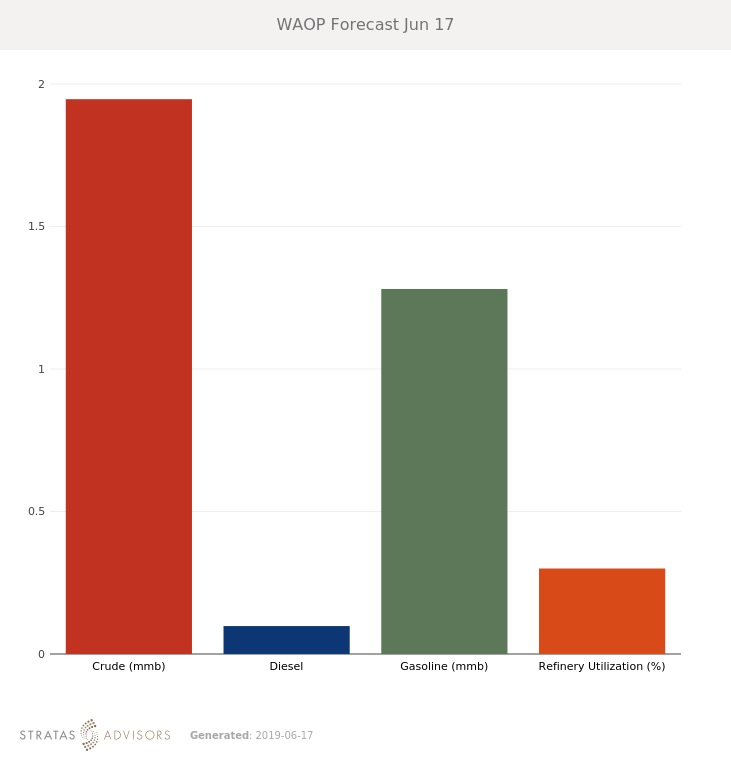

Brent fell $0.19/bbl last week to average $61.57/bbl but with significant intra-week volatility. WTI fell $0.51/bbl to average $52.49/bbl. For the week ahead we expect Brent to average $62.50/bbl as geopolitical tensions remain high.

Markets were transfixed by reports that two tankers had been attacked near the Strait of Hormuz, with the U.S. quickly asserting that the attack was carried out by Iran. Iran has continued to deny its involvement in the attacks as well as the earlier attacks on May 12. Almost more important than what actually transpired is what this means for Iran-U.S. relations. Leaders in both countries have made dramatic statements, and neither side appears willing to make any sort of goodwill gesture in an effort to lower tensions. The most likely outcome of the attacks will be an increased U.S. military presence in the Strait, increasing the likelihood of a confrontation. Prices will remain supported next week on the back of geopolitical tensions.

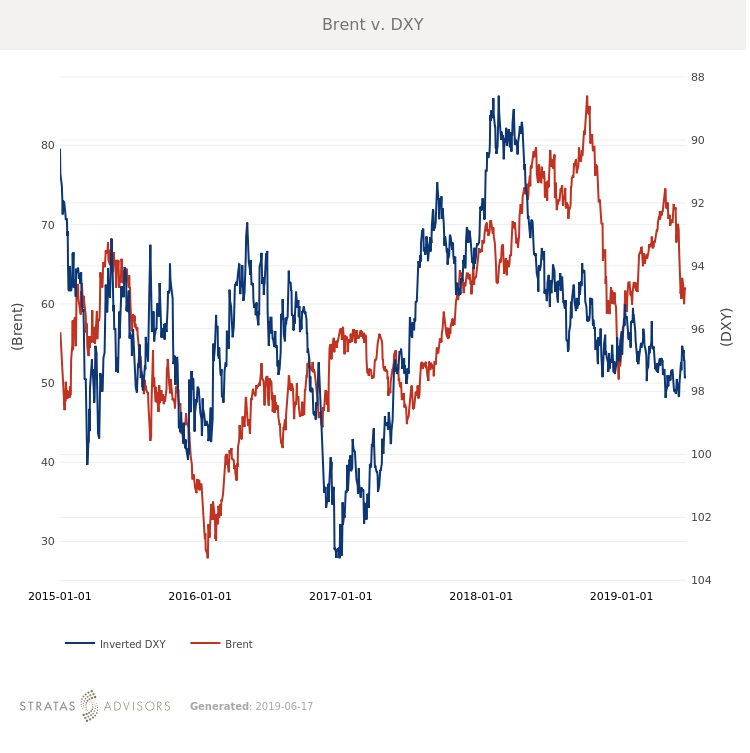

Elsewhere, markets saw several governmental agencies release more bearish outlooks for the global economy and future crude oil demand. A trend appears to be forming in which there is an entrenched expectation that trade disputes will be resolved by 2020. Given that we are halfway through 2019 with no concrete progress to report this seems unlikely and any macroeconomic expectations will need to take into account the impact on timing and negotiations that upcoming U.S. elections will have.

Geopolitical Unrest: Positive

Global Economy: Negative

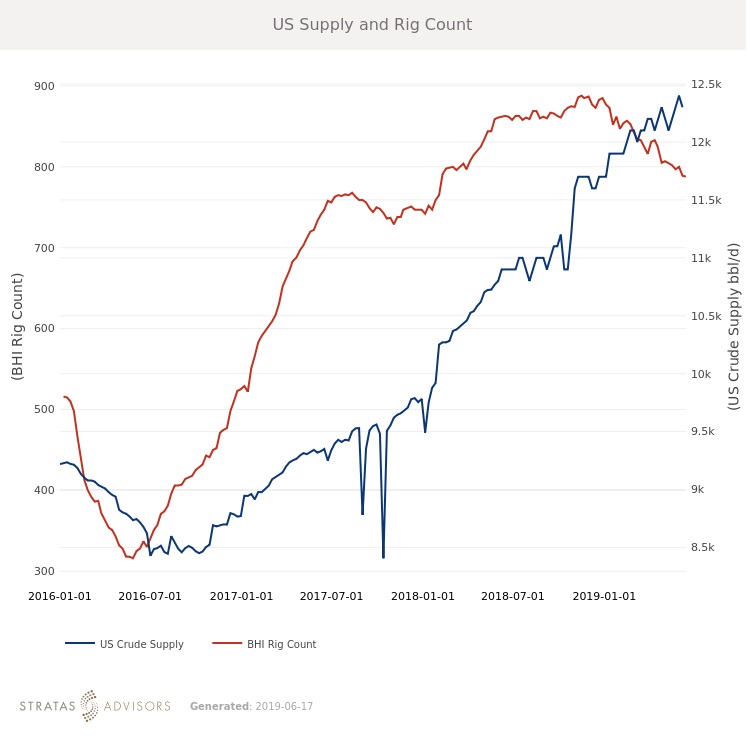

Oil Supply: Neutral

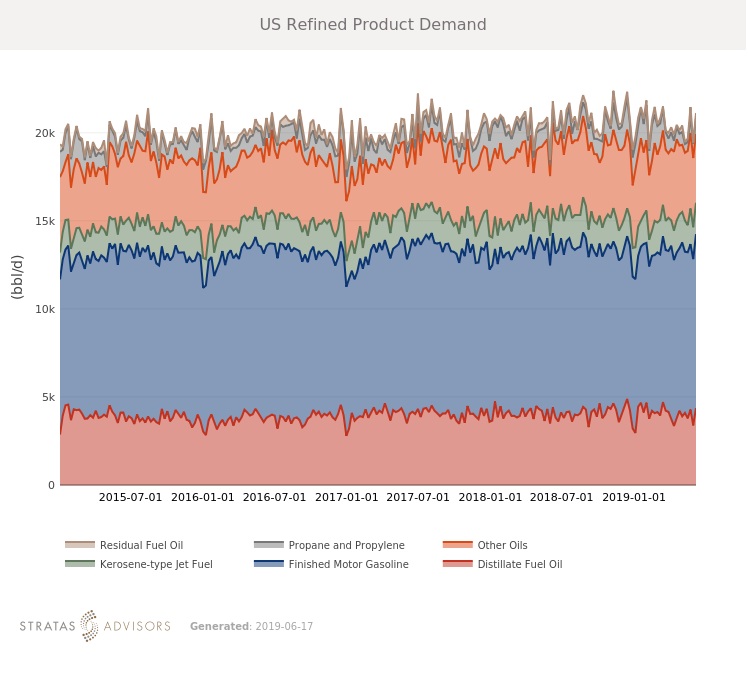

Oil Demand: Neutral

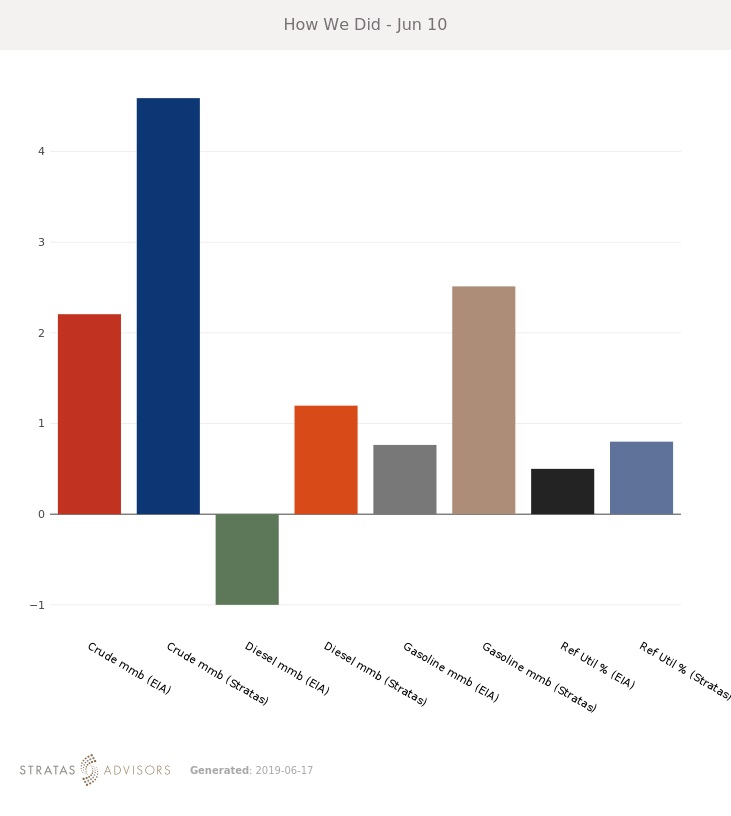

How We Did

Recommended Reading

Midstream Operators See Strong NGL Performance in Q4

2024-02-20 - Export demand drives a record fourth quarter as companies including Enterprise Products Partners, MPLX and Williams look to expand in the NGL market.

Post $7.1B Crestwood Deal, Energy Transfer ‘Ready to Roll’ on M&A—CEO

2024-02-15 - Energy Transfer co-CEO Tom Long said the company is continuing to evaluate deal opportunities following the acquisitions of Lotus and Crestwood Equity Partners in 2023.

Pembina Pipeline Enters Ethane-Supply Agreement, Slow Walks LNG Project

2024-02-26 - Canadian midstream company Pembina Pipeline also said it would hold off on new LNG terminal decision in a fourth quarter earnings call.

Williams Beats 2023 Expectations, Touts Natgas Infrastructure Additions

2024-02-14 - Williams to continue developing natural gas infrastructure in 2024 with growth capex expected to top $1.45 billion.

Waha NatGas Prices Go Negative

2024-03-14 - An Enterprise Partners executive said conditions make for a strong LNG export market at an industry lunch on March 14.