While oil prices are still not high enough to have much impact on demand associated with OECD-type markets, higher prices will dampen demand in emerging markets, Stratas Advisors said in its latest forecast. (Source: Shutterstock.com)

[Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

The price of Brent crude ended the week at $86.47 after closing the previous week at $81.93. The price of WTI ended the week at $84.27 after closing the previous week at $78.94. Oil prices were supported by oil traders increasing their net long positions. Traders of Brent crude oil increased their net long positions by 21% by adding to their long positions, while reducing their short positions. Traders of WTI crude also increased their net long positions, which are now at the highest level since Nov. 23 of last year. However, in comparison to the same period of 2021, net long positions are nearly 18% less.

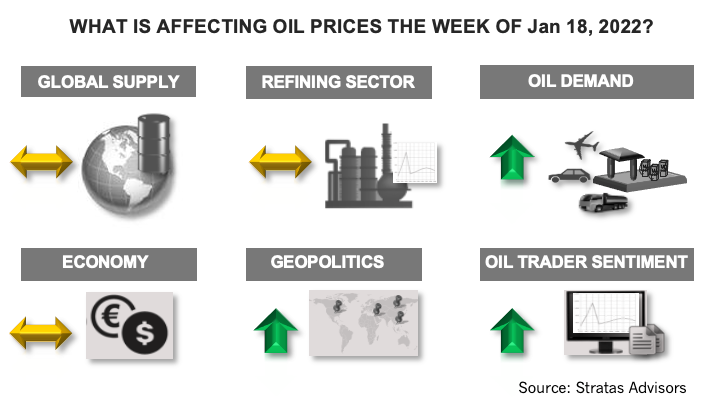

Oil prices are being supported by the following factors:

- The outlook for oil supply is generally supportive of oil prices with OPEC+ members adhering to the agreement of monthly increases, which are warranted by market conditions, even while some members are struggling to increase production

- The geopolitical environment is supportive of oil prices because of the related uncertainties associated with future oil and gas supply, including supply from Russia and CIS, Africa, and the Middle East, which is providing for a risk premium

- With respect to macroeconomics, the global economy is larger than the pre-COVID level, with only the Middle East and Latin America yet to exceed pre-COVID levels, and the global economy will further expand in 2022 (Stratas Advisors is forecasting that the size of global economy will increase by 3.73% in 2022)

- The oil demand outlook looks favorable with Europe and the U.S. on the verge of getting past the worst of Omicron, and governments shifting to less-restrictive policies (at least for those who are vaccinated), as attitudes change to living with COVID-19, instead of eliminating COVID-19

From a negative perspective, there is risk associated with central bankers shifting from accommodating monetary policies to more neutral policies, and the potential for policy errors, which would reverse economic growth. Additionally, while the number of COVID-19 cases in Asia remains low, there is the risk that oil demand will be negatively affected by aggressive mitigation efforts associated with zero-COVID policies. Furthermore, there are risks associated with the stability of non-OECD markets, which, as reported by the World Bank, are facing rising debt payments this year (74 low-income nations will have to repay $35 billion to lenders in 2022), while China is dealing with a real estate sector that is over-leveraged. At this time, however, these risks are being outweighed by the positive factors.

So how high will oil prices go? We still hold to our view that there will be responses—from the supply and demand side—that will keep oil prices from moving to triple-digits. While some members of OPEC+ are struggling to increase supply, there are other members that can increase supply—including Saudi Arabia, the United Arab Emirates (UAE), Qatar and Kuwait. Additionally, there is scope for increased activity associated with the U.S. oil producers, as indicated by the rig count increasing by 11 last week. Based on our latest quarterly update, we are forecasting the U.S. crude production will average 11.86 million bbl/d in the first quarter of this year, and will continue to increase throughout the year and will average 12.42 million bbl/d in the fourth quarter of this year. However, U.S. oil production would still be 550,000 million b/d below fourth-quarter 2019.

From the demand side, while prices are still not high enough to have much impact on demand associated with OECD-type markets, higher prices will dampen demand in emerging markets. Furthermore, major consuming countries can draw on their strategic oil reserves. Reuters has reported that China will start releasing crude oil from its strategic reserves at the beginning of February, with the volumes depending on the oil prices—more volume if the oil prices are above $85 and less volume if oil prices are around $75. The release of oil from its strategic reserve, plus China reducing its imports of crude oil when oil prices are high, will help to dampen the increase in oil prices.

About the Author:

John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Deepwater Roundup 2024: Offshore Australasia, Surrounding Areas

2024-04-09 - Projects in Australia and Asia are progressing in part two of Hart Energy's 2024 Deepwater Roundup. Deepwater projects in Vietnam and Australia look to yield high reserves, while a project offshore Malaysia looks to will be developed by an solar panel powered FPSO.

BP: Gimi FLNG Vessel Arrival Marks GTA Project Milestone

2024-02-15 - The BP-operated Greater Tortue Ahmeyim project on the Mauritania and Senegal maritime border is expected to produce 2.3 million tonnes per annum during it’s initial phase.

TotalEnergies Acquires Eagle Ford Interest, Ups Texas NatGas Production

2024-04-08 - TotalEnergies’ 20% interest in the Eagle Ford’s Dorado Field will increase its natural gas production in Texas by 50 MMcf/d in 2024.

Help Wanted (Badly): Attracting Workers to Energy is Becoming Difficult

2024-03-27 - Attracting workers to the energy industry is becoming a difficult job, despite forecasted growth in the industry.

Tech Trends: Halliburton’s Carbon Capturing Cement Solution

2024-02-20 - Halliburton’s new CorrosaLock cement solution provides chemical resistance to CO2 and minimizes the impact of cyclic loading on the cement barrier.