Brent fell sharply last week, down $3.51/bbl to average $72.51/bbl (in line with last week’s forecast) while West Texas Intermediate (WTI) fell $2.97/bbl to average $68.96/bbl. Prices could see some transient support at the start of the week as headlines are again being dominated by the war of words between the U.S. and Iranian leaders. As we have spoken about previously, the chances of Iran physically closing the Strait of Hormuz are exceedingly slim, unless the U.S. or its allies provoke Tehran by physically blocking oil shipments.

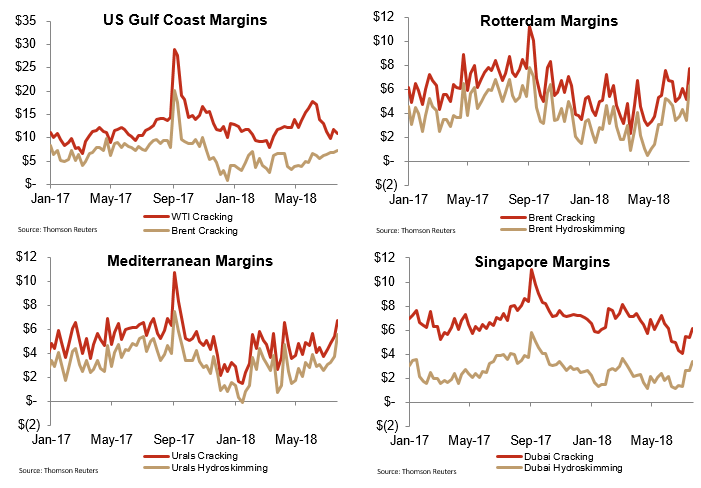

Although U.S. crude runs fell sharply, they remain slightly above last year’s levels. Globally, margins are at or above the five-year seasonal average and are likely to support continued runs. The drop in U.S. runs appears to have been linked to equipment outages more so than a change in economics, and thus runs will pick up in upcoming data releases. For the week ahead, we expect geopolitical concerns to help stop the bleeding and allow Brent to trade generally sideways.

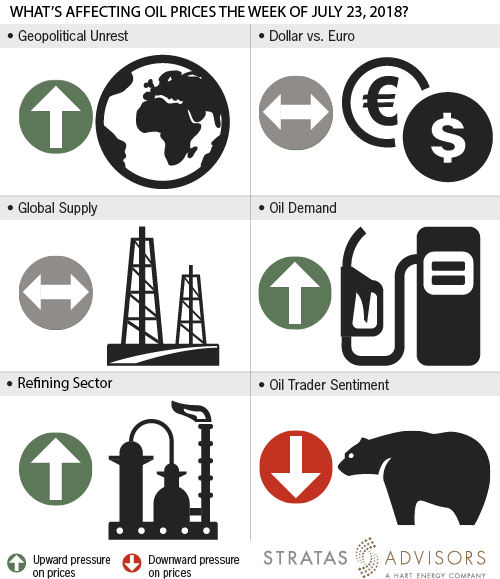

Geopolitical: Positive

Geopolitics will be a positive factor in the week ahead as concerns abound around the Strait of Hormuz.

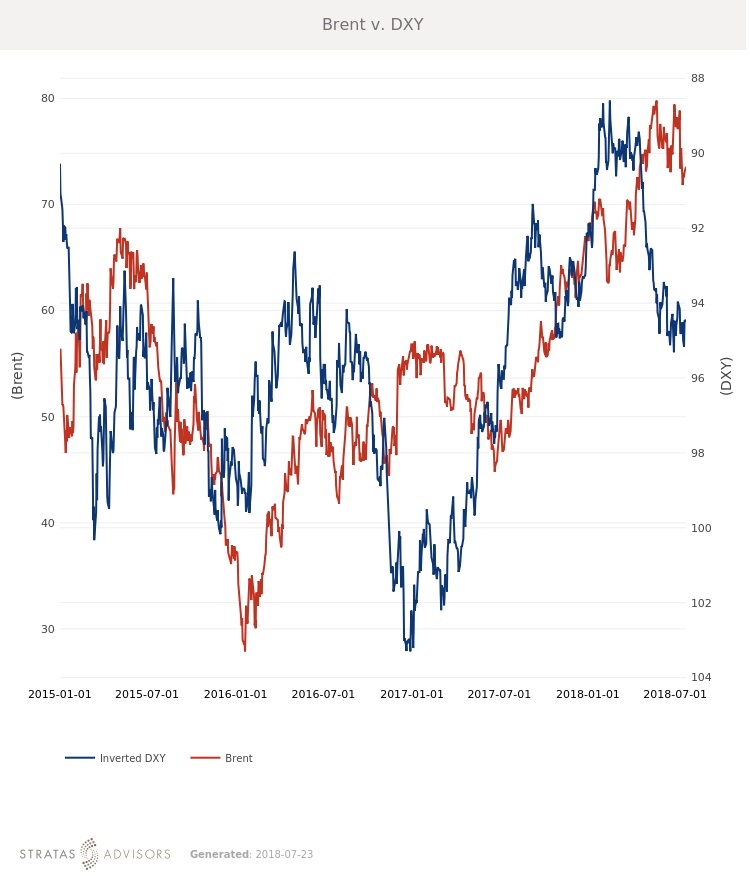

Dollar: Neutral

The dollar will be a neutral factor in the week ahead as fundamental and sentiment-related drivers continue to have more impact on crude oil prices.

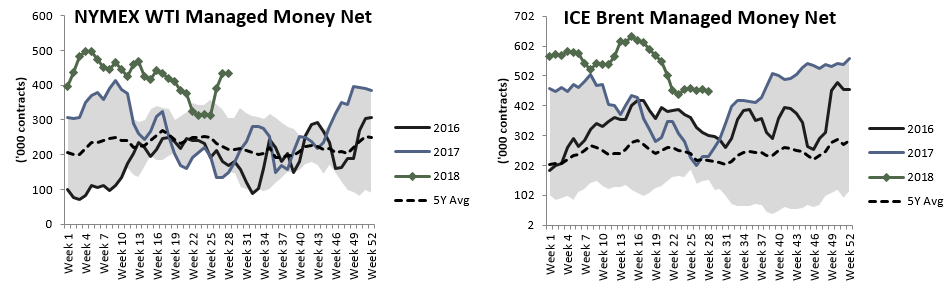

Trader Sentiment: Negative

Trader sentiment will be a negative factor in the week ahead.

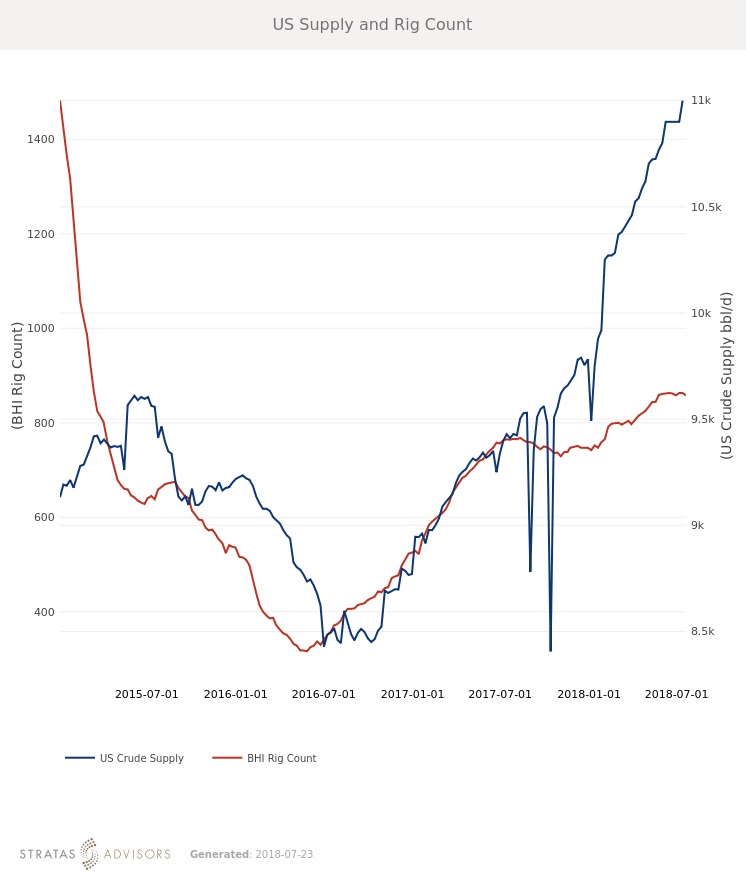

Supply: Neutral

Supply will be a neutral factor in the week ahead. While short-term outages in Libya and Iraq should theoretically provide support, Russia and other major producers continue to broadcast their ability to raise production.

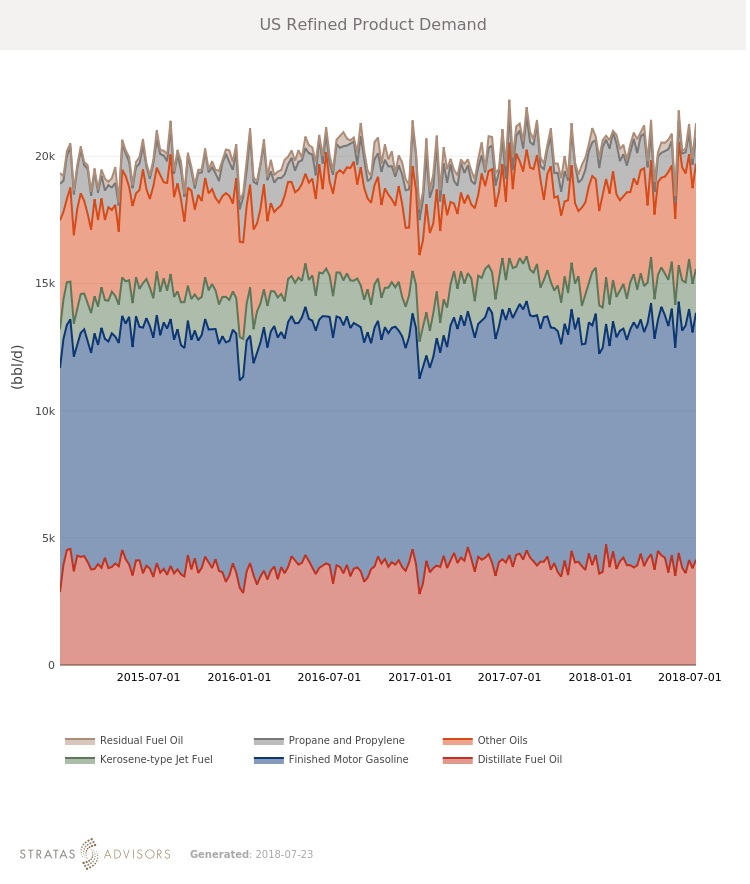

Demand: Positive

Demand will be a positive factor in the week ahead as rising prices fail to stymie demand.

Refining Margins: Positive

Refining will be a positive factor in the week ahead. Although U.S. crude runs fell sharply, they remain slightly above prior year levels. Globally, margins are at or above the five-year seasonal average and are likely to support continued runs. The drop in U.S. runs appears to have been linked to equipment outages more so than a change in economics, and thus runs will pick up in upcoming data releases.

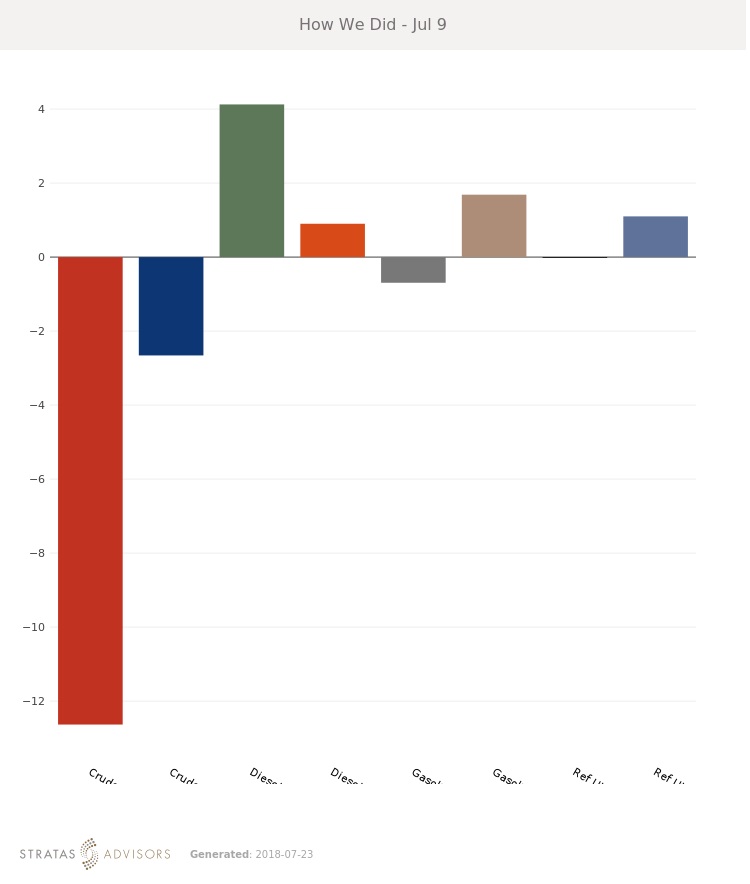

How We Did

Recommended Reading

President: Financial Debt for Mexico's Pemex Totaled $106.8B End of 2023

2024-02-21 - President Andres Manuel Lopez Obrador revealed the debt data in a chart from a presentation on Pemex at a government press conference.

From Restructuring to Reinvention, Weatherford Upbeat on Upcycle

2024-02-11 - Weatherford CEO Girish Saligram charts course for growth as the company looks to enter the third year of what appears to be a long upcycle.

TechnipFMC Eyes $30B in Subsea Orders by 2025

2024-02-23 - TechnipFMC is capitalizing on an industry shift in spending to offshore projects from land projects.

NOV's AI, Edge Offerings Find Traction—Despite Crowded Field

2024-02-02 - NOV’s CEO Clay Williams is bullish on the company’s digital future, highlighting value-driven adoption of tech by customers.

Patterson-UTI Braces for Activity ‘Pause’ After E&P Consolidations

2024-02-19 - Patterson-UTI saw net income rebound from 2022 and CEO Andy Hendricks says the company is well positioned following a wave of E&P consolidations that may slow activity.