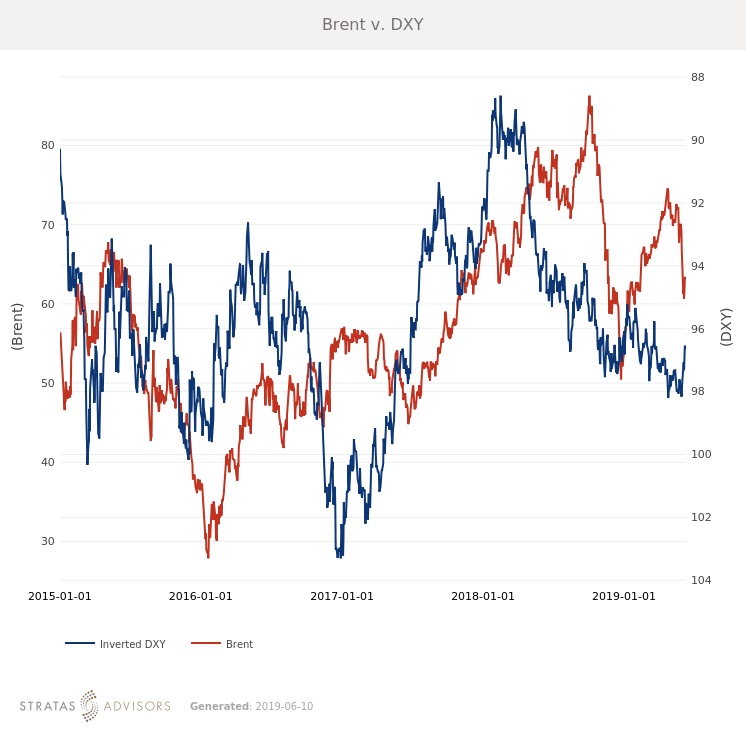

Despite a last minute recovery, Brent fell $6.44/bbl last week with the benchmark crude nearly ending on June 5 sub-$60/bbl. WTI’s average fell $4.01/bbl last week and also some recovery at the end of the week despite a large crude and refined products build.

For the week ahead we expect Brent to average $61/bbl as prices pause and markets reevaluate economic expectations. The Brent-WTI differential will remain wide as fears of an economic slowdown and/or production increase are especially weighted towards U.S. markets.

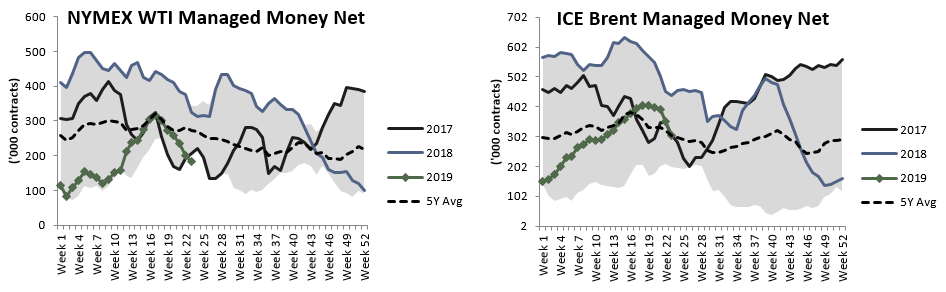

Oil ministers from Russia and Saudi Arabia have been meeting on the sidelines of the St. Petersburg International Forum. We expect to see statements reaffirming a commitment to stable oil markets. However, the Russian government is increasingly facing pressure from internal firms to end the production agreement and raise production. Russia’s April compliance was 80% according to the latest IEA report with many of the other OPEC+ signatories achieving compliance above 100%. Russia’s withdrawal would likely have a more immediate impact on optics than overall fundamentals. However, the optics would be very negative, and would certainly force Saudi Arabia to shoulder an even greater share of the burden, beyond the 256% compliance reported in April.

Friday saw the most lackluster employment report in months, and stoked fears that the economy is swiftly slowing. Retail sales and factory orders also slowed in April, showing that consumers and business alike are becoming more cautious. Over the weekend it was announced that tariffs against Mexico had been averted, removing at least one element of uncertainty although the trade dispute with China continues to drag on.

Geopolitical Unrest: Neutral

Global Economy: Neutral

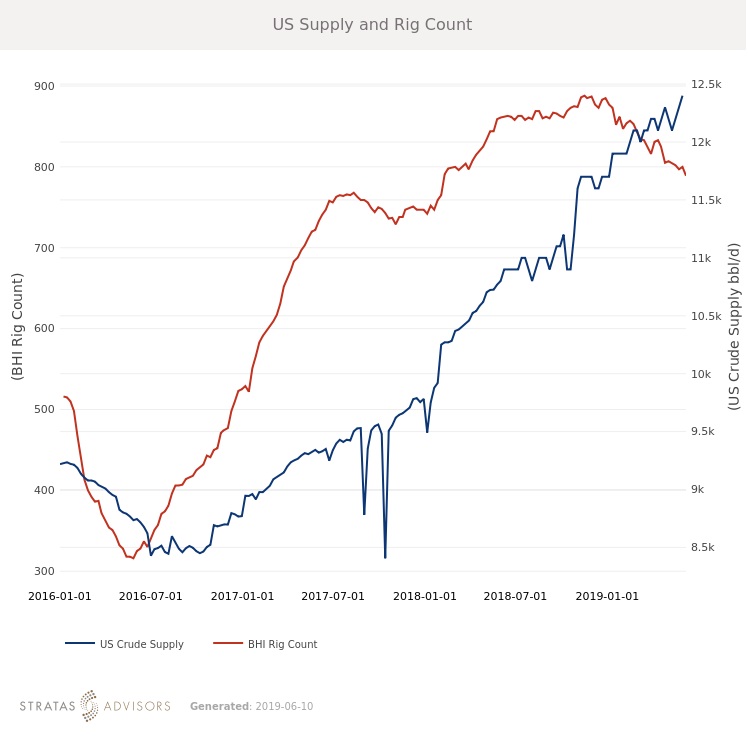

Oil Supply: Negative

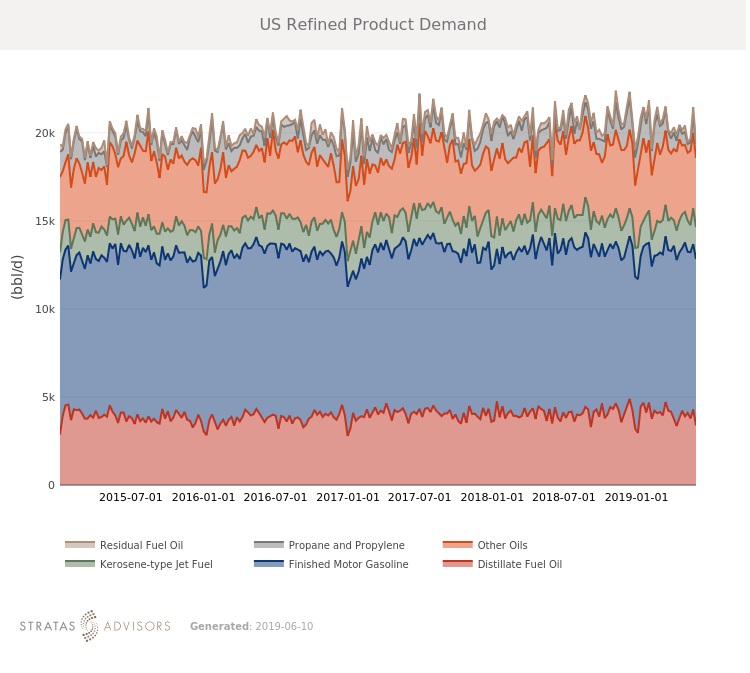

Oil Demand: Neutral

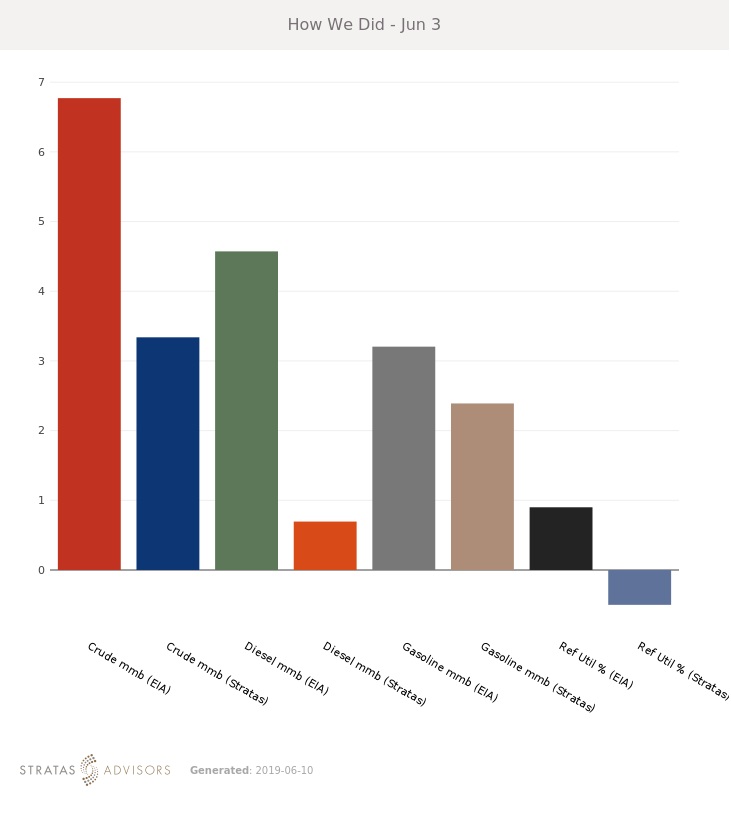

How We Did

Recommended Reading

Russia Orders Companies to Cut Oil Output to Meet OPEC+ Target

2024-03-25 - Russia plans to gradually ease the export cuts and focus on only reducing output.

BP Starts Oil Production at New Offshore Platform in Azerbaijan

2024-04-16 - Azeri Central East offshore platform is the seventh oil platform installed in the Azeri-Chirag-Gunashli field in the Caspian Sea.

Exclusive: Chevron Balancing Low Carbon Intensity, Global Oil, Gas Needs

2024-03-28 - Colin Parfitt, president of midstream at Chevron, discusses how the company continues to grow its traditional oil and gas business while focusing on growing its new energies production, in this Hart Energy Exclusive interview.

Imperial Expects TMX to Tighten Differentials, Raise Heavy Crude Prices

2024-02-06 - Imperial Oil expects the completion of the Trans Mountain Pipeline expansion to tighten WCS and WTI light and heavy oil differentials and boost its access to more lucrative markets in 2024.

Carlson: $17B Chesapeake, Southwestern Merger Leaves Midstream Hanging

2024-02-09 - East Daley Analytics expects the $17 billion Chesapeake and Southwestern merger to shift the risk and reward outlook for several midstream services providers.