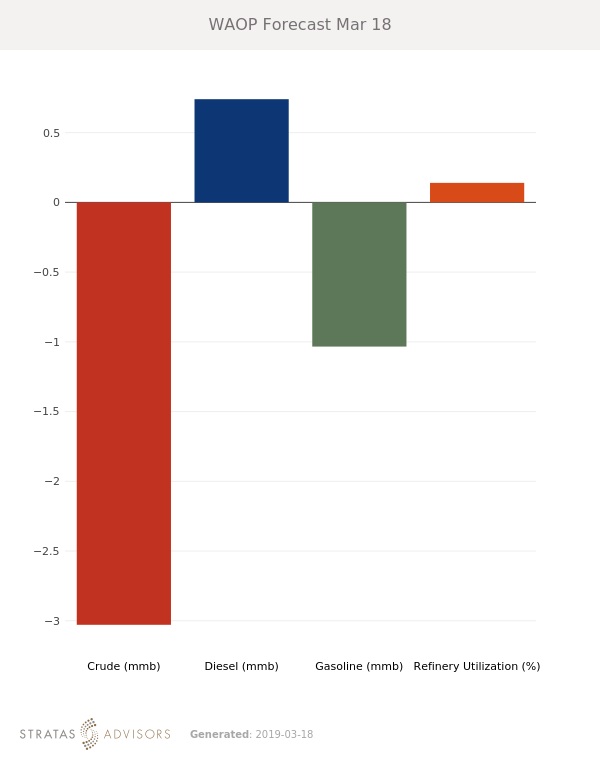

In the week since our last edition of What’s Affecting Oil Prices, Brent rose $1.13/bbl last week to average $67.04/bbl, stronger than our expectations.

WTI rose $1.39/bbl to average $57.81/bbl. For the week ahead, we expect prices to see marginal strength from the results of the Joint Ministerial Monitoring Committee (JMMC) meeting, with Brent averaging around $67.75/bbl.

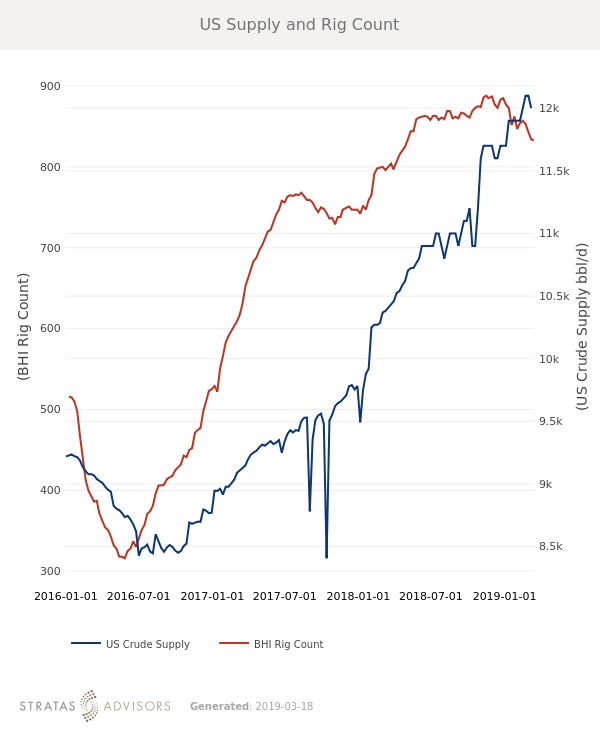

The JMMC meeting took place in Azerbaijan, and was relatively uneventful. This is supportive for prices as it indicates that the OPEC production agreement could stay in place. So far compliance has been below previous years, but has been trending higher. Also impacting supply, the Baker Hughes rig count continues to fall, implying that operators are adhering to their cash flow spending plans.

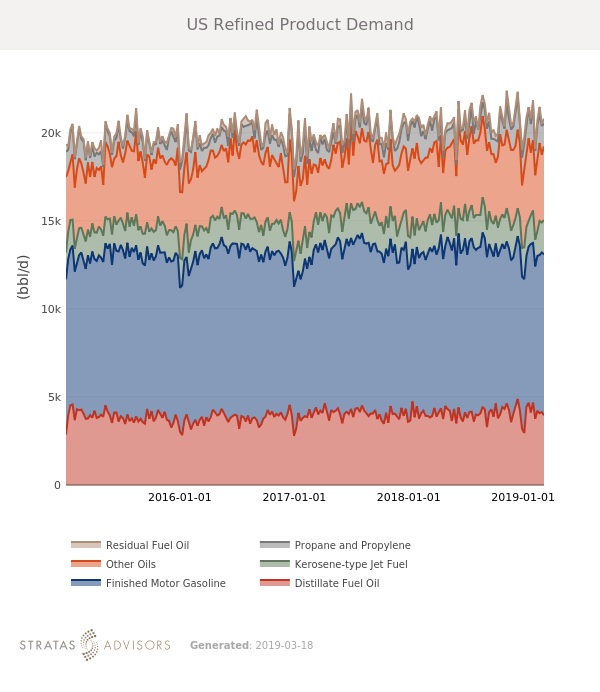

On the demand side, fears persist of a broad slowdown. While economic figures continue to inspire caution, weekly product data has not yet slowed down. Product stocks at the Amsterdam-Rotterdam-Antwerp hub remain below the five-year average. In the U.S., product demand is generally in line with prior years and product stocks are generally at or below the five-year average.

Geopolitical: Neutral

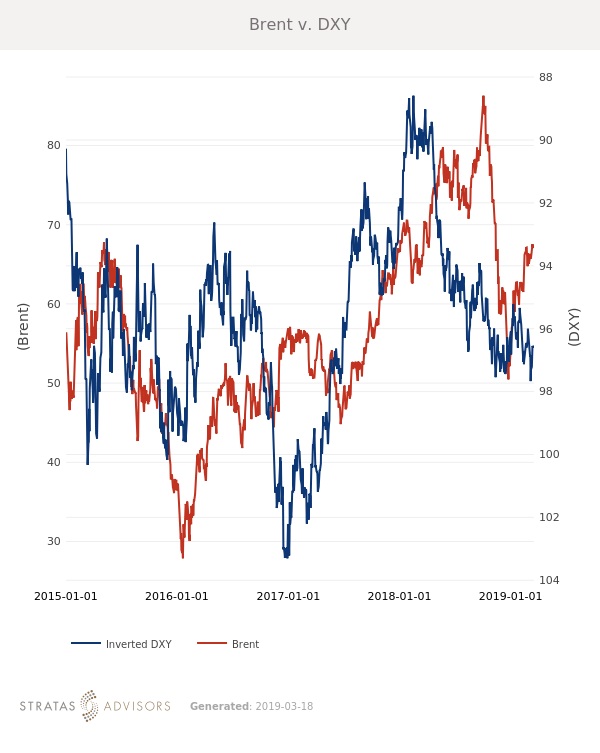

Dollar: Neutral

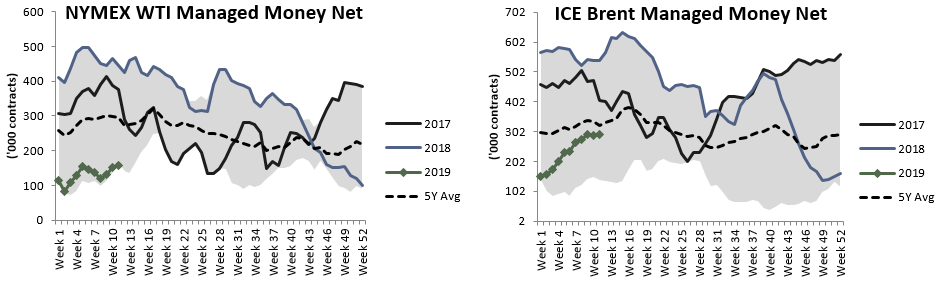

Trader Sentiment: Positive

Supply: Negative

Demand: Neutral

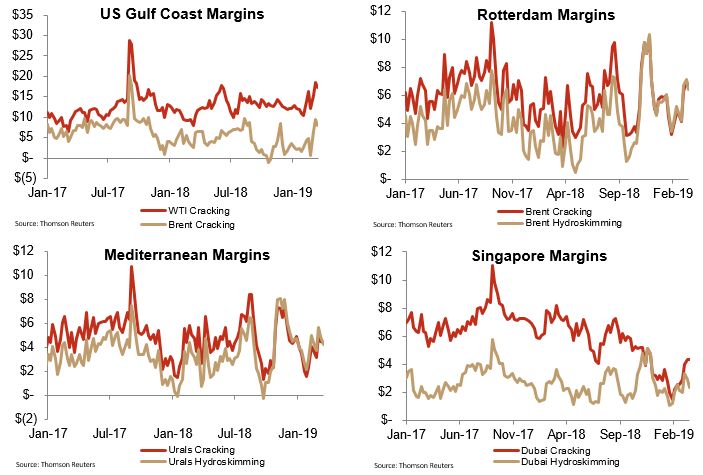

Refining Margins: Neutral

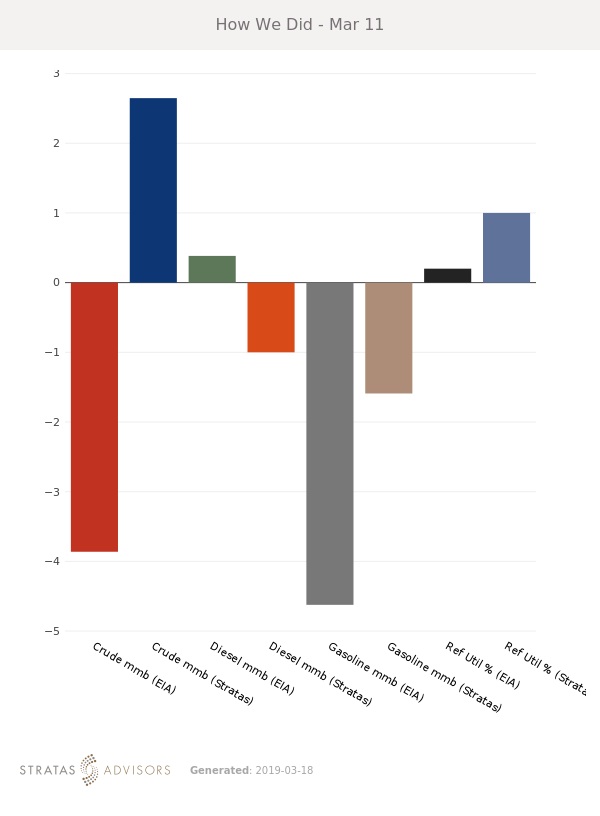

How We Did

Recommended Reading

CEO: Coterra ‘Deeply Curious’ on M&A Amid E&P Consolidation Wave

2024-02-26 - Coterra Energy has yet to get in on the large-scale M&A wave sweeping across the Lower 48—but CEO Tom Jorden said Coterra is keeping an eye on acquisition opportunities.

Hess Corp. Boosts Bakken Output, Drilling Ahead of Chevron Merger

2024-01-31 - Hess Corp. increased its drilling activity and output from the Bakken play of North Dakota during the fourth quarter, the E&P reported in its latest earnings.

E&P Earnings Season Proves Up Stronger Efficiencies, Profits

2024-04-04 - The 2024 outlook for E&Ps largely surprises to the upside with conservative budgets and steady volumes.

Patterson-UTI Braces for Activity ‘Pause’ After E&P Consolidations

2024-02-19 - Patterson-UTI saw net income rebound from 2022 and CEO Andy Hendricks says the company is well positioned following a wave of E&P consolidations that may slow activity.

Uinta Basin: 50% More Oil for Twice the Proppant

2024-03-06 - The higher-intensity completions are costing an average of 35% fewer dollars spent per barrel of oil equivalent of output, Crescent Energy told investors and analysts on March 5.