(Source: Shutterstock.com)

[Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

Last week’s political events in the U.S. were certainly chaotic, starting with the formal Congressional objections to the electoral votes to the additional developments that unfolded later that day. While startling, both financial and oil markets were essentially oblivious to the events. The Dow Jones and other financial indexes moved upwards during the chaos, and oil prices maintained momentum, remaining above $50/bbl.

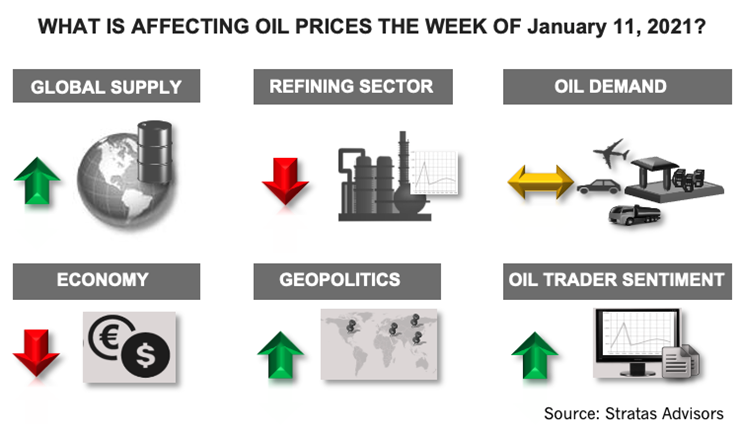

However, there was an additional event on the other side of the world related to oil markets, and will have significant impact on the management of the oil fundamentals and price stability: the OPEC+ meeting and Saudi Arabia’s unilateral decision to cut 1 million bbl/d for February and March supply.

Both topics, the U.S. political arena and the management of the oil markets, are poised for interaction, and the resulting dynamics could trigger market volatility that will surpass even that seen last year. The unilateral cut in production taken by Saudi Arabia has the potential to undermine the OPEC+ framework. Additionally, the oil market will be affected by the transition from the Trump administration to the Biden administration and additional geopolitical issues.

About the Author:

Jaime Brito is vice president at Stratas Advisors with over 24 years of experience on refining economics and market strategies for the oil industry. He is responsible for managing the refining and crude-related services, as well as completing consulting.

Recommended Reading

TPG Adds Lebovitz as Head of Infrastructure for Climate Investing Platform

2024-02-07 - TPG Rise Climate was launched in 2021 to make investments across asset classes in climate solutions globally.

Air Products Sees $15B Hydrogen, Energy Transition Project Backlog

2024-02-07 - Pennsylvania-headquartered Air Products has eight hydrogen projects underway and is targeting an IRR of more than 10%.

NGL Growth Leads Enterprise Product Partners to Strong Fourth Quarter

2024-02-02 - Enterprise Product Partners executives are still waiting to receive final federal approval to go ahead with the company’s Sea Port Terminal Project.

Sherrill to Lead HEP’s Low Carbon Solutions Division

2024-02-06 - Richard Sherill will serve as president of Howard Energy Partners’ low carbon solutions division, while also serving on Talos Energy’s board.

Magnolia Appoints David Khani to Board

2024-02-08 - David Khani’s appointment to Magnolia Oil & Gas’ board as an independent director brings the board’s size to eight members.