In its latest quarterly update, Stratas Advisors forecasts that global oil demand will be around 1 million bbl/d less than the firm’s forecast at the beginning of the year. (Source: Shutterstock.com)

Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

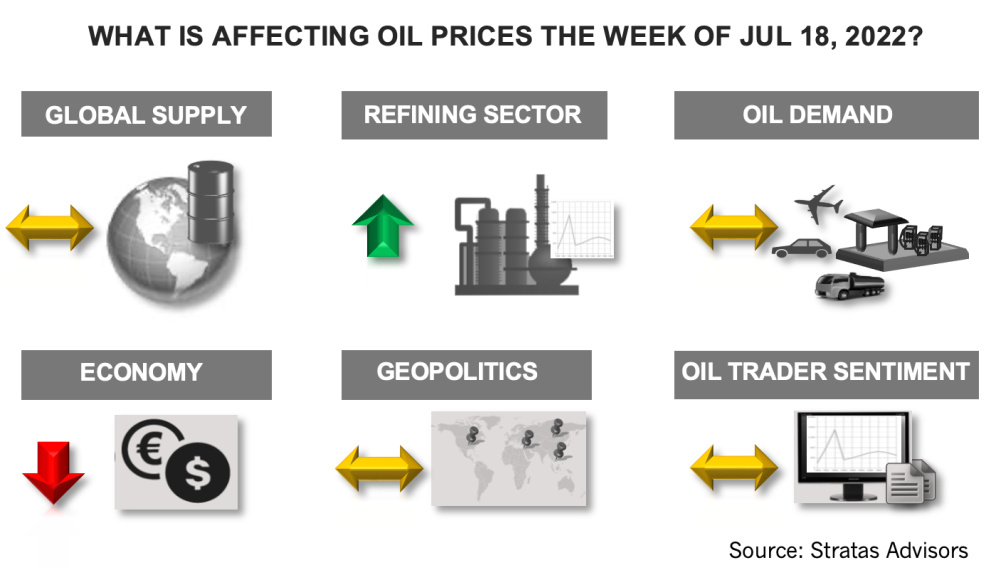

The price of Brent crude ended the week at $101.16 after closing the previous week at $107.02. The price of WTI ended the week at $97.59 after closing the previous week $104.79. As such, while oil prices are revisiting the lower support levels, the price of Brent crude is staying within the channel between $100 and $120.

The most recent data continue to indicate slowing economic growth.

- The U.S. continues to experience elevated inflation with the June report showing that the Consumer Price Index increased by 9.1% from the previous year and 1.3% from the previous month. With inflation running high, wages are lagging well behind the overall increase in prices, which is increasing the risk of a recession, given the importance of consumer spending to support the overall economy. The U.S. economy had negative growth in the first quarter, and early indications are that the economic growth will be negative in the second quarter. Additionally, much of the inflation is being driven by supply chain issues and shortages, which cannot be addressed through monetary policy. Regardless, the U.S. Federal Reserve seems intent on continuing to raise interest rates. The latest indications are that the Federal Reserve will raise interest rates by 0.75% at its next meeting on July 26-27, which will be the second consecutive such increase.

- The European Central Bank also seems intent on raising interest rates, even though economic activity is slowing down. The most recent Purchasing Managers’ Indexes (PMIs) for Euro area declined with the Manufacturing PMI falling from 54.60 to 52.10 and the Services PMI falling from 56.10 to 53.

- China’s economy also continues to struggle with second-quarter growth being reported at only 0.4% from the previous year and a decrease of 2.6% from the first quarter. However, China’s PMIs for June indicate that its economic activity is picking up. China’s composite PMI increased from 48.1 to 51.7. Additionally, China’s official Manufacturing PMI increased to 50.2 from 49.6, which is the first expansion since February (readings above 50 indicate expansion, while readings below 50 indicate contraction). However, the impact of COVID-19 and zero-COVID policies in China is not over, with China now dealing with the BA.5 sub-variant, which is highly contagious.

The slowing economic growth is translating into waning growth for oil. The latest weekly report from the U.S. Energy Information Administration (EIA) indicates that gasoline demand in the United States decreased to 8.06 million bbl/d from the previous week of 9.41 million bbl/d. In comparison, for the same period of the previous year, gasoline demand was 9.28 million bbl/d. Based on the four-week average, current gasoline demand is running 750,000 bbl/d less than for the same period of 2019, which represents a difference of 7.9%. Furthermore, in our most recent quarterly update (short-term outlook) global oil demand to forecasted to be only 2.63 million bbl/d greater in 2022 than in 2021, which is around 1 million bbl/d less than our forecast at the beginning of the year.

While there is downward pressure on oil prices, there are also factors providing support.

- We are still expecting that overall demand growth for oil will be slightly greater than the growth in oil supply during the third quarter, even though the oil supply-side situation has been stabilizing.

- Furthermore, despite the visit to the Middle East by U.S. President Joe Biden, we are not expecting any material change in the supply strategy of Saudi Arabia or OPEC+.

- Additionally, as we pointed out in our note of last week, now that oil traders having reduced their net long positions to the lowest level since April 2020, we are expecting that oil traders will start reversing this trend.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

EIA: Permian, Bakken Associated Gas Growth Pressures NatGas Producers

2024-04-18 - Near-record associated gas volumes from U.S. oil basins continue to put pressure on dry gas producers, which are curtailing output and cutting rigs.

Benchmark Closes Anadarko Deal, Hunts for More M&A

2024-04-17 - Benchmark Energy II closed a $145 million acquisition of western Anadarko Basin assets—and the company is hunting for more low-decline, mature assets to acquire.

‘Monster’ Gas: Aethon’s 16,000-foot Dive in Haynesville West

2024-04-09 - Aethon Energy’s COO described challenges in the far western Haynesville stepout, while other operators opened their books on the latest in the legacy Haynesville at Hart Energy’s DUG GAS+ Conference and Expo in Shreveport, Louisiana.

Mighty Midland Still Beckons Dealmakers

2024-04-05 - The Midland Basin is the center of U.S. oil drilling activity. But only those with the biggest balance sheets can afford to buy in the basin's core, following a historic consolidation trend.

Mesa III Reloads in Haynesville with Mineral, Royalty Acquisition

2024-04-03 - After Mesa II sold its Haynesville Shale portfolio to Franco-Nevada for $125 million late last year, Mesa Royalties III is jumping back into Louisiana and East Texas, as well as the Permian Basin.