While Stratas Advisors expects oil prices to move higher during the next couple of months, the firm believes the increase will be moderate, in part, because of the U.S. dollar. (Source: Shutterstock.com)

[Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

The price of Brent crude ended the week at $72.69 after closing the previous week at $71.89. The price of WTI ended the week at $70.91 after closing the previous week at $69.62.

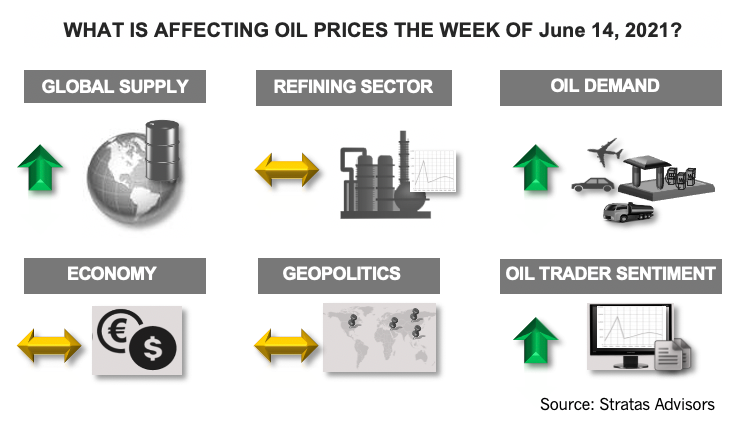

The price movement aligned with our view that the same themes that have been driving oil prices will continue to provide support for oil prices. Furthermore, the sentiment of the oil traders has been becoming more bullish with traders adding to their net long positions. Traders of WTI have been especially bullish with their net positions increasing by 18% during the last three weeks.

We are expecting that oil prices will move higher during the next month with global demand increasing—and outstripping global supply—resulting in global oil inventories continuing to be drawn down. Crude oil inventories in the U.S. continue to decline with the latest Energy Information Administration report indicating that crude inventories decreased by 5.24 million barrels, which is the 10th week of decreases out of the last 11 weeks. The level of crude inventories continues to be lower than for the same period of 2019. While refining inputs are increasing in response to rising demand, oil production in the U.S. continues to stagnate. Even with the six oil rigs that were added last week, the average weekly increase in rigs still lags the increase in demand and prices. Actually, the rate of rig increases has been slowing down in recent months—and at the current pace—it will take until the end of 2022 before the U.S. oil sector reaches pre-pandemic levels.

While we are expecting oil prices to move higher during the next couple of months, we think the increase will be moderate, in part, because of the U.S. dollar. Last week, the U.S. Dollar Index increased to 90.59, which is the third straight week of the U.S. dollar strengthening. This increase is a reversal of the downward trend in the U.S. dollar that started back in March of last year with the U.S. Dollar Index falling from around 99. We have been pointing out for a while that if the U.S. Dollar Index breaks through the support level of 90, it could fall all the way to 80—which would put significant upward pressure on oil prices. However, we are expecting that U.S. dollar will stabilize through the rest of the year, given the recovery of the U.S. economy.

About the Author:

John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Vår Energi Hits Oil with Ringhorne North

2024-04-17 - Vår Energi’s North Sea discovery de-risks drilling prospects in the area and could be tied back to Balder area infrastructure.

Tethys Oil Releases March Production Results

2024-04-17 - Tethys Oil said the official selling price of its Oman Export Blend oil was $78.75/bbl.

Exxon Mobil Guyana Awards Two Contracts for its Whiptail Project

2024-04-16 - Exxon Mobil Guyana awarded Strohm and TechnipFMC with contracts for its Whiptail Project located offshore in Guyana’s Stabroek Block.

Deepwater Roundup 2024: Offshore Europe, Middle East

2024-04-16 - Part three of Hart Energy’s 2024 Deepwater Roundup takes a look at Europe and the Middle East. Aphrodite, Cyprus’ first offshore project looks to come online in 2027 and Phase 2 of TPAO-operated Sakarya Field looks to come onstream the following year.

E&P Highlights: April 15, 2024

2024-04-15 - Here’s a roundup of the latest E&P headlines, including an ultra-deepwater discovery and new contract awards.