Brent crude and WTI prices both fell from the week prior to $79.94 and $73.39 respectively. (Source: Shutterstock.com)

The price of Brent crude ended the week at $79.94 after closing the previous week at $86.66. The price of WTI ended the week at $73.39 after closing the previous week at $79.68.

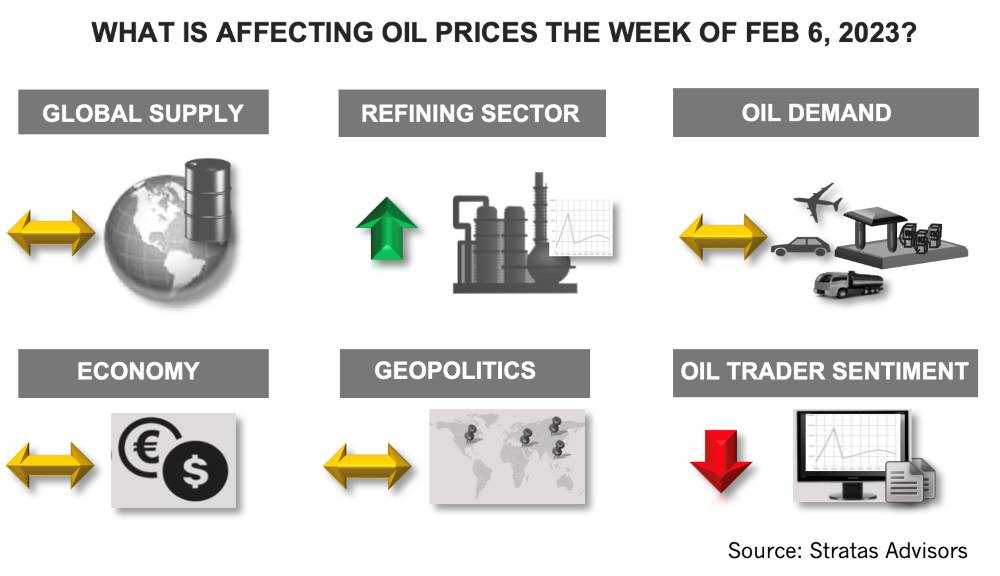

Last week, we put forth the view that, for the most part, the price of Brent crude will remain in a channel between $80 and $90, given that supply/demand will be relatively balanced. The concerns about the global economy and the major economies will establish a ceiling on oil prices, while OPEC+ will place a floor under prices. We still hold to that view.

As we expected, the Joint Ministerial Monitoring Committee (JMMC) of OPEC+ that meet on Feb. 1 recommended no changes to OPEC+ supply policy. The next scheduled meeting of the JMMC is on April 3, and the next full OPEC+ meeting is scheduled in June.

The EU ban on seaborn imports of Russian oil products took effect on Feb. 5. Additionally, a price cap of $100/bbl has been agreed to by the Group of Seven allied democracies with respect to the purchase of Russian diesel fuel, which will preclude buyers from having access to insurance and services provided by western entities if the purchase price is more than $100/bbl (there is a grace period of 55 days for product loaded on tankers before Sunday, Feb. 5).

There are also price caps on other products, including fuel oil, with the price cap set at $45. The biggest concern, however, pertains to the diesel market, given the relative tightness of the global diesel market and that Europe is dependent on imports of diesel fuel, including significant imports from Russia. As we stated last week, we do not expect any major disruptions to the oil product market resulting from the sanctions. The sanctions, however, will result in shifts in trade flows and increased shipping costs, which will put upward pressure on diesel prices relative to oil prices.

While the latest jobs report for the U.S. showed a surprising increase of 517,000 jobs in January, there are other signs that the state of the U.S. economy is weakening. For instance, the Institute for Supply Management reported that the manufacturing index for January fell to 47.4 from 48.4 in December, which is a reading consistent with a recession. The U.S. consumer is also facing challenges:

- Wage growth continues to lag overall inflation, with real wages falling for 23 consecutive months and are now dropping below pre-COVID levels.

- U.S. consumers have been increasing their debt to new record levels while reducing their savings rate well below pre-COVID levels – not exactly a sustainable dynamic. Additionally, the average interest rate on U.S. credit cards has increased to over 19%, which is a record high. There is also a negative wealth effect with housing prices falling and equity markets well below the highs of early 2022. The impact on consumer spending already showed up in 4Q with the growth in real discretionary consumer spending falling to 1.8%, which compares to the historical median (2012-2019) of 2.9%.

Additionally, there are concerns about the resolution of the debt ceiling. The U.S. Treasury has started drawing down the $346 billion its currently holds to prevent a default, but it is expected that these funds will only last through early June of this year. While we do not think the U.S. will default, the path to a compromise is likely to be complicated, in part, from the recently adopted rules by the Republican majority in the U.S. Congress, which requires that any increase to the debt limit includes spending cuts along with blocking increases to mandatory spending for social programs, and a supermajority to raise taxes.

There also remains significant geopolitical risk, including increased tensions between the U.S. and China, and the risk of the Russia-Ukraine conflict escalating and expanding beyond the borders of Ukraine, which is increasing the longer the conflict continues.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

From Restructuring to Reinvention, Weatherford Upbeat on Upcycle

2024-02-11 - Weatherford CEO Girish Saligram charts course for growth as the company looks to enter the third year of what appears to be a long upcycle.

JMR Services, A-Plus P&A to Merge Companies

2024-03-05 - The combined organization will operate under JMR Services and aims to become the largest pure-play plug and abandonment company in the nation.

New Fortress Energy Sells Two Power Plants to Puerto Rico

2024-03-18 - New Fortress Energy sold two power plants to the Puerto Rico Electric Power Authority to provide cleaner and lower cost energy to the island.

Kimmeridge Fast Forwards on SilverBow with Takeover Bid

2024-03-13 - Investment firm Kimmeridge Energy Management, which first asked for additional SilverBow Resources board seats, has followed up with a buyout offer. A deal would make a nearly 1 Bcfe/d Eagle Ford pureplay.

SilverBow Rejects Kimmeridge’s Latest Offer, ‘Sets the Record Straight’

2024-03-28 - In a letter to SilverBow shareholders, the E&P said Kimmeridge’s offer “substantially undervalues SilverBow” and that Kimmeridge’s own South Texas gas asset values are “overstated.”