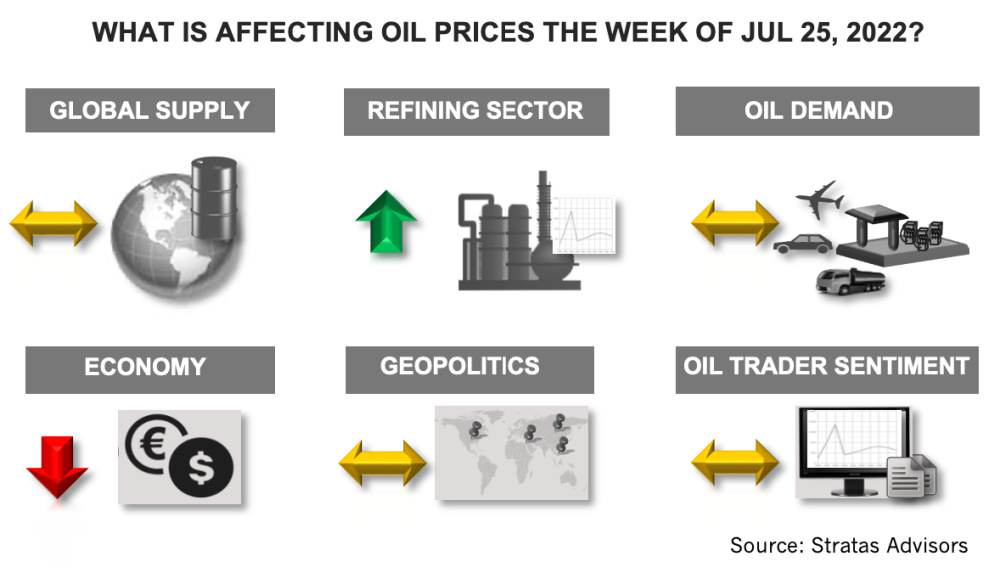

Additionally, now that oil traders have reduced their net long positions to the lowest level since April 2020, oil traders are reversing this trend, according to Stratas Advisors latest oil price forecast. (Source: Shutterstock.com)

Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

The price of Brent crude ended the week at $103.20 after closing the previous week at $101.16. The price of WTI ended the week at $94.70 after closing the previous week $97.59.

In our weekly note of June 13, we highlighted that the oil demand will be the most important factor impacting the direction of future oil prices. And the recent data is still indicating further slowdown in economic growth and oil demand.

- The U.S. economy continues to show signs of slowing down. Last week, the number of initial jobless claims increased for the third consecutive week and is now at the highest level in eight months. Additionally, the preliminary survey of purchasing managers released at the end of last week indicates that the Services PMI declined from 52.7 to 47, and that the Manufacturing PMI declined from 52.3 from 52.7. The U.S. Compositive Output Index declined from 52.3 to 47.5, which is the lowest level in 26 months. During the upcoming week, there are some important economic data that will be released including the second-quarter GDP growth and the latest inflation data. The Federal Reserve will also be meeting on July 26 and 27 and will be deciding on the extent of the next interest rate hike.

- The latest weekly report from Energy Information Administration (EIA) indicates that gasoline demand in the U.S. increased to 8.52 million bbl/d from the previous week of 8.06 million bbl/d. However, in comparison, for the same period of the previous year, gasoline demand was 9.3 million bbl/d. Based on the 4-week average, current gasoline demand is running 804,000 bbl/d less than for the same period of 2019, which represents a difference of 8.43%. Diesel demand in the U.S. increased to 3.7 million b/d from the previous week of 3.37 million bbl/d. In comparison, for the same period of the previous year, diesel demand was 3.93 million bbl/d. Based on the four-week average, diesel demand is running 48,000 bbl/d less than for the same period of 2019, which represents a difference of 1.26%. Jet fuel demand increased to 1.64 million bbl/d from 1.36 million bbl/d of the previous week. In comparison, for the same period of the previous year, jet fuel demand was 1.41 million bbl/d. Based on the four-week average, jet fuel demand is running 273,000 bbl/d less than in 2019, which is about 15% less.

- Additional downward pressure on economy activity and oil demand stems from the European Central Bank (ECB) increasing interest rates last week for the first time in 11 years. The ECB also indicated additional rate increases because inflation is well above the target rate of 2%.

- The strength of the US dollar is also putting downward pressure on the oil price. The U.S. Dollar Index closed last week at 106.61, which is the highest since July 2002—and when the price of Brent crude oil was around $26.

- From a technical perspective, the price of Brent crude is approaching the 200-day simple moving average for the first time since December 2021. If the price of Brent crude breaks through this level, the next support level is around $80.

However, as we pointed out last week, while there are a number of factors putting downward pressure on oil prices, there are also factors providing upward support for oil prices:

- We are still expecting that overall demand growth for oil will be slightly greater than the growth in oil supply during the third quarter, even though the oil supply-side situation with respect to the Russia-Ukraine conflict has been stabilizing.

- The latest EIA report indicated that U.S. oil production declined to 11.9 million bbl/d from the previous week of 12 million bbl/d. Additionally, the number of operating oil rigs in the U.S. remained unchanged at 599 rigs, which compares to the pre-COVID level of 683 that occurred during the week of March 13, 2020. The number of operating oil rigs in Canada decreased by one and now stands at 124, which compares to 93 operating rigs for the same period of the previous year. From a global perspective, the total oil and gas rig count reached 1,706 at the end of June, which compares to 1,325 of the previous year, but is still well below that of 2019, when the rig count was 2,221. While the U.S. and Canadian rig count lags 2019 level by 19%, the rig count in the other regions lags by 28%. The rig count in Europe lags by 55%, Africa by 33%, Middle East by 27%, and Asia by 14%.

- Furthermore, despite the recent visit to the Middle East by President Biden, we are not expecting any material change in the supply strategy of Saudi Arabia or OPEC+.

Additionally, now that oil traders have reduced their net long positions to the lowest level since April 2020, oil traders are reversing this trend. Last week, traders of WTI crude increased their net long positions by increasing their long positions, while reducing their short positions. This is the second consecutive week of increases after the steep decline that occurred during the previous four weeks. Even with the increase the net long positions remain at the lowest level since April 2020. Similarly, traders of Brent crude increased their net long position by increasing their long positions, while reducing their short positions.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

US Drillers Add Oil, Gas Rigs for First Time in Five Weeks

2024-04-19 - The oil and gas rig count, an early indicator of future output, rose by two to 619 in the week to April 19.

Strike Energy Updates 3D Seismic Acquisition in Perth Basin

2024-04-19 - Strike Energy completed its 3D seismic acquisition of Ocean Hill on schedule and under budget, the company said.

Santos’ Pikka Phase 1 in Alaska to Deliver First Oil by 2026

2024-04-18 - Australia's Santos expects first oil to flow from the 80,000 bbl/d Pikka Phase 1 project in Alaska by 2026, diversifying Santos' portfolio and reducing geographic concentration risk.

Iraq to Seek Bids for Oil, Gas Contracts April 27

2024-04-18 - Iraq will auction 30 new oil and gas projects in two licensing rounds distributed across the country.

Vår Energi Hits Oil with Ringhorne North

2024-04-17 - Vår Energi’s North Sea discovery de-risks drilling prospects in the area and could be tied back to Balder area infrastructure.