Brent fell $2.16/bbl last week to average $64.43/bbl, in line with Stratas Advisors' forecast. WTI fell $2.60/bbl to average $58.24/bbl. For the week ahead, Stratas Advisors expect Brent to continue drifting lower, likely averaging $63.50/bbl.

Little immediate bullish support for crude is present, but the recent signing of a U.S.-China trade deal helps provide a floor for prices. This week could see volatility in some Mediterranean-focused grades as Libyan supplies are interrupted once again. However, overall markets shrugged off the force majeure, as there is plenty of supply to fill the gap. Overall weakness in crude will likely continue through the first quarter per seasonal norms. The first quarter tends to see crude and product stock builds but any outsized movements in the U.S., Europe or Asia would still be viewed negatively. In China, Lunar New Year’s celebrations may entail less travel than usual as the country deals with outbreaks of a new coronavirus.

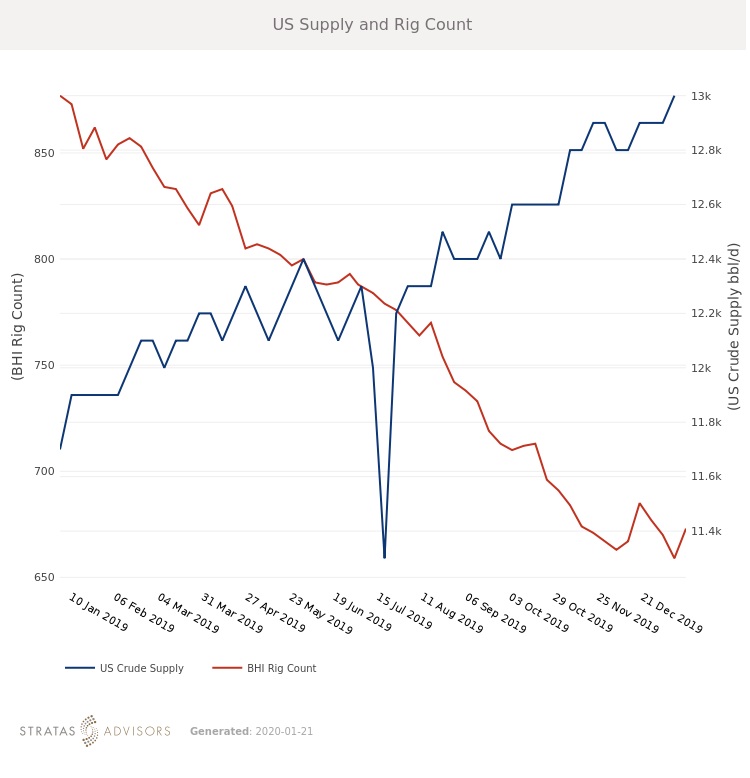

OPEC+ has been surprisingly silent about its plans for March. Some recent statements have indicated that there is room for an upside surprise in demand, but it is unclear how much that possibility is factoring into future actions. For now outages in Libya and Venezuela, along with generally decent compliance, are helping the organization meet its production goals. With Norway’s Johan Sverdrup field increasing deliveries, non-OPEC supply growth will be top of mind again and markets could be disappointed if stronger signals do not come from OPEC.

Geopolitical Unrest – Neutral

Global Economy – Neutral

Oil Supply – Negative

Oil Demand – Negative

Recommended Reading

Galp Seeks to Sell Stake in Namibia Oilfield After Discovery, Sources Say

2024-04-22 - Portuguese oil company Galp Energia has launched the sale of half of its stake in an exploration block offshore Namibia.

Deepwater Roundup 2024: Offshore Australasia, Surrounding Areas

2024-04-09 - Projects in Australia and Asia are progressing in part two of Hart Energy's 2024 Deepwater Roundup. Deepwater projects in Vietnam and Australia look to yield high reserves, while a project offshore Malaysia looks to will be developed by an solar panel powered FPSO.

Texas Earthquake Could Further Restrict Oil Companies' Saltwater Disposal Options

2024-04-12 - The quake was the largest yet in the Stanton Seismic Response Area in the Permian Basin, where regulators were already monitoring seismic activity linked to disposal of saltwater, a natural byproduct of oil and gas production.

US Raises Crude Production Growth Forecast for 2024

2024-03-12 - U.S. crude oil production will rise by 260,000 bbl/d to 13.19 MMbbl/d this year, the EIA said in its Short-Term Energy Outlook.

NAPE: Chevron’s Chris Powers Talks Traditional Oil, Gas Role in CCUS

2024-02-12 - Policy, innovation and partnership are among the areas needed to help grow the emerging CCUS sector, a Chevron executive said.