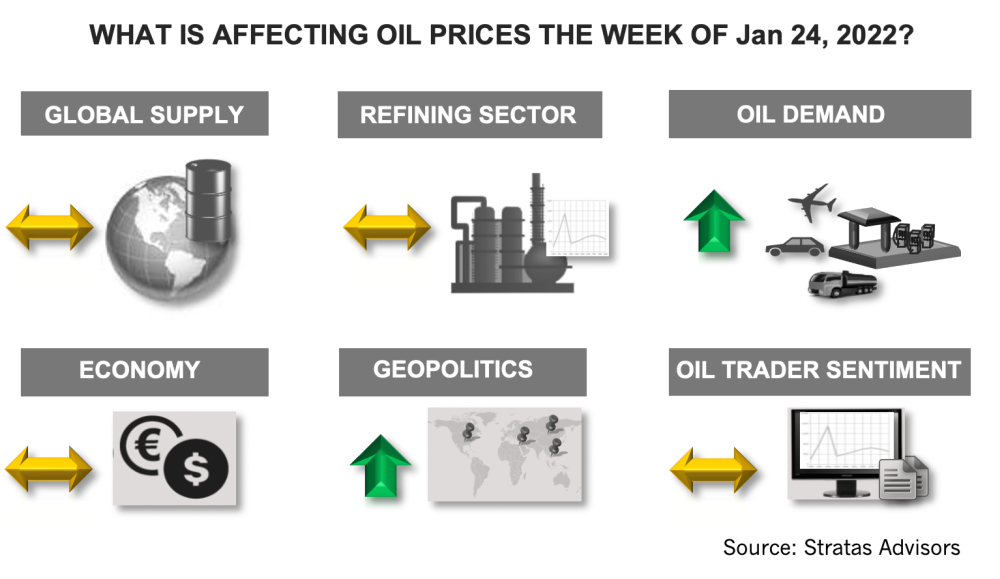

For the upcoming week, Stratas Advisors expects oil prices will move sideways with a downward bias after the significant upward move of the previous two weeks. (Source: Shutterstock.com / Image of Russia military helicopters by Fasttailwind / Shutterstock.com)

Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

The price of Brent crude ended the week at $87.90 after reaching $88.38 on Jan. 20 and after closing the previous week at $86.47. The price of WTI ended the week at $84.83 after reaching $86.90 and after closing the previous week at $84.27.

Geopolitics continue to be supportive of oil prices. Tensions between Russia and the U.S. and NATO allies remain elevated with western intelligence claiming that Russia is planning to replace the current Ukrainian leadership with a pro-Russian leader. This claim comes on the heels of a previous claim that Russia has deployed mercenaries into two eastern regions of Ukraine. And now it is being reported over the weekend that in addition to sending military equipment to Ukraine the Biden Administration is considering the deployment of additional U.S. troops (in the order of 1,000 to 5,000), along with aircraft and warships to NATO member states in the Baltics and Eastern Europe. Additionally, there continue to be geopolitical tensions in the Middle East, including those associated with Iran and the U.S., and highlighted by U.S. airstrikes on Jan. 22 in Syria, and the recent drone attack on the United Arab Emirates (UAE) by the Yemen-based Houthis.

There remain concerns about supply with OPEC+ struggling to increase actual production to align with announced monthly increases of 400,000 bbl/d. In December, compliance of OPEC+ was 122%, which compares to 117% in November. The over-compliance translates into OPEC+ members underproducing by around 750,000 bbl/d. In January, a significant portion of the under production will be reduced with Libya production rebounding back to around 1.2 million bbl/d, along with increased production in Nigeria and Kazakhstan. Outside of OPEC+, supply from the US and Canada is poised to increase.

The Omicron variant continues to spread the impact of COVID-19 from a global perspective. However, the rate of increase in cases is slowing down. Furthermore, cases in the U.S. appears to have peaked on Jan. 15 at 805,069 and have now fallen to 705,878.

While the increase level of inflation being experienced in the U.S. is the result of many factors that are not related to monetary policy, it looks like the U.S. Federal Reserve is ready to move forward with a rate increase in March. Last week, the U.S. Dollar Index increased to 95.64 from the previous week of 95.17. The future strength of the U.S. dollar will be dependent on the ability of the U.S. economy to continue to expand with a less accommodating monetary policy, and the robustness of the U.S. equity markets. We think there is a material risk that the Federal Reserve will tighten too fast, which will cause the U.S. economy to slow down, and the U.S. equity markets to turn downward—which in turn will result in a weaker U.S. dollar.

In contrast to the U.S. reducing monetary support, China is moving in the opposite direction. China’s central bank has recently reduced interest rates, as part of China’s efforts to provide additional liquidity. The easing is in response to the economy slowing down with growth forecasted by The Chinese Academy of Social Sciences to be only 5.3% in 2022 (in comparison with 8% in 2021). Additionally, China is dealing with property sector that is hampered by significant level of debt.

Besides the risks associated with policy errors by central bankers, there are risks associated with the stability of non-OECD markets, which, as reported by the World Bank, are facing rising debt payments this year (74 low-income nations will have to repay $35 billion to lenders in 2022.

For the upcoming week, we are expecting that oil prices will move sideways with a downward bias after the significant upward move of the previous two weeks.

About the Author:

John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

EQT Sees Clear Path to $5B in Potential Divestments

2024-04-24 - EQT Corp. executives said that an April deal with Equinor has been a catalyst for talks with potential buyers.

Matador Hoards Dry Powder for Potential M&A, Adds Delaware Acreage

2024-04-24 - Delaware-focused E&P Matador Resources is growing oil production, expanding midstream capacity, keeping debt low and hunting for M&A opportunities.

TotalEnergies, Vanguard Renewables Form RNG JV in US

2024-04-24 - Total Energies and Vanguard Renewable’s equally owned joint venture initially aims to advance 10 RNG projects into construction during the next 12 months.

Ithaca Energy to Buy Eni's UK Assets in $938MM North Sea Deal

2024-04-23 - Eni, one of Italy's biggest energy companies, will transfer its U.K. business in exchange for 38.5% of Ithaca's share capital, while the existing Ithaca Energy shareholders will own the remaining 61.5% of the combined group.

EIG’s MidOcean Closes Purchase of 20% Stake in Peru LNG

2024-04-23 - MidOcean Energy’s deal for SK Earthon’s Peru LNG follows a March deal to purchase Tokyo Gas’ LNG interests in Australia.