(Source: Shutterstock.com)

[Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

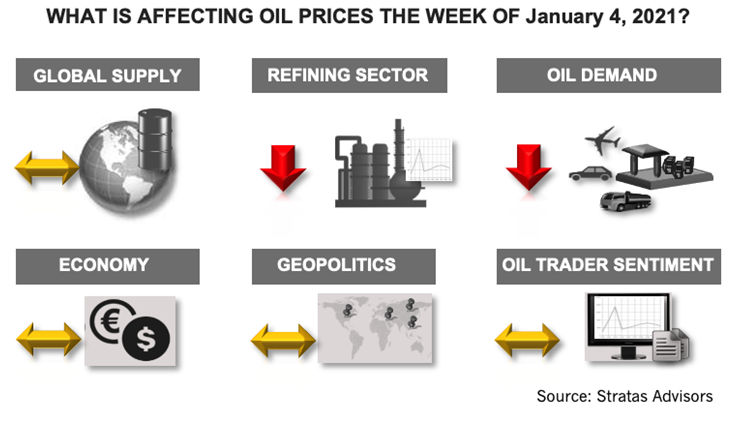

The price of Brent crude oil closed last week at $51.80, which was up slightly from the previous week’s close of $51.29. The price movement aligned with our expectations that oil prices would hold up—even with the ongoing concerns about COVID-19 and the impact on oil demand. These concerns were outweighed by the passage of another stimulus/recovery package that was signed by President Trump on Dec. 27, 2020. The price of WTI closed the week at $48.52 after closing the prior week at $48.30.

About the Author:

John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

TotalEnergies Starts Production at Akpo West Offshore Nigeria

2024-02-07 - Subsea tieback expected to add 14,000 bbl/d of condensate by mid-year, and up to 4 MMcm/d of gas by 2028.

E&P Highlights: Feb. 5, 2024

2024-02-05 - Here’s a roundup of the latest E&P headlines, including an update on Enauta’s Atlanta Phase 1 project.

CNOOC’s Suizhong 36-1/Luda 5-2 Starts Production Offshore China

2024-02-05 - CNOOC plans 118 development wells in the shallow water project in the Bohai Sea — the largest secondary development and adjustment project offshore China.

US Drillers Cut Oil, Gas Rigs for First Time in Three Weeks

2024-02-02 - Baker Hughes said U.S. oil rigs held steady at 499 this week, while gas rigs fell by two to 117.

Equinor Receives Significant Discovery License from C-NLOPB

2024-02-02 - C-NLOPB estimates recoverable reserves from Equinor’s Cambriol discovery at 340 MMbbl.