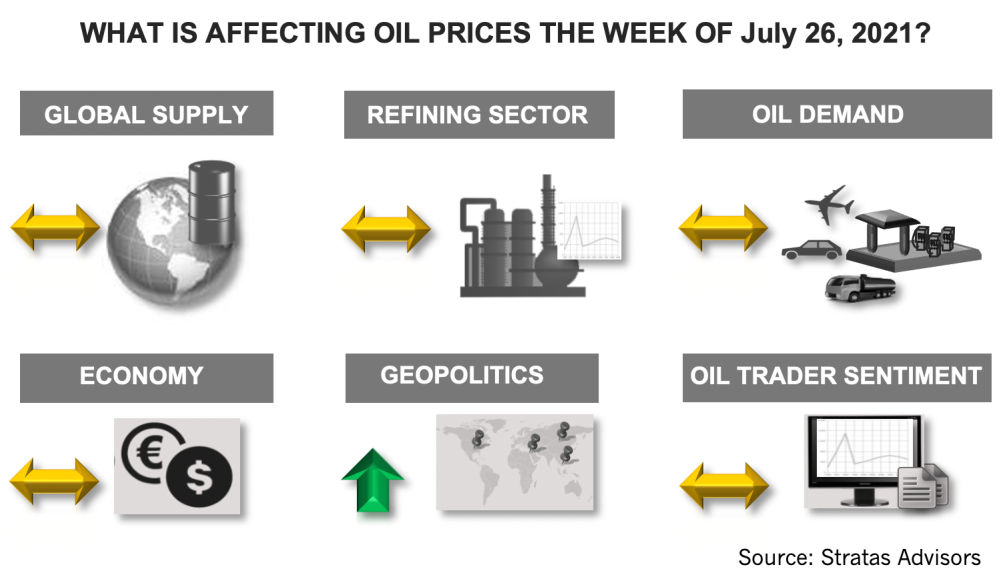

As for the lingering effect of COVID-19, Stratas Advisors says as long as hospitalizations, serious cases and deaths stay relatively low, the impact of another wave of elevated COVID cases on the global economy and oil demand will be mitigated. (Source: Collage by Hart Energy; images from Shutterstock.com)

[Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

The price of Brent crude ended last week at $74.19 after closing the previous week at $73.30 and rebounding from $68.62 on July 26. The price of WTI crude followed a similar pattern ending the week at $72.17 after falling to $66.42 on July 26.

With consideration of the agreed supply increases associated with OPEC+, coupled with our forecasted increases in non-OPEC supply and forecasted demand growth, we are projecting that demand will continue to outstrip supply throughout the rest of the year. However, the level of global oil inventories will still be higher than that of pre-COVID at the end of 2021.

We highlighted back in our note of July 12, our expectation that oil prices will continue to trade within a relatively narrow range for the next couple of months. The main risk to this expectation from the supply side is a deal that allows Iran to increase its oil exports substantially in the next few months.

With the negotiations between Iran and the U.S. dragging on there is recent news is that the U.S. is considering tighter sanctions on Iranian oil exports to China, which would further hamper Iran’s economy and affect around 1 million bbl/d. Such sanctions would also heighten the tensions between the U.S. and China. The incoming leader of the Islamic Republic, Ebrahim Raïssi, has stressed that widening the agreement to include Iran's regional policy and its ballistic program are not negotiable because they fall under the sovereignty of Iran. From the perspective of the U.S., it will be very difficult for the Biden Administration to sell a deal to the U.S. voters and their representatives—which will be viewed as enabling Iran to increase oil and gas exports, which are helpful to China—while the administration is perceived to be hindering U.S. production of oil and gas. The selling process will be made even more difficult if the deal does not address other issues including Iran’s ballistic program and interference in the rest of the region. It will be viewed as caving to Iran just to get a deal—and one that does not provide any real benefits to the U.S. and its allies in the region.

Because of the relevance to the energy sector and the oil market, we have assessed the range of issues surrounding the negotiations, which includes the following:

- Given the perspective of the U.S.—what is the possibility of Iran being more flexible?

- What role do the Europeans play in the negotiations?

- Does the election of the new president and the control of all branches of the government by the conservatives affect the negotiations?

- How does the exchange of drone attacks and bombing attacks between the U.S. and Iran-backed militias affect the negotiation?

- How damaging have the sanctions been on Iran—how and who is suffering?

- How supportive are the masses of the hardline? Does the supreme leader and the conservatives have credibility?

- How important is a deal for Iran—especially with Iran expanding its ties to China?

- What is the dynamic between Iran and India? And how does India’s relationship with the U.S. affect the relationship between Iran and India?

- How do the Arab allies of the U.S. view the negotiations?

From the demand side, we believe that upside surprise is unlikely—especially considering the lingering impact of COVID-19. Last week, we highlighted Israel because of its high rate of vaccination and availability of data. The number of cases continue to increase and have increased by 167% over the last 14 days. With respect to hospitalization, the weekly admissions are 206, which compares to 855 at the same period of last year. Weekly new ICU admissions stands at 100, which compares to 324 at the same period of last year. The average number of daily deaths is 1.71, which compares to 9.86 at the same period of last year. It appears that the COVID cases are following the season patterns of last year, but with the vaccine the rate of hospitalization, the number of serious cases requiring ICU admission, and the number of deaths are all running well below the pre-vaccine era. If the pattern with Israel holds for other countries, while there is a real potential of further waves of elevated COVID cases, as long as hospitalizations, serious cases and deaths stay relatively low, the impact on the global economy and oil demand will be mitigated.

About the Author:

John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Marketed: Sage Natural Resources 34 Well Package in Tarrant, Wise Counties, Texas

2024-02-02 - Sage Natural Resources retained EnergyNet for the sale of a 34 package (ORRI) in Tarrant and Wise counties, Texas.

Marketed: Mississippian Play Opportunity in Blaine County, Oklahoma

2024-02-02 - An undisclosed seller retained EnergyNet for the sale of a Mississippian play opportunity in the Webb 15-22-1XH Well in Blaine County, Oklahoma.

Marketed: EnCore Permian Holdings 17 Asset Packages

2024-03-05 - EnCore Permian Holdings LP has retained EnergyNet for the sale of 17 asset packages available on EnergyNet's platform.

Marketed: Bendel Ventures 73 Well Package in Texas

2024-03-05 - Bendel Ventures LP has retained EnergyNet for the sale of a 73 well package in Iron and Reagan counties, Texas.

Marketed: Stone Hill Minerals Holdings 95 Well Package in Colorado

2024-02-28 - Stone Hill Minerals Holdings has retained EnergyNet for the sale of a D-J Basin 95 well package in Weld County, Colorado.