In the week since our last edition of What’s Affecting Oil Prices, brent rose $4.50/bbl last week to average $59.93/bbl. WTI rose $4.22/bbl to average $50.97/bbl. While recent price increases are a positive sign, gains are very tenuous and prices could easily backslide on concerns about demand. This week “earnings season” starts and markets will be closely watching for company concerns about consumer spending. For the week ahead, we expect Brent to average $61/bbl.

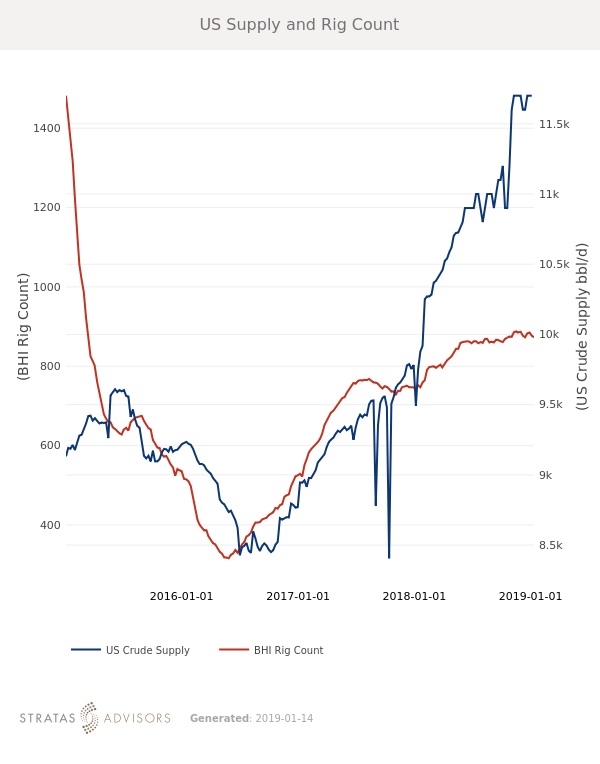

In an effort to support prices, Saud Arabia announced it would cut production above and beyond its original agreement. This Friday, Jan. 18, the IEA will release the first Oil Market Report since the official supply deal. The IEA will report on current compliance levels and anything lower than full compliance will likely cause prices to dip.

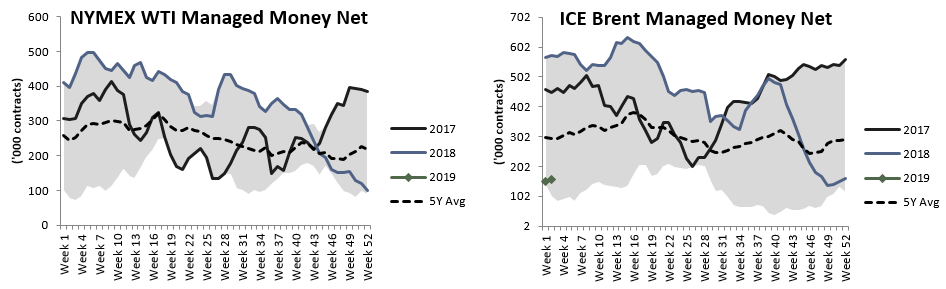

The U.S. government shutdown is still ongoing, and thus NYMEX positioning data is not being released. However, Brent data indicates that growth in short-positioning has started to slow.

Geopolitical: Neutral

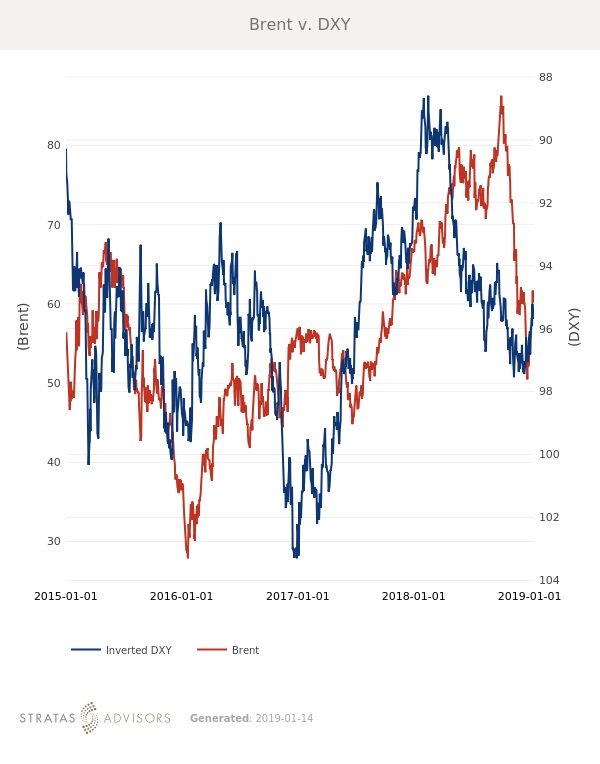

Dollar: Neutral

Trader Sentiment: Neutral

Supply: Negative

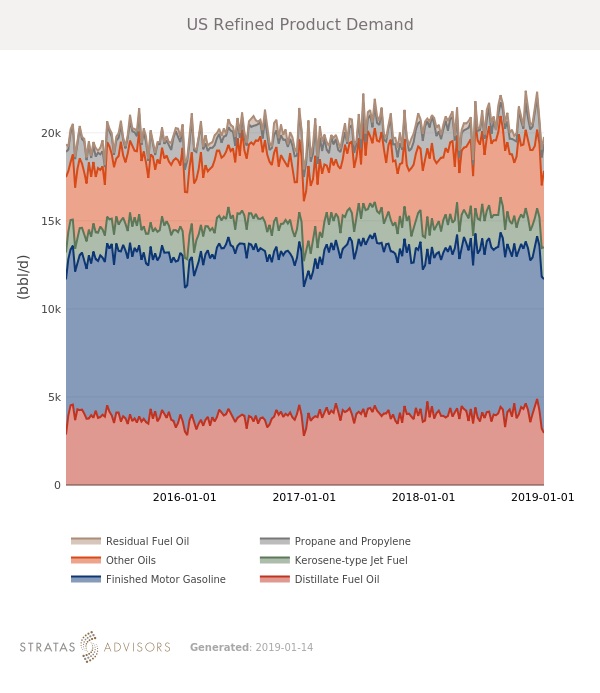

Demand: Neutral

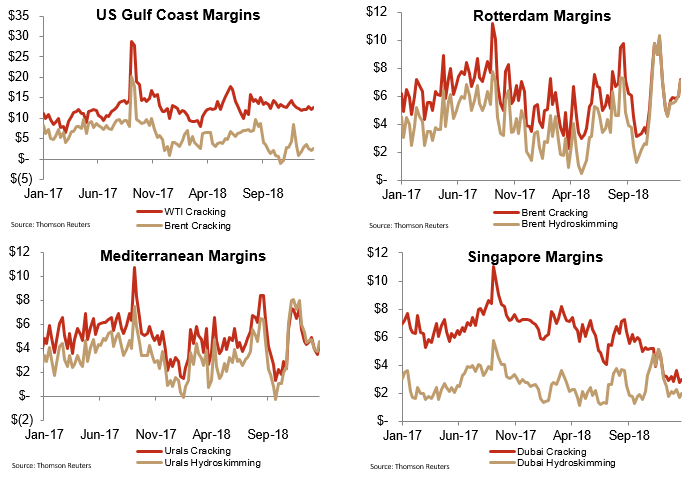

Refining Margins: Neutral

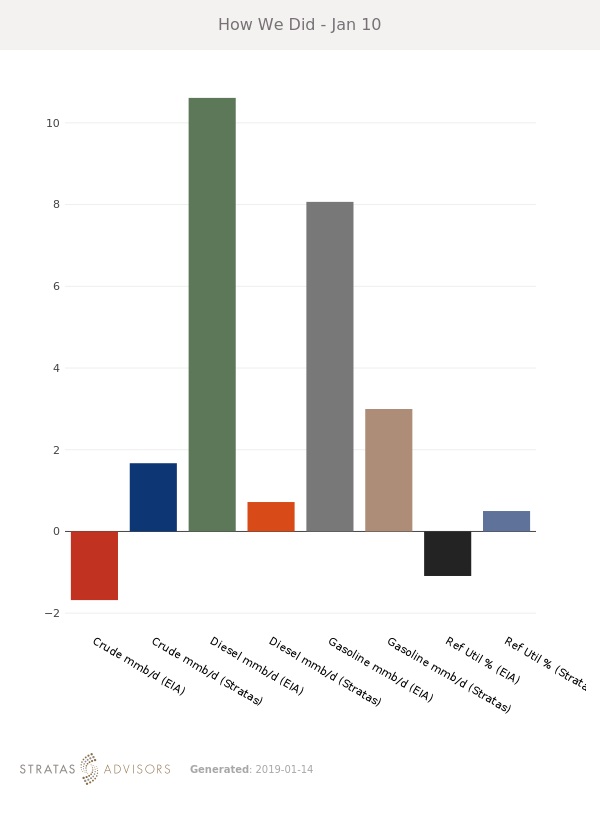

How We Did

Recommended Reading

Rhino Taps Halliburton for Namibia Well Work

2024-04-24 - Halliburton’s deepwater integrated multi-well construction contract for a block in the Orange Basin starts later this year.

Halliburton’s Low-key M&A Strategy Remains Unchanged

2024-04-23 - Halliburton CEO Jeff Miller says expected organic growth generates more shareholder value than following consolidation trends, such as chief rival SLB’s plans to buy ChampionX.

Deepwater Roundup 2024: Americas

2024-04-23 - The final part of Hart Energy E&P’s Deepwater Roundup focuses on projects coming online in the Americas from 2023 until the end of the decade.

Ohio Utica’s Ascent Resources Credit Rep Rises on Production, Cash Flow

2024-04-23 - Ascent Resources received a positive outlook from Fitch Ratings as the company has grown into Ohio’s No. 1 gas and No. 2 Utica oil producer, according to state data.

E&P Highlights: April 22, 2024

2024-04-22 - Here’s a roundup of the latest E&P headlines, including a standardization MoU and new contract awards.