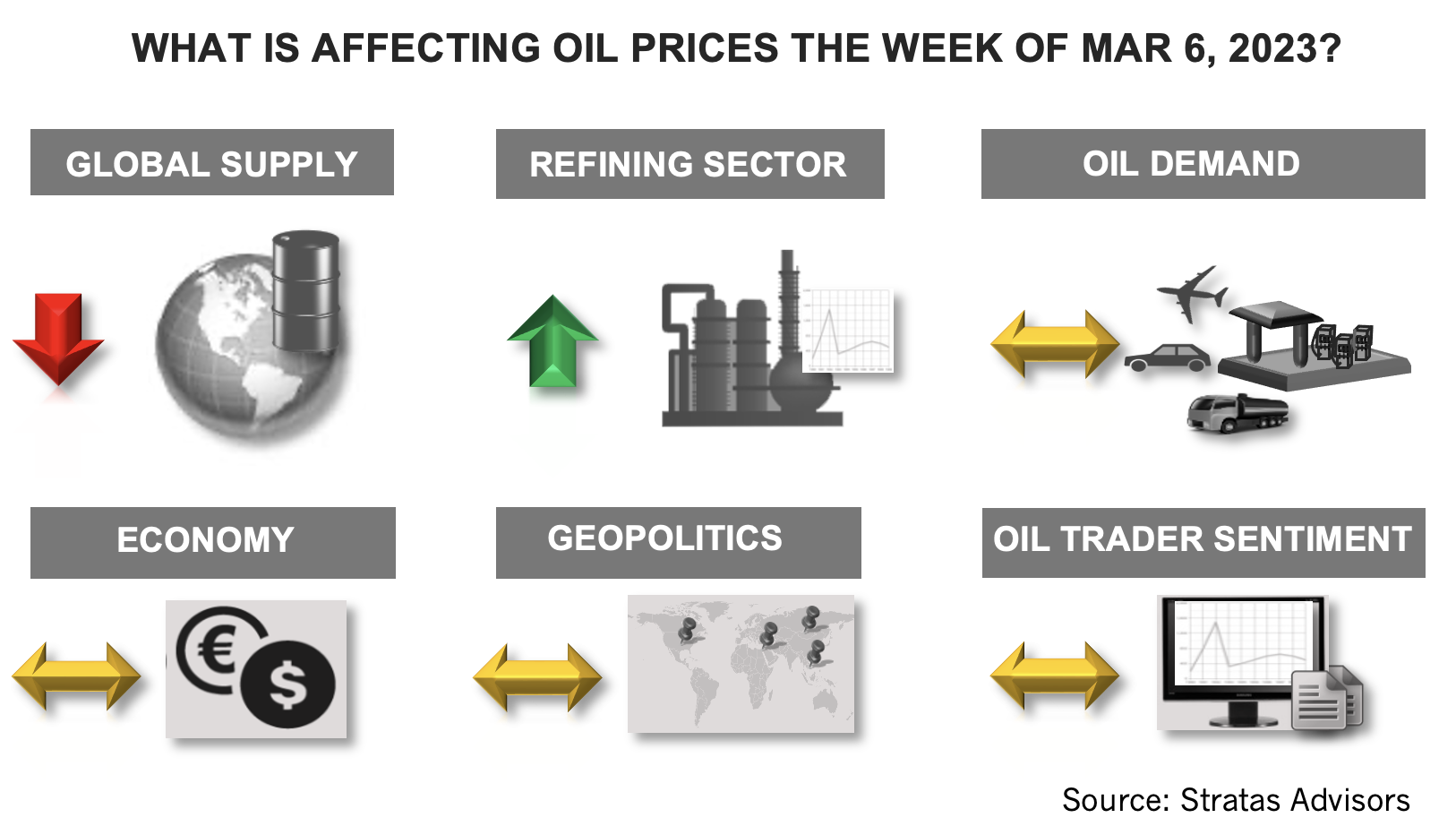

Oil prices are affected by different global factors. (Source: Shutterstock)

The price of Brent crude ended the week at $85.83 after closing the previous week at $83.16. The price of WTI ended the week at $79.68 after closing the previous week at $76.32.

As we have forecasted, the price of Brent crude has remained between $80 and $90 since mid-November of 2022. Concerns about the global economy and the moderating impact on oil demand growth continue to place a ceiling on prices, while the ability of OPEC+ to align supply with demand place a floor on prices. There is nothing appearing on the horizon that will change this dynamic.

The outlook for global economy has improved, but there are still factors that are negatively affecting economic growth, including economic growth in the China and Europe, as well as the US. The latest surveys from the Institute for Supply Management (ISM) indicate that non-manufacturing sector, which makes up more than 60% of the US economy continued to expand in February with a reading of 55.1 (any reading about 50 indicates growth). In contrast to the improving non-manufacturing sector, the manufacturing sector (which accounts for around 11% of the US economy) shrank in February with a reading of 47.4, which continues the downward trend that started in November 2022. In addition to the struggling manufacturing sector, the housing market has been affected in a major way by the rate increases implemented by the Federal Reserve. The National Association of Realtors have reported that sales of existing homes have decreased for 12 consecutive months, which is a record. Additionally, investment in housing declined at an annual rate of 26% from October through December of 2022. The decline has continued into 2023 with the Commerce Department reporting that construction spending decreased by 0.1% in January because of the pullback in single-family homebuilding. Based in part on the divergence of the non-manufacturing and manufacturing sectors, coupled with the weakness in the housing market, we are expecting that the Federal Reserve at its next meeting schedule for March 21-22 will only raise rates by 0.25% instead of 0.50%, even though inflation continues to be a concern. Given the economic outlook, we have been forecasting that oil demand will grow by 2.11 MMbbl/d in 2023. In comparison, the IEA recently increased its forecast for growth in oil demand to 2.00 MMbbl/d, which was an increase of 100,000 bbl/d from its January forecast.

With respect to oil supply, we are expecting that the sanctions on Russia will have a limited impact. We are forecasting that Russia will produce 10.36 MMbbl/d in 1Q23 (which is a decrease of 460,000 bbl/d from 4Q2022) and 10.28 MMbbl/d for 2023 (which is a decrease of 450,000 bbl/d from 2022). Moreover, if Russia’s oil supply decreases further, we believe that other members of OPEC+ have sufficient ability to address the resulting gap, with Saudi Arabia, Iraq, Kuwait, and UAE all able to increase supply. (It is worth note that one wildcard is the production associated with African producers, which is susceptible to internal conflict). Additionally, we are forecasting that non-OPEC supply will increase on average by 1.56 MMbbl/d with US production averaging 12.50 MMbbl/d in 2023, which is 630,000 bbl/d more than in 2022. As such, we are forecasting that oil markets will remain adequately supplied through 2023.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Analysts: Diamondback-Endeavor Deal Creates New Permian Super Independent

2024-02-12 - The tie-up between Diamondback Energy and Endeavor Energy—two of the Permian’s top oil producers—is expected to create a new “super-independent” E&P with a market value north of $50 billion.

APA Closes $4.5B Callon Deal, Deepening Permian Roots

2024-04-01 - About two-thirds of Apache’s daily production will come from the Permian Basin after APA Corp. completed its $4.5 billion takeout of Callon Petroleum.

Marketed: EnCore Permian Holdings 17 Asset Packages

2024-03-05 - EnCore Permian Holdings LP has retained EnergyNet for the sale of 17 asset packages available on EnergyNet's platform.

Continental Resources Makes $1B in M&A Moves—But Where?

2024-02-26 - Continental Resources added acreage in Oklahoma’s Anadarko Basin, but precisely where else it bought and sold is a little more complicated.

Matador Hoards Dry Powder for Potential M&A, Adds Delaware Acreage

2024-04-24 - Delaware-focused E&P Matador Resources is growing oil production, expanding midstream capacity, keeping debt low and hunting for M&A opportunities.