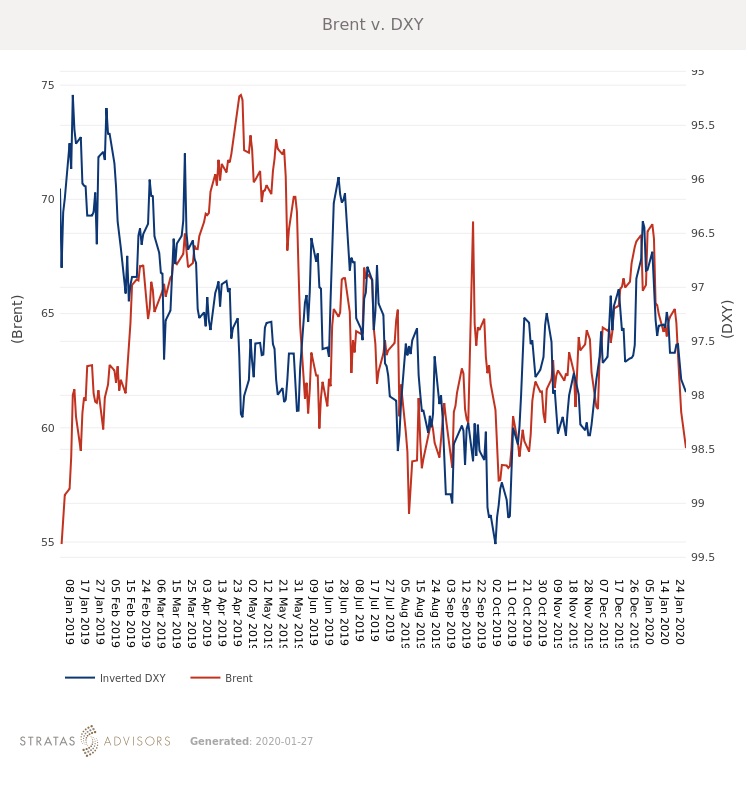

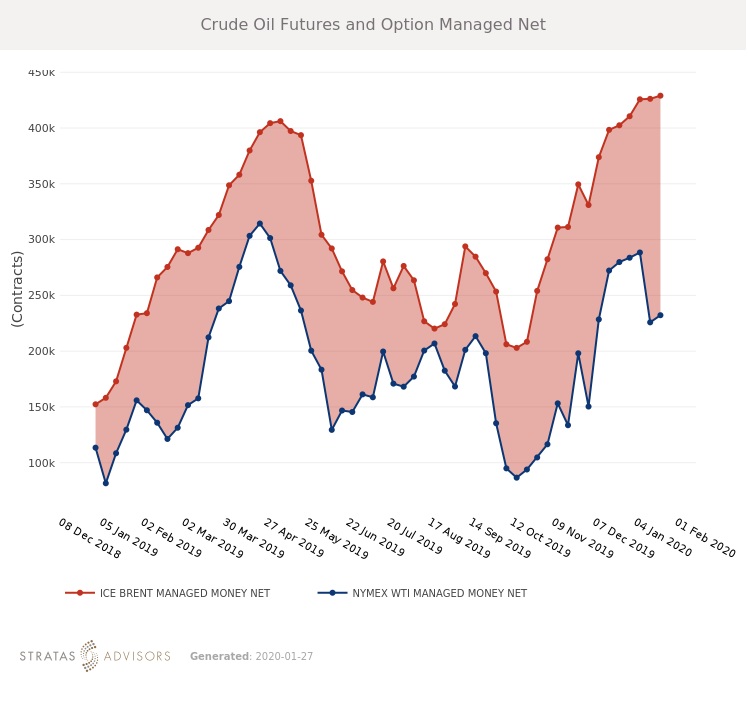

Weekly average Brent fell $1.29/bbl last week to average $63.15/bbl, slightly below our $63.50/bbl forecast. WTI fell $2.02/bbl to average $56.22/bbl. For the week ahead, Stratas Advisors expect Brent to continue to struggle, likely averaging close to $60/bbl.

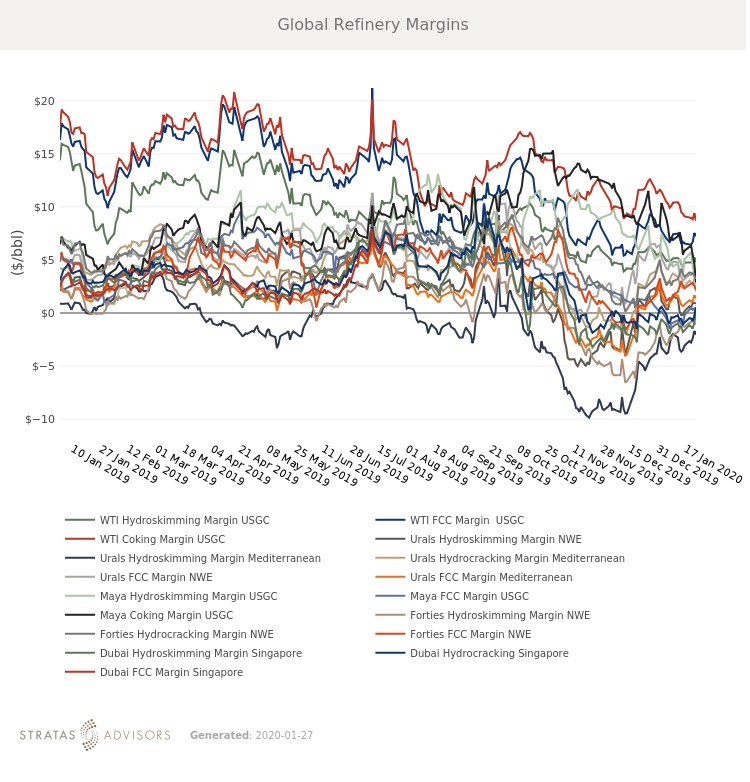

Demand fears stemming from the coronavirus outbreak appear overblown, but that doesn’t mean they won’t continue to weigh on prices in the short-term. The Lunar New Year celebration in China is one of the largest travel holidays in the country and the virus has severely curtailed festivities. Several cities have been placed under quarantine, major attractions closed and festivities have been canceled in other cities. Similar to the SARS outbreak of 2003 the virus has now been confirmed in several other countries, but international travel restrictions are not currently in place. The SARS virus was contained within a year, and no new cases have been reported since 2004. Although the outbreak will certainly weigh on first-quarter transportation demand in China, it is unlikely to alter expected fuel demand around the globe. We expect that the ultimate outcome will be wider price differentials between some Asian crude and product grades compared to their international counterparts. Most notably, if demand in China were significantly reduced we would expect Brent-Dubai to widen.

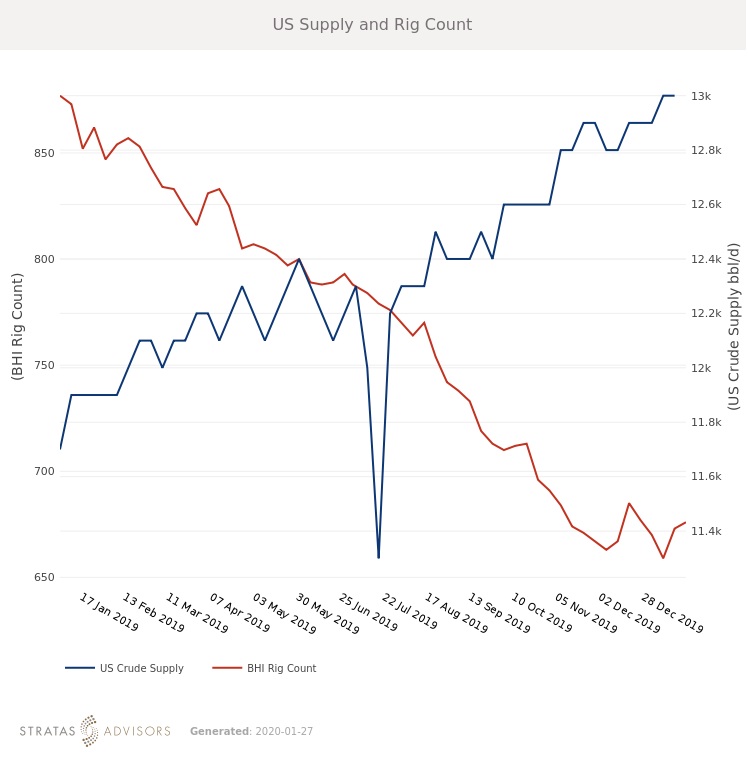

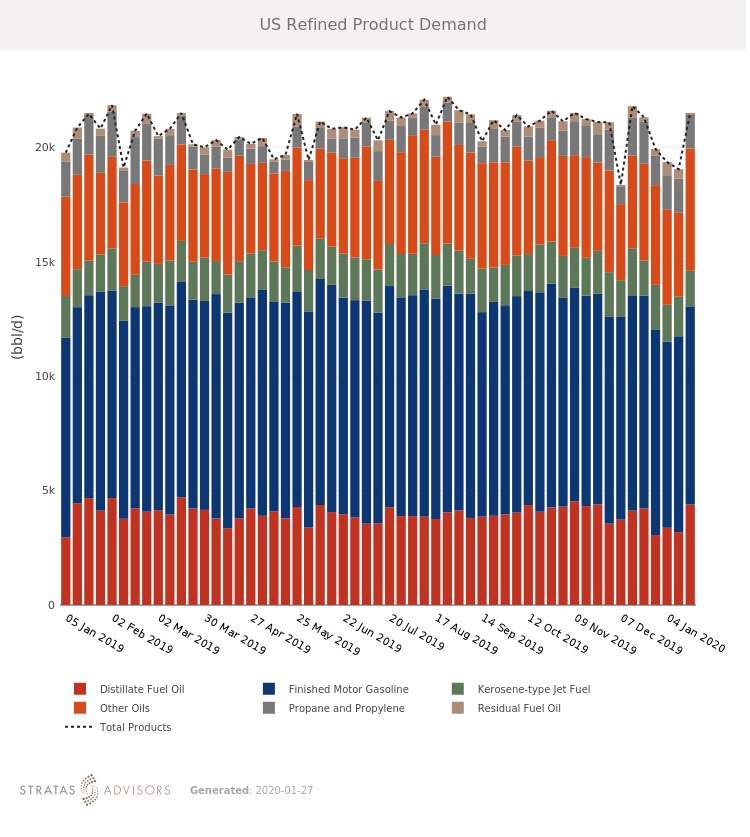

WTI has fallen more than Brent in 2020, and especially since demand fears were reinforced by reduced travel in China. Due to strong production growth in the United States and the fragmented nature of the industry, any oversupply would appear first in the U.S. Crude and distillate stocks in the U.S. are currently below the five-year average. Gasoline stocks are elevated but are in line with last year’s levels and continue to follow seasonal patterns. If crude and distillate stocks build sharply, domestic prices will be even more negatively impacted. A light refinery maintenance season should stave off any unexpected increases, but markets are likely to view even seasonal movements in a negative light given persistent demand concerns.

Geopolitical Unrest – Neutral

Global Economy – Neutral

Oil Supply – Negative

Oil Demand – Negative

Recommended Reading

Gunvor Group Inks Purchase Agreement with Texas LNG Brownsville

2024-03-19 - The agreement with Texas LNG Brownsville calls for a 20-year free on-board sale and purchase agreement of 0.5 million tonnes per annum of LNG for a Gunvor Group subsidiary.

FERC Approves Extension of Tellurian LNG Project

2024-02-19 - Completion deadline of Tellurian’s Driftwood project was moved to 2029 and phase 1 could come online in 2027.

CERAWeek: Two Minutes with EQT’s Toby Rice on Energy Security

2024-03-22 - EQT Corp. President and CEO Toby Z. Rice spoke to Hart Energy on March 20 on the sidelines of CERAWeek by S&P Global to discuss natural gas infrastructure bottlenecks, energy security and the company’s advances on LNG.

Commentary: Fact-checking an LNG Denier

2024-03-10 - Tampa, Florida, U.S. Rep. Kathy Castor blamed domestic natural gas producers for her constituents’ higher electricity bills in 2023. Here’s the truth, according to Hart Energy's Nissa Darbonne.

The Secret to Record US Oil Output? Drilling Efficiencies—EIA

2024-03-06 - Advances in horizontal drilling and fracking technologies are yielding more efficient oil wells in the U.S. even as the rig count plummets, the Energy Information Administration reported.