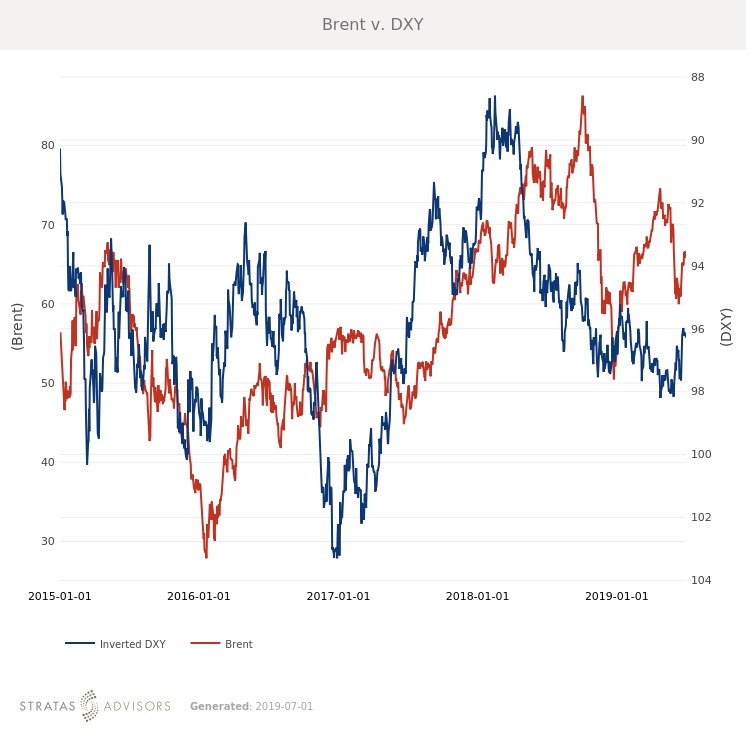

Crude oil increased again last week, rising $2.99/bbl to average $65.90. WTI increased even more, up $3.87/bbl to average $58.60/bbl. Crude was supported by positive expectations for both the G-20 meeting and the OPEC meeting. Prices will likely rise again next week, albeit at a slower pace as some of the potential gain has been built in. Brent will likely average $67/bbl in the week ahead, with some volatility in the first half of the week.

As of this writing, the OPEC meetings had not yet concluded, but statements from the ministers involved all seem to point toward a continuation of the ongoing supply agreement.

Additionally, the sideline meeting of Chinese President Xi Jinping and U.S. President Donald Trump was considered a success by markets, although which country came out on top is still to be determined. Trump agreed to hold off on imposing further tariffs and rolled back some restrictions on the Chinese tech firm Huawei. This is also good news for U.S. consumers and companies as it staves off an expected increase in costs that could have slowed consumer spending. For now, a definitive timeline has not been set for official talks to resume but negotiations should start soon in order for markets to maintain their positive momentum.

Outside of the OPEC meeting, weekly fundamental data has been more mixed. Stocks in the European ARA hub are rising, and a recent heat wave is unlikely to support increased consumption.

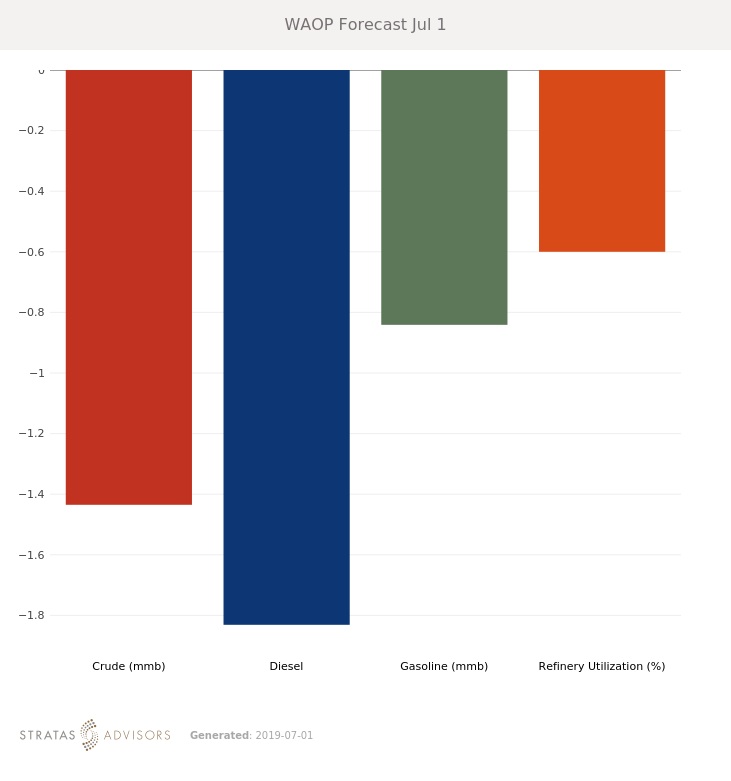

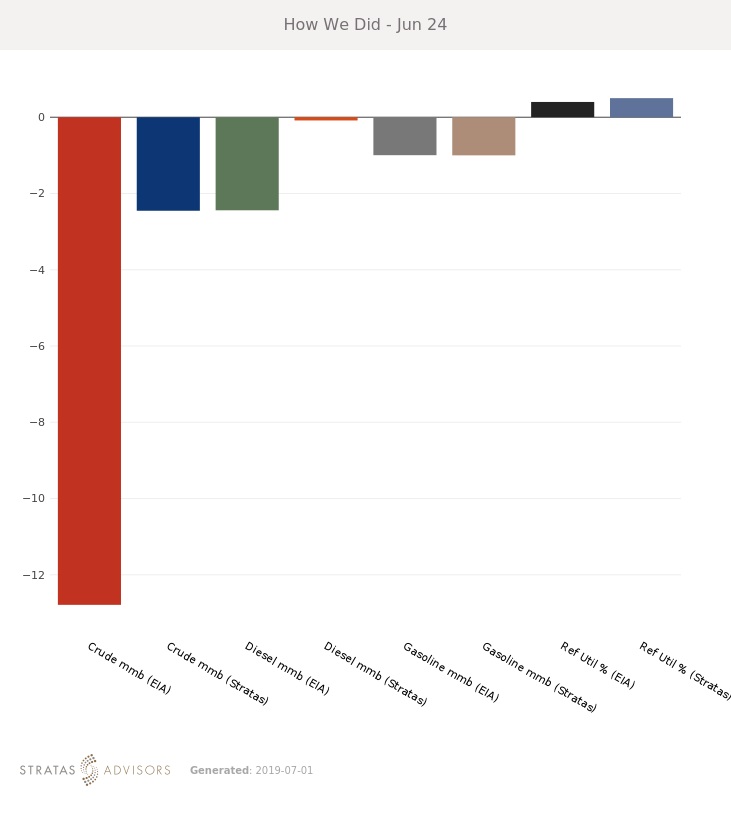

In the U.S., commercial crude inventories took a sharp leg downward but remain above the five-year average. Products are mixed with distillate below the five-year average and falling, while gasoline stocks are flat at the average.

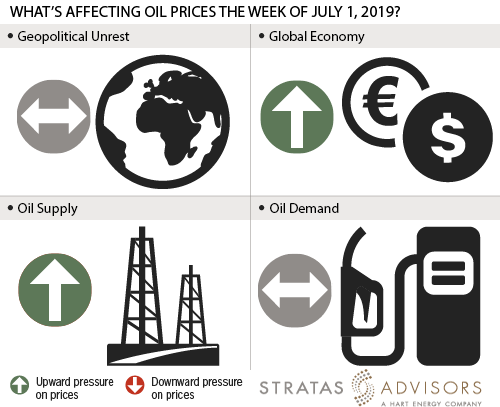

Geopolitics – Neutral

Global Economy – Positive

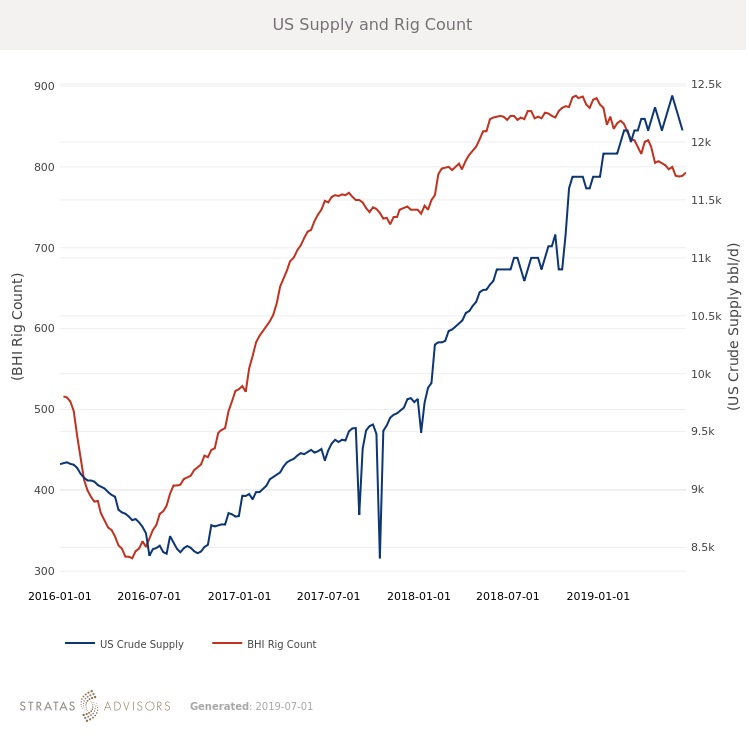

Oil Supply – Positive

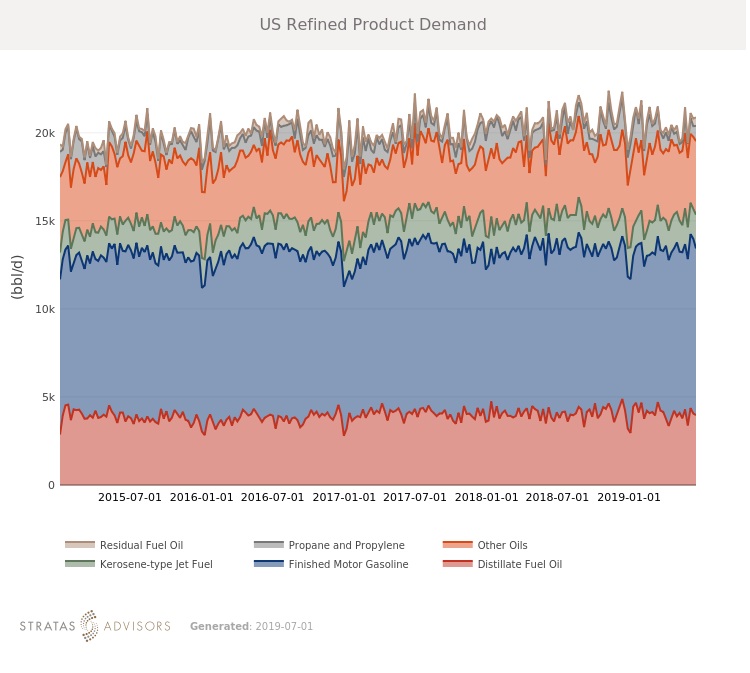

Oil Demand – Neutral

How We Did

Recommended Reading

Chesapeake Slashing Drilling Activity, Output Amid Low NatGas Prices

2024-02-20 - With natural gas markets still oversupplied and commodity prices low, gas producer Chesapeake Energy plans to start cutting rigs and frac crews in March.

Shell’s CEO Sawan Says Confidence in US LNG is Slipping

2024-02-05 - Issues related to Venture Global LNG’s contract commitments and U.S. President Joe Biden’s recent decision to pause approvals of new U.S. liquefaction plants have raised questions about the reliability of the American LNG sector, according to Shell CEO Wael Sawan.

BP Pursues ‘25-by-‘25’ Target to Amp Up LNG Production

2024-02-15 - BP wants to boost its LNG portfolio to 25 mtpa by 2025 under a plan dubbed “25-by-25,” upping its portfolio by 9% compared to 2023, CEO Murray Auchincloss said during the company’s webcast with analysts.

Some Payne, But Mostly Gain for H&P in Q4 2023

2024-01-31 - Helmerich & Payne’s revenue grew internationally and in North America but declined in the Gulf of Mexico compared to the previous quarter.

Uinta Basin: 50% More Oil for Twice the Proppant

2024-03-06 - The higher-intensity completions are costing an average of 35% fewer dollars spent per barrel of oil equivalent of output, Crescent Energy told investors and analysts on March 5.