Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

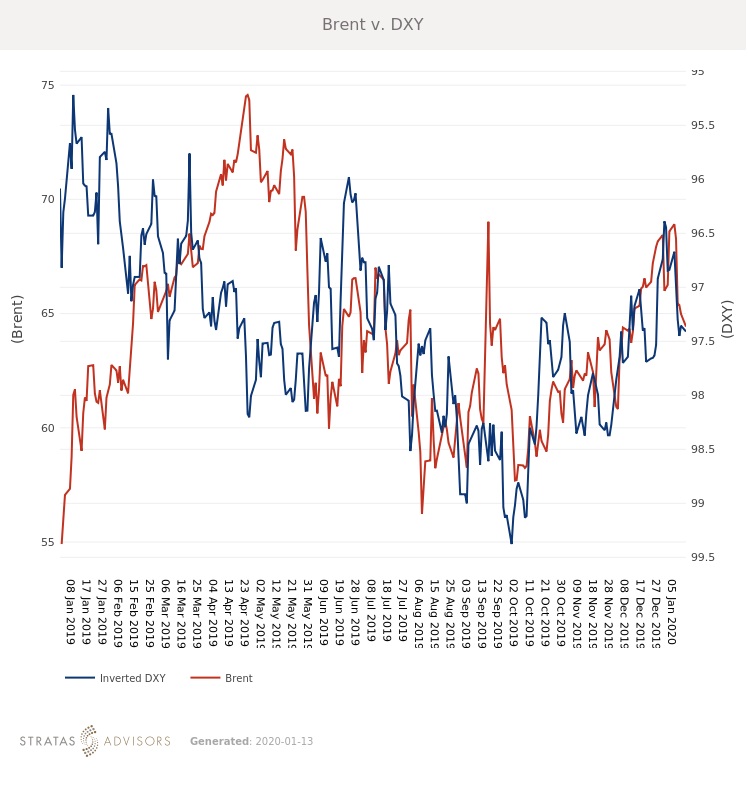

Brent and WTI both fell last week as tensions in the Middle East subsided. Brent fell $0.73/bbl last week to average $66.59/bbl, and WTI fell $0.91/bbl to average $60.84/bbl. For the week ahead, Stratas Advisors expect prices to be generally range-bound, supported by the upcoming signing of the U.S.-China Phase One trade deal. However, since much of the upside from the trade agreement is already factored into prices, the signing will provide little additional lift. Stratas Advisors expect Brent to average closer to $65/bbl.

The U.S. and China are expected to sign a preliminary trade agreement on Wednesday, but details on what exactly is in the deal remain scarce. There could be some volatility if the details of the deal are released and do not match with statements from the White House and leaders in Beijing. Although the details are vague, and markets generally assume that China will not be able to fully comply with the details so far released by the White House, there is upside to having a deal in place. A deal in place ostensibly adds a level of predictability to trade policy that has been absent. It should also outline next steps in terms of what tariffs would come into effect if the terms of the deal are not met. Overall, while a trade deal is unlikely to have an immediate impact on actual economic metrics, it will be a positive for sentiment and could encourage investment over the course of 2020.

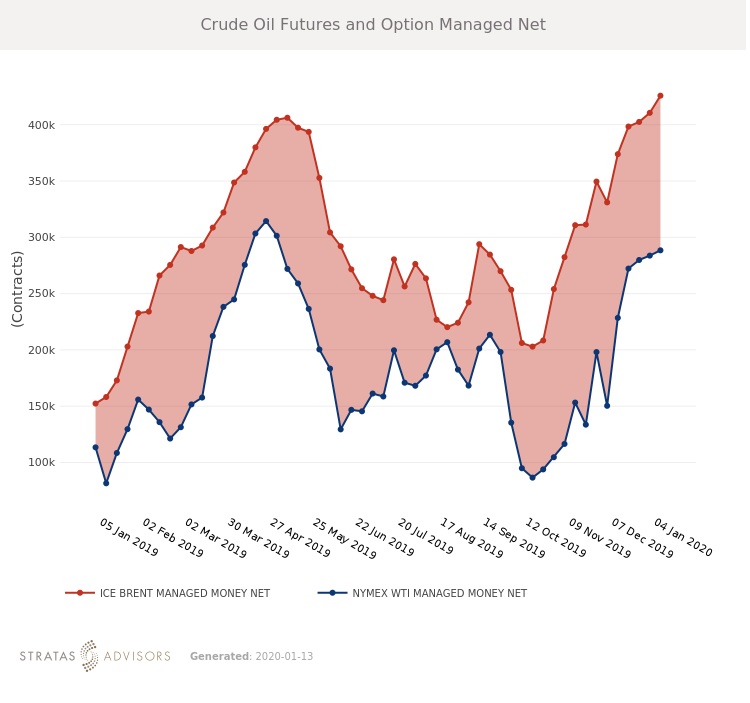

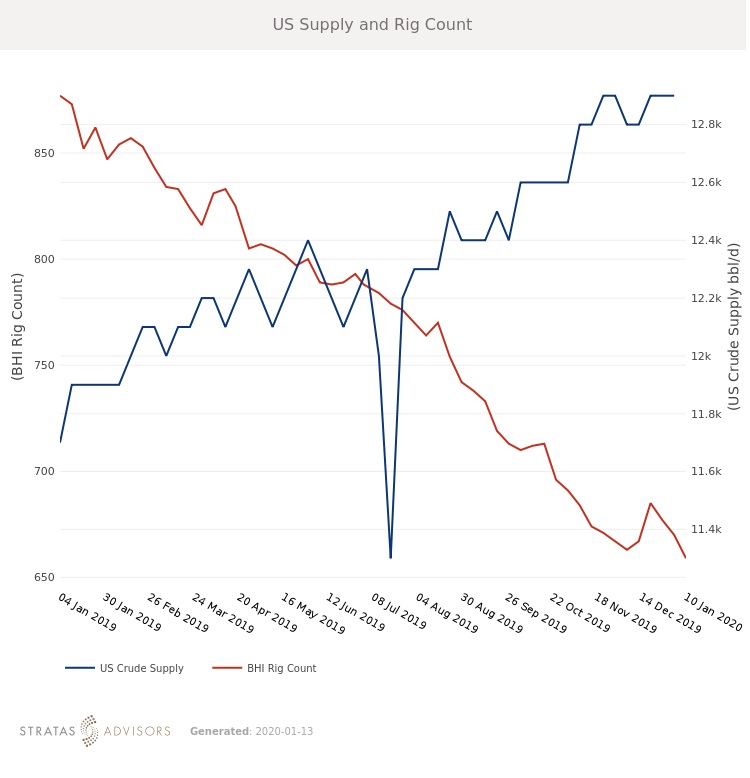

In the absence of major headlines, attention will shift back to inventory levels and supply in the weeks ahead. The first quarter tends to see crude and product stock builds but any outsized movements in the U.S., Europe or Asia will still be viewed negatively. While it appears that OPEC+ is achieving promised production cuts, the path beyond March remains murky. Markets likely will expect a continuation of the supply agreement in some form and will begin looking for signaling from OPEC leaders to that effect.

Geopolitical Unrest – Negative

Global Economy – Positive

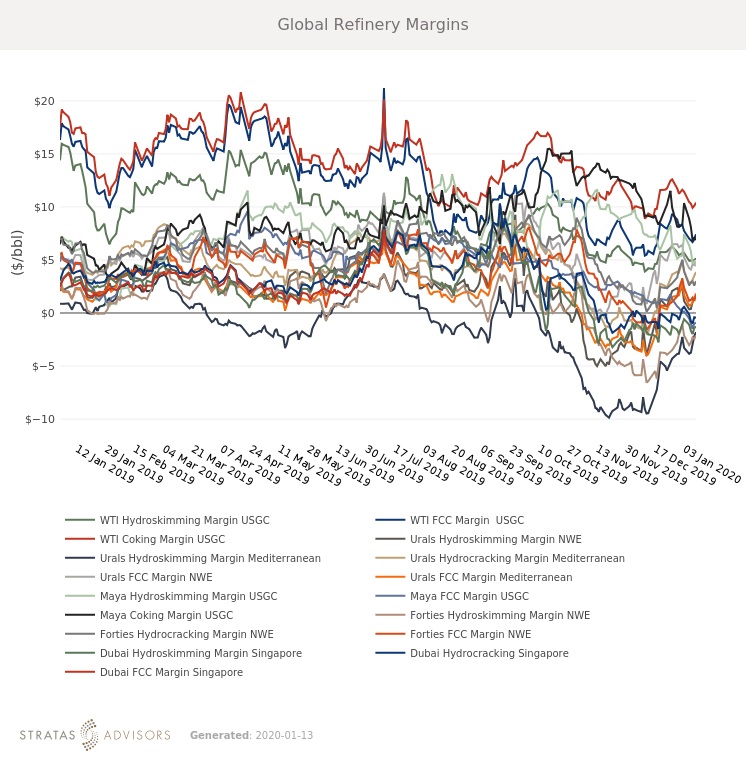

Oil Supply – Neutral

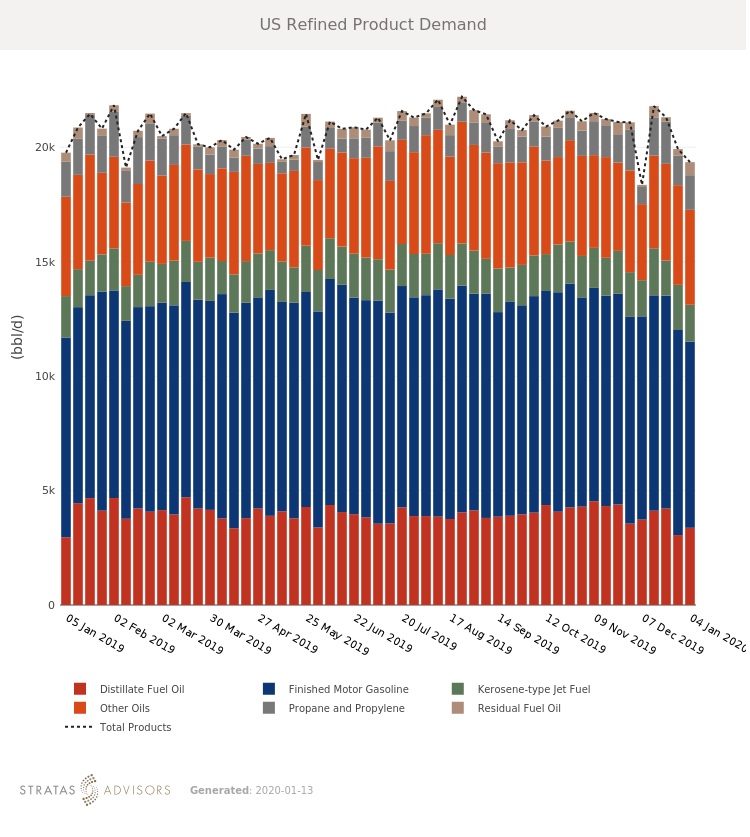

Oil Demand – Neutral

Recommended Reading

President: Financial Debt for Mexico's Pemex Totaled $106.8B End of 2023

2024-02-21 - President Andres Manuel Lopez Obrador revealed the debt data in a chart from a presentation on Pemex at a government press conference.

Private Equity: Seeking ‘Scottie Pippen’ Plays, If Not Another Michael Jordan

2024-01-25 - The Permian’s Tier 1 acreage opportunities for startup E&Ps are dwindling. Investors are beginning to look elsewhere.

Some Payne, But Mostly Gain for H&P in Q4 2023

2024-01-31 - Helmerich & Payne’s revenue grew internationally and in North America but declined in the Gulf of Mexico compared to the previous quarter.

Uinta Basin: 50% More Oil for Twice the Proppant

2024-03-06 - The higher-intensity completions are costing an average of 35% fewer dollars spent per barrel of oil equivalent of output, Crescent Energy told investors and analysts on March 5.

In Shooting for the Stars, Kosmos’ Production Soars

2024-02-28 - Kosmos Energy’s fourth quarter continued the operational success seen in its third quarter earnings 2023 report.