Current gasoline demand is running only 14,000 bbl/d behind last year but diesel demand is lagging last year’s demand by 549,000 bbl/d. (Source: Shutterstock)

The price of Brent crude ended the week at $74.99 after closing the previous week at $72.97. The price of WTI ended the week at $69.25 after closing the previous week at $66.74.

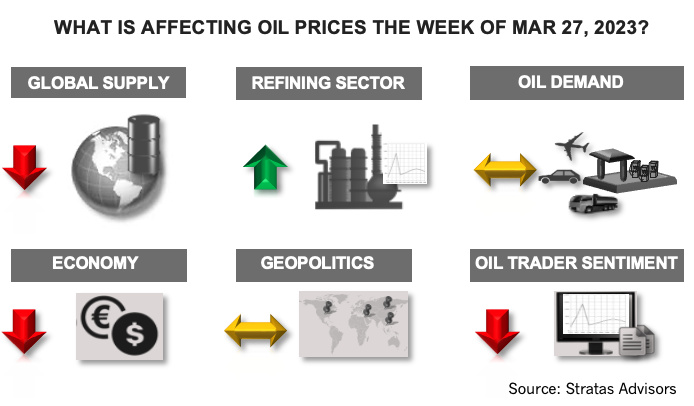

While crude prices recovered a portion of the significant downturn that occurred during the previous week, oil prices are still facing some headwinds. There is adequate supply available with demand growth remaining muted, including in the U.S. where oil demand has been lagging demand of last year. Based on the 4-week average, current gasoline demand is running only 14,000 bbl/d behind last year but diesel demand is lagging last year’s demand by 549,000 bbl/d. The decline in gasoline and diesel demand is offsetting the increase in jet fuel demand which is running ahead last year’s demand for the last four weeks by 101,000 bbl/d (in comparison to 2019, demand of gasoline, diesel and jet fuel are all running well below pre-COVID demand). While China has removed COVID-related restrictions, the rebound in the economy has been relatively modest. It has also been recently reported that Russia is planning to enable the maintenance of its crude oil exports by reducing refinery runs (by taking some refining capacity offline) in April to offset cuts in oil production.

While the central banks are raising interest rates, concerns about the health of the banking sector are also increasing. Regional banks in the U.S. continue to be under pressure with billions of their deposits being shifted to the “too big to fail” banks and money market funds. Additionally, the rising interest rates are having a negative effect on the U.S. housing market. One indication is that the median price of U.S. homes is now lower than during the same period of the previous year. The automotive sector is also showing strains, as indicated by the Cox Automotive Dealer Sentiment for 1Q 2023 at 43 (reading below 50 are negative) which is the lowest level since the COVID days of 2020. Consumers are also under pressures with credit card debt at a record high coupled with record high interest rates. Additionally, real wages have been declining for the last two years with wage increases significantly lagging the inflation rate.

These concerns are also being reflected by the sentiment of oil traders, which is increasingly negative. Last week, traders of Brent crude decreased their net long positions by 27.20%, which follows the decrease of 21.76% of the previous week. Traders of WTI decreased their net long positions by 42.49% and their net long positions have now dropped to the levels not seen since 2010.

We still think that the price of Brent has support around $70.00 and the price of WTI has support around $65.00. As such, we think it will take some other unexpected bad news to break below these levels – such as another bank failure. It will also take some unexpected, good news to push the price of Brent above $80.00 and WTI above $75.00 – such as a production cut by OPEC+.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Marketed: Wasatch Energy Management Non-operated WI in Utah

2024-02-14 - Wasatch Energy Management has retained EnergyNet for the sale of non-operated working interest and royalty opportunities in Duchesne and Uintah counties, Utah.

Marketed: Stone Hill Minerals Holdings 95 Well Package in Colorado

2024-02-28 - Stone Hill Minerals Holdings has retained EnergyNet for the sale of a D-J Basin 95 well package in Weld County, Colorado.

Marketed: Navigation Powder River Eight Leasehold Lots in Wyoming

2024-04-09 - Navigation Powder River has retained EnergyNet for the sale of eight non-producing federal leasehold lots in Converse and Campbell counties, Wyoming.

Marketed: Amati Royalties Powder River Basin Opportunity

2024-03-01 - Amati Royalties has retained EnergyNet for the sale of a Powder River Basin opportunity with four wells and two pending wells in Campbell County, Wyoming.

TotalEnergies Entering, OMV Exiting SapuraOMV JV

2024-01-31 - TotalEnergies aims to deepen its presence in Malaysia through the $903 million deal to acquire OMV’s interest in the SapuraOMV Upstream joint venture.