Stratas Advisors said it still holds the view that a deal among OPEC, Russia and other oil producers—known as OPEC+—will be reached. (Source: Shutterstock.com)

Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

[Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

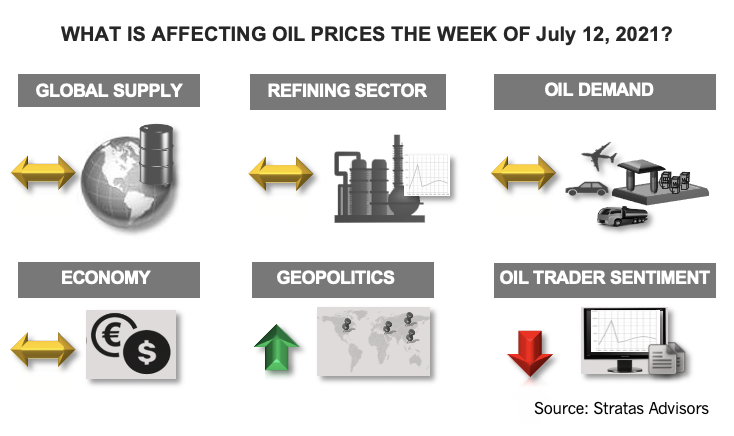

The price of Brent crude ended last week at 75.58 after closing the previous week at $75.97 with the price rebounding at the end of the week after falling to $73.43 on July 7. The price of WTI crude had a similar pattern ending the week at $74.63 after falling to $72.20 on Juy 7.

The big news of last week was that OPEC+ meeting planned for July 5 did not take place, and a stalled deal to increase supply (starting in August through December by 400,000 bbl/d each month) and the extension of the OPEC+ framework though the end of 2022. The sticking point remains that the United Arab Emirates (UAE) wants to have its baseline increased from 3.2 million bbl/d to 3.8 million bbl/d.

We are still holding to our view that a deal will be reached—but it will take some additional time and further discussions at the highest level. If an agreement is not reached, the impact on the oil prices will be negative because it will signal the end of the OPEC+ framework, which has been critical to rebalancing of the oil markets and supporting the increase in oil prices to above pre-COVID levels. Without the framework, it is likely that individual members will start to increase supply to not lose market share.

RELATED:

OPEC+ Yet to Make Progress in Resolving Impasse

There is also renewed uncertainty about demand because of the ongoing impact from COVID-19, and the potential for resurgence. It is likely that the world is going to be dealing with COVID-19 for longer (and maybe a lot longer). While it is unlikely that there will be anything like widespread restrictions in the future, COVID-19 will still be a drag on the global economy and mobility. Therefore, the risk to the demand is biased to the downside. Global cases started increasing during the week of June 21 with cases increasing by 72,002, and then increasing by 109,881 during the following week. The bulk of the increases stem from Europe and Southeast Asia, but now cases are starting to increase in the U.S. (On a positive note, the number of weekly global deaths is still declining and has fallen to 53,994, which is nearly half the recent high of 96,703 that occurred during the week of April 26.) With cases creeping upward, there is also increasing number of cases occurring with people who have been fully vaccinated, giving indication that the vaccine is not 100% preventative (as expected), but also an indication that the effectiveness of the vaccines is waning with time. There are also concerns about the Delta variant and other current and potential future variants. These developments highlight that while the impact of the virus has been mitigated, the world is still being affected by the virus. The big concern will be when the weather turns cold again in the northern hemisphere.

However, we are not expecting that oil prices will drop significantly—unless there is a deal that allows Iran to increase its oil exports substantially in the next few months, which we think is becoming even more unlikely because of recent developments. Furthermore, we do not think there is much more upside potential for oil prices, given the extend of the shut-in production and that any upside surprise in demand is unlikely. Additionally, we expect the U.S. dollar to continue to strengthen through the rest of the year, which will dampen commodity prices, including oil prices.

About the Author:

John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Petrie Partners: A Small Wonder

2024-02-01 - Petrie Partners may not be the biggest or flashiest investment bank on the block, but after over two decades, its executives have been around the block more than most.

Matador Stock Offering to Pay for New Permian A&D—Analyst

2024-03-26 - Matador Resources is offering more than 5 million shares of stock for proceeds of $347 million to pay for newly disclosed transactions in Texas and New Mexico.

Kimmeridge Fast Forwards on SilverBow with Takeover Bid

2024-03-13 - Investment firm Kimmeridge Energy Management, which first asked for additional SilverBow Resources board seats, has followed up with a buyout offer. A deal would make a nearly 1 Bcfe/d Eagle Ford pureplay.

CorEnergy Infrastructure to Reorganize in Pre-packaged Bankruptcy

2024-02-26 - CorEnergy, coming off a January sale of its MoGas and Omega pipeline and gathering systems, filed for bankruptcy protect after reaching an agreement with most of its debtors.

Enbridge Advances Expansion of Permian’s Gray Oak Pipeline

2024-02-13 - In its fourth-quarter earnings call, Enbridge also said the Mainline pipeline system tolling agreement is awaiting regulatory approval from a Canadian regulatory agency.