Another factor to consider, according to Stratas Advisors, is that during the previous week oil traders reduced their net long positions significantly and their net long positions are now at the lowest level since April 2020. (Source: Shutterstock.com)

Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

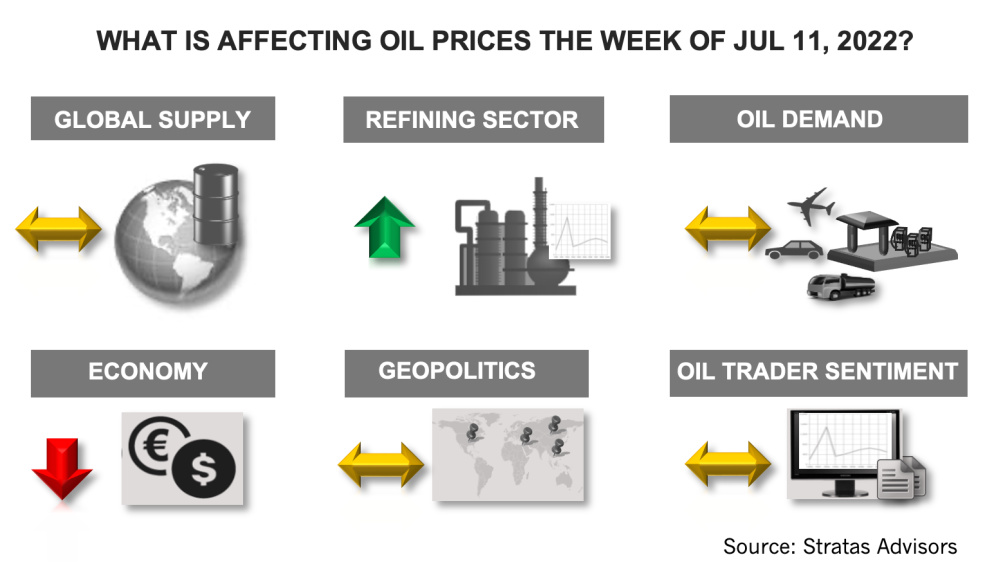

The price of Brent crude ended the week at $107.02 after closing the previous week at $111.63, and the price of WTI ended the week at $104.79 after closing the previous week $108.43. During our previous note published on June 27, we highlighted that while prices have been declining, the price movement remained on the upward trend that started in December of last year. We also stated that if the trend breaks, we expected to see the price of Brent crude oil dropping towards $100. And that is what happened with prices falling to $100 earlier in the week but the lower support level held—and oil prices recovered in the latter part of the week.

We also highlighted that oil prices were moderating because of tepid demand associated with the slowing global economy. Last week, there were further signs that growth associated with the major western economies is slowing. While the U.S. economy continues to add jobs, the number of jobs is still 755,000 below that of the pre-pandemic level. Additionally, wage increases are lagging well below the overall inflation rate. The resulting stress on households is illustrated by the Consumer Sentiment Index reaching a record low in June. Furthermore, the US PMIs that were released last week fell from May. The Manufacturing Purchasing Managers’ Index (PMI) fell from 57 to 52.7 and the Services PMI fell to 52.7 from 53.4, as did the PMIs for other major developed economies.

- The PMIs for the Euro area declined with the Manufacturing PMI falling from 54.6 to 52.1 and the Services PMI falling from 56.1 to 53.

- In a similar fashion, the PMIs for OECD Asia declined. The composite PMI for Japan fell from 53.3 to 52.7 and the composite PMI for South Korea fell from 51.8 to 51.3.

The weakness in the other major economies, coupled with the expectation that the U.S. Federal Reserve will persist with raising interest rates, the US dollar continues to strengthen. The U.S. Dollar Index increased to 107.01 from 105.14 of the previous week and is at the highest level since early in 2002. As we have previously noted, the strengthening US dollar is making oil prices even more expensive for those countries which have seen their currencies weaken against the U.S. dollar.

In contrast to the OECD economies, China’s PMIs for June indicate that its economic activity is picking up. China’s composite PMI increased from 48.1 to 51.7. Additionally, China’s official Manufacturing PMI increased to 50.2 from 49.6, which is the first expansion since February (readings above 50 indicate expansion, while readings below 50 indicate contraction). However, the impact of COVID-19 and zero-COVID policies in China is not over, as highlighted by Shanghai experiencing increasing cases stemming from the BA.5 sub-variant, which is highly contagious.

However, while the supply side of the oil market has become more stable during the last couple of months, there remains geopolitical risk associated with oil supply, including oil production in Africa and especially so in Libya. There is also risk associated with oil shipments from Kazakhstan because of its dependency on the Caspian Pipeline Consortium (CPC) pipeline. On July 5, a Russia judge ordered CPC to halt shipments for 30 days because of so-called documentary violations of the CPC’s Oil Spill Response Plan. The company has appealed and there is a hearing scheduled for July 11. Regardless of the ruling, the development highlights the vulnerability of the 1.5 million bbl/d of oil that is shipped through the CPC pipeline.

Another factor to consider is that during the previous week, oil traders reduced their net long positions significantly and their net long positions are now at the lowest level since April 2020. Consequently, we are expecting that oil traders will start reversing this trend.

Considering this set of factors, we think that oil prices will drift sideways this week.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

US Refiners to Face Tighter Heavy Spreads this Summer TPH

2024-04-22 - Tudor, Pickering, Holt and Co. (TPH) expects fairly tight heavy crude discounts in the U.S. this summer and beyond owing to lower imports of Canadian, Mexican and Venezuelan crudes.

What's Affecting Oil Prices This Week? (April 22, 2024)

2024-04-22 - Stratas Advisors predict that despite geopolitical tensions, the oil supply will not be disrupted, even with the U.S. House of Representatives inserting sanctions on Iran’s oil exports.

Association: Monthly Texas Upstream Jobs Show Most Growth in Decade

2024-04-22 - Since the COVID-19 pandemic, the oil and gas industry has added 39,500 upstream jobs in Texas, with take home pay averaging $124,000 in 2023.

Shipping Industry Urges UN to Protect Vessels After Iran Seizure

2024-04-19 - Merchant ships and seafarers are increasingly in peril at sea as attacks escalate in the Middle East.

Paisie: Crude Prices Rising Faster Than Expected

2024-04-19 - Supply cuts by OPEC+, tensions in Ukraine and Gaza drive the increases.