If the trend does breaks, Stratas Advisors expects to see the price of Brent crude oil dropping towards $100 with an average forecasted Brent price of $96 for the third quarter and $88 for the fourth quarter. (Source: Shutterstock.com)

Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

The price of Brent crude ended the week at $113.12 after closing the previous week at $122.01. The price of WTI ended the week at $109.16 after closing the previous week $120.67.

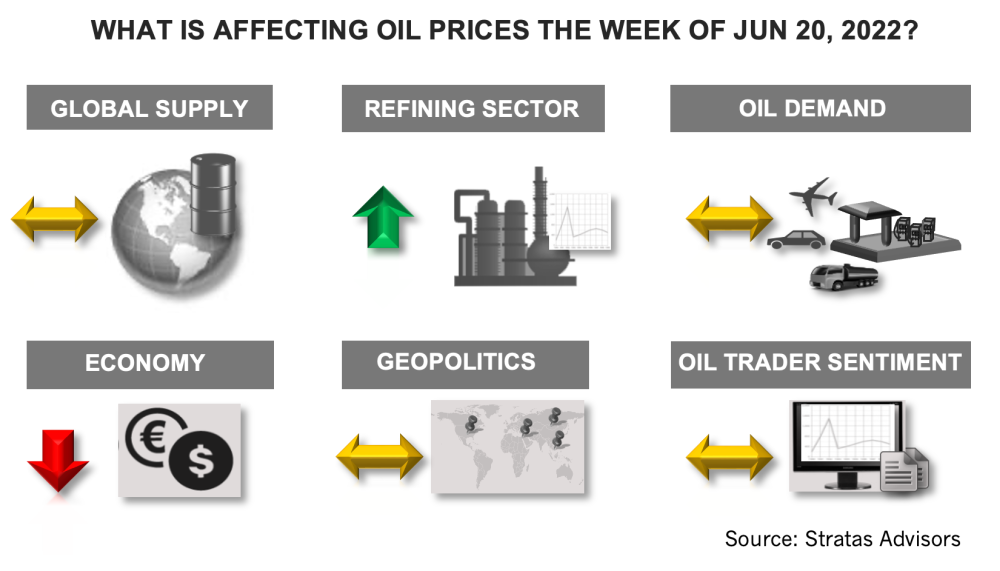

For weeks, we have been putting forth the view that oil prices would not move much above $120 because of a stabilizing supply situation coupled with moderating demand—and that there was substantial downside risk. Now that the EU has agreed to ban the imports of Russia oil, we think that will be the last major announcement which will negatively affect sentiment pertaining to future oil supply. While the EU is also working to implement a ban on insurers covering oil tankers (oil and refined products) that will be phased in over six months, we do not think the ban will have a major impact on Russian oil exports. We are holding to that view, in part, because we think there is sufficient tanker capacity to handle the increased distances that Russia crude oil (and products) will need to travel to reach markets other than Europe. For instance, in January of this year, global very large crude carrier (VLCC) tonnes miles were still some 16% below pre-COVID levels. Additionally, the utilization rate for VLCCs was below 50%. And after an extremely difficult 2020 and a slow recovery, at least some of the vessel owners will be open to additional business. We also think there is some potential upside to oil supply, including increased non-OPEC supply. Additionally, there is potential for several of African producers to produce more oil, although it will require the easing of internal conflict for these producers to do so on a consistent basis. (Conversely, we do not expect that there will be an increase in Iranian exports stemming from a renewed nuclear deal. While there has been some noise about the U.S. reducing sanctions to allow Iran to export more oil, we think this is highly unlikely—and even more so now, given the recent actions by Iran to remove cameras that allows for monitoring by the International Atomic Energy Agency, as well as new U.S.-imposed sanctions on Iran’s petrochemical exports.

With respect to oil demand, there is no doubt that elevated oil prices are negatively affecting demand from a global perspective and the strong U.S. dollar is further intensifying the impact for those countries who have seen their currency weaken against the U.S. dollar. And last week, the U.S. dollar strengthened further with the U.S. Dollar Index increasing to 104.65, which is the highest level since December of 2002. Demand is also weakening in the U.S., as indicated by the latest report from the Energy Information Administration. Gasoline demand in the U.S. decreased to 9.09 million b/d from the previous week of 9.2 million bbl/d. In comparison, for the same period of the previous year, gasoline demand was 9.36 million bbl/d. Based on the four-week average, current gasoline demand is running 644,000 bbl/d less than for the same period of 2019, which represents a difference of 6.7%. Diesel demand in the US decreased to 3.62 million bbl/d from the previous week of 3.65 million bbl/d. In comparison, for the same period of the previous year, diesel demand was 4.34 million b/d. Based on the four-week average, diesel demand is running 249,000 bbl/d less than in 2019, which represents of difference of 6.2%. Jet fuel demand remained essentially unchanged from the previous week at 1.52 million bbl/d. In comparison, for the same period of the previous year, jet fuel demand was 1.26 million bbl/d. Based on the four-week average, jet fuel demand is running 250,000 bbl/d less than in 2019, which is about 14% less.

We have also been highlighting the risk of potential errors related to monetary policy with the central banks shifting from accommodating to tightening in an attempt to cool down the rate of increase in prices. The effort is complicated by much of the price increases are being driven by supply-side factors that cannot be addressed by monetary policy. These factors include disruptions to the supply of energy and food and to the supply chain of other manufacturing sectors, including the automotive sector. However, influential voices are pushing the Federal Reserve to raise interest rates aggressively, even in the face of a slowing economy. As such, the risk of a widespread recession is growing—especially since the actual causes of increased prices are not being addressed with the appropriate polices or required urgency.

While the price of Brent crude oil declined last week, the price movement remains on the upward trend that started in December of last year. If the trend breaks, we are expecting to see the price of Brent crude oil dropping towards $100. And this decline would be consistent with our short-term outlook from February, which includes an average forecasted Brent price of $96 for the third quarter and $88 for the fourth quarter.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Defeating the ‘Four Horsemen’ of Flow Assurance

2024-04-18 - Service companies combine processes and techniques to mitigate the impact of paraffin, asphaltenes, hydrates and scale on production—and keep the cash flowing.

Tech Trends: AI Increasing Data Center Demand for Energy

2024-04-16 - In this month’s Tech Trends, new technologies equipped with artificial intelligence take the forefront, as they assist with safety and seismic fault detection. Also, independent contractor Stena Drilling begins upgrades for their Evolution drillship.

AVEVA: Immersive Tech, Augmented Reality and What’s New in the Cloud

2024-04-15 - Rob McGreevy, AVEVA’s chief product officer, talks about technology advancements that give employees on the job training without any of the risks.

Lift-off: How AI is Boosting Field and Employee Productivity

2024-04-12 - From data extraction to well optimization, the oil and gas industry embraces AI.

AI Poised to Break Out of its Oilfield Niche

2024-04-11 - At the AI in Oil & Gas Conference in Houston, experts talked up the benefits artificial intelligence can provide to the downstream, midstream and upstream sectors, while assuring the audience humans will still run the show.