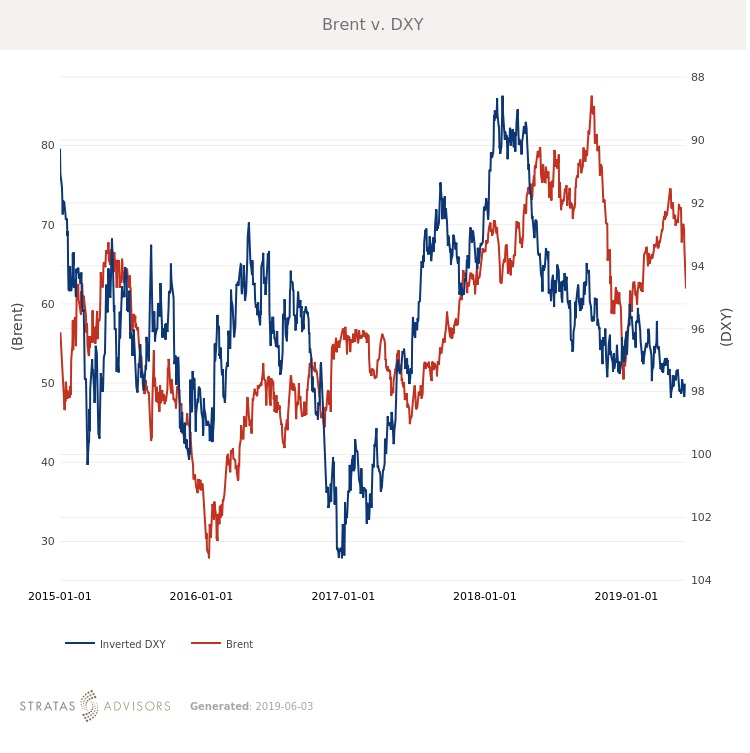

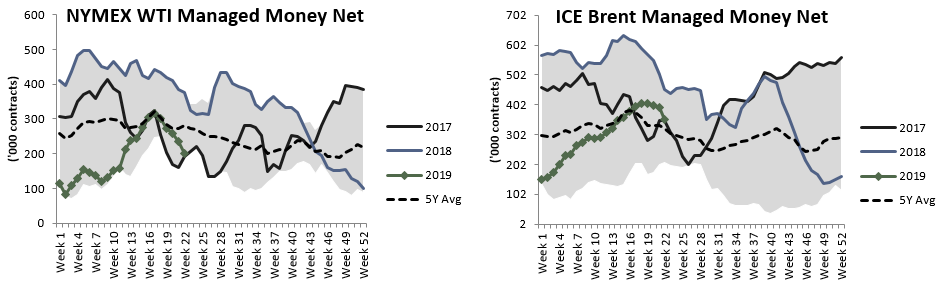

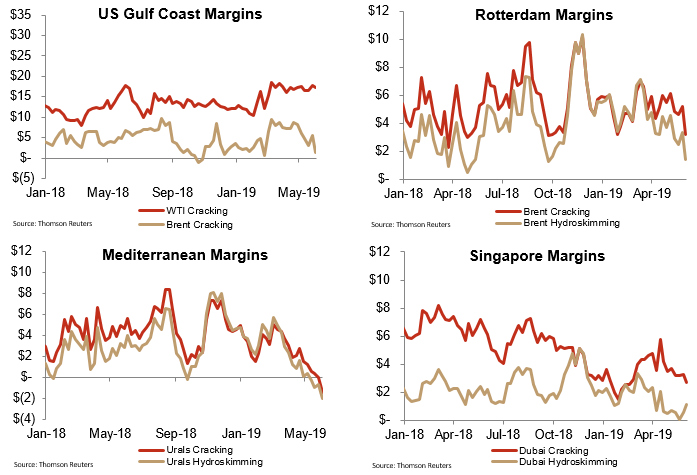

In the week since our last edition of What’s Affecting Oil Prices, the weekly average Brent price fell $2.11/bbl last week to average $68.21/bbl. WTI fell even more sharply, down $3.80/bbl to average $57.01/bbl. Both crudes lost more than $5/bbl from their prices at the start of last week as sentiment swiftly turned against crude. The disparity in price movements of US and international crudes continues to show that concerns are broad-based and not rooted in fundamental changes.

Stratas Advisors has expected these oscillations for some time now, and a common theme in these weekly analyses has been that the longer a bull or bear run lasts without fundamental support, the more severe the “corrections” will be. We expect prices will continue to fall, albeit less dramatically this week, with Brent averaging $61/bbl as markets seek a floor.

On the demand side, economic concerns remain front of mind. The tariff dispute with China continues to drag on, and shipments entering both countries are now subject to increased costs. Adding to the difficulty in securing a deal, after Chinese telecom company Huawei was effectively banned in the U.S., Beijing has threatened to issue similar bans on a list of American companies. And at the end of last week, President Trump made a surprise announcement that imports from Mexico could be subject to an escalating 5% tariff (with a potential cap at 25%) if the Mexican government did not do more to stem the flow of immigrants to the US.

Senior Mexican officials are meeting with their White House counterparts this week to discuss the threat and possible solutions. While the tariffs themselves certainly have implications for trade, they also underline the uncertainty in dealing with the current administration. The tariff announcement was made with no reference to the revised NAFTA agreement that is currently being reviewed by the Canada, Mexico, and U.S. governments.

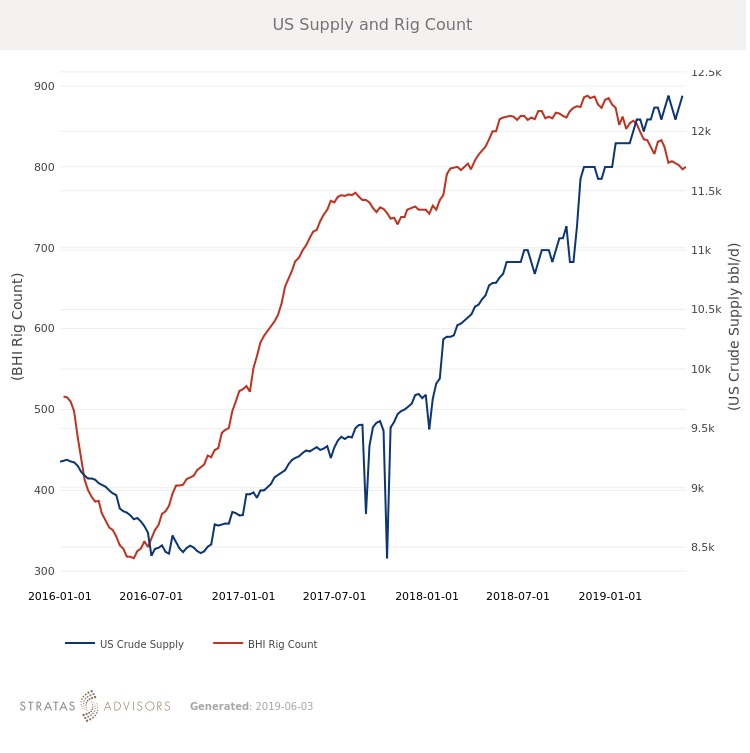

After last week’s severe price correction, Saudi Arabia and other OPEC members quickly provided assurances that any production increase would only be decided once markets were decisively balanced. Elsewhere on the supply side, not much has changed in a week. This week could see flows of Urals start to resume as the refineries affected by the Druzbha pipeline contamination have come to a sharing agreement for what to do with the contaminated crude.

Geopolitics: Neutral

Global Economy: Negative

Oil Supply: Negative

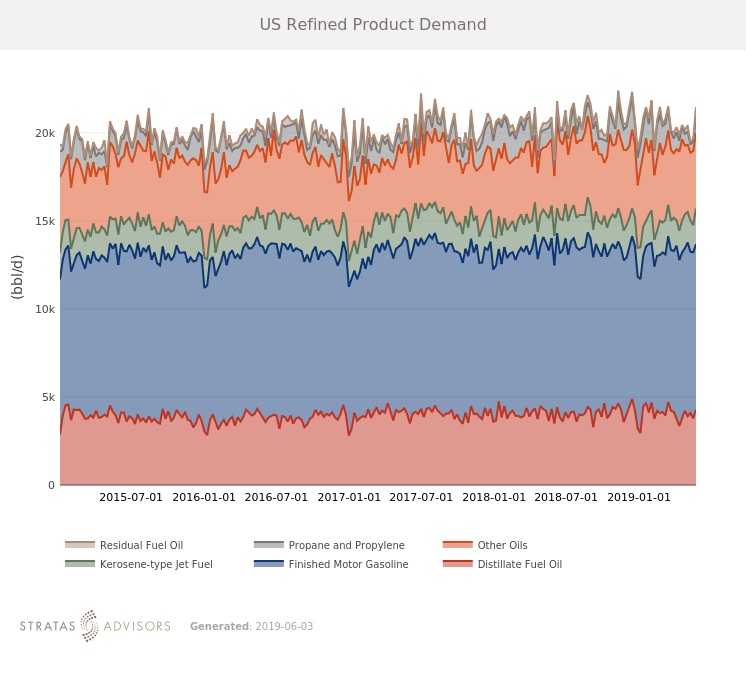

Oil Demand: Neutral

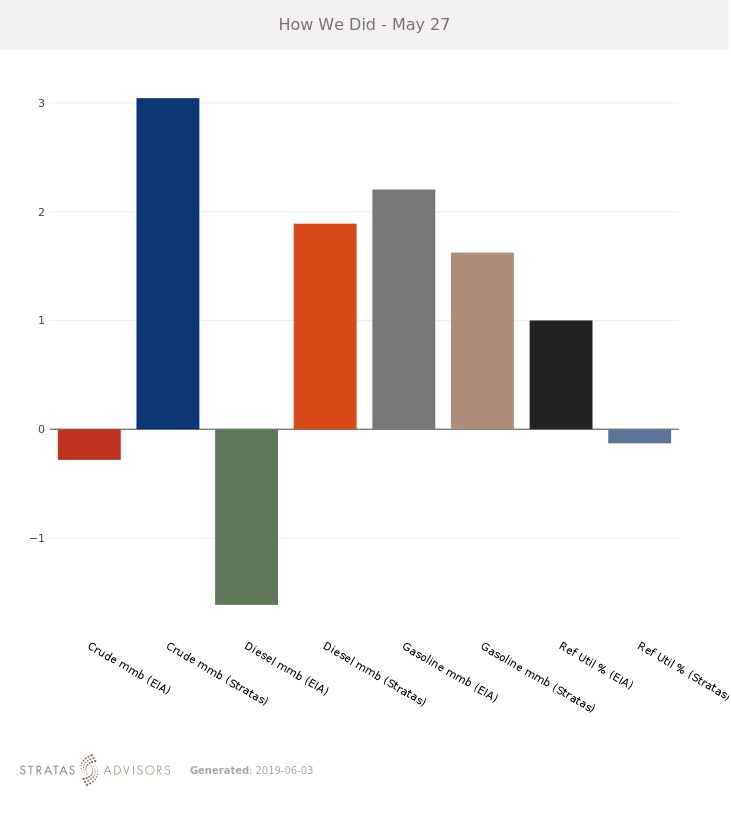

How We Did

Recommended Reading

Babcock & Wilcox to Convert Coal Plant to NatGas

2024-03-18 - B&W will convert the plant’s two coal-fired boilers to natural gas by designing and installing burners, air systems, fans and other equipment.

Midstream Builds in a Bearish Market

2024-03-11 - Midstream companies are sticking to long term plans for an expanded customer base, despite low gas prices, high storage levels and an uncertain political LNG future.

Tinker Associates CEO on Why US Won’t Lead on Oil, Gas

2024-02-13 - The U.S. will not lead crude oil and natural gas production as the shale curve flattens, Tinker Energy Associates CEO Scott Tinker told Hart Energy on the sidelines of NAPE in Houston.

Argentina's Vaca Muerta Shale Formation Drives Record Oil Production in February

2024-03-22 - Argentina's Neuquen province hit a record for daily oil production in February.

API Gulf Coast Head Touts Global Emissions Benefits of US LNG

2024-04-01 - The U.S. and Louisiana have the ability to change global emissions through the export of LNG, although new applications have been frozen by the Biden administration.