In the weeks since the last edition of What’s Affecting Oil Prices, Brent fell $0.11/bbl last week to average $61.51/bbl.

However, the news wasn’t all bad as much of the drop was actually driven by a sharp downward price move on Jan. 28 and by Feb. 1 Brent closed at $62.75/bbl—on track for our $63/bbl forecast, but a few days too late. WTI was a similar story, although it did in fact follow our forecast and close the week at $55.26/bbl. For the week ahead we see continued strength in prices, and again expect to see Brent averaging $63/bbl and WTI averaging $54/bbl or better.

In the U.S., crude runs continue to seasonally decline, but likely builds in crude stocks will be offset by expected declines in product stocks. The situation in Venezuela continues to bear watching due to its implications for North American heavy crude oil flows but for the moment, developments are mainly political in nature, with limited physical impact.

Also worth mentioning, immigration negotiations to avert another government shutdown appear to be making very little progress. While we continue to think it unlikely that a full shutdown will resume in two weeks, we are raising our internal estimates of the likelihood of another partial shutdown. We also continue to watch for progress on trade negotiations between the U.S. and China. While Friday’s (Feb. 1) announcements were more positive than expected, at this point tariffs have been in place long enough that economic data out of China is more relevant.

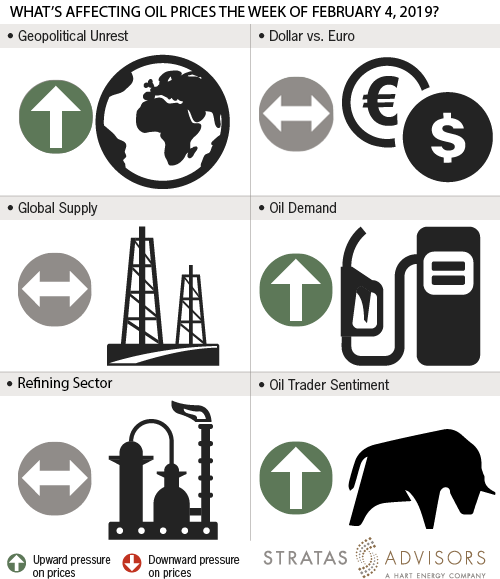

Geopolitical: Positive

Dollar: Neutral

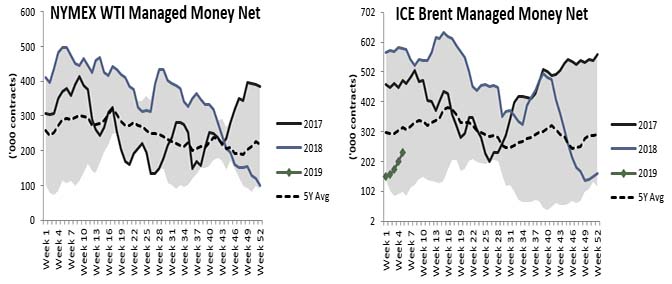

Trader Sentiment: Positive

Supply: Neutral

Demand: Positive

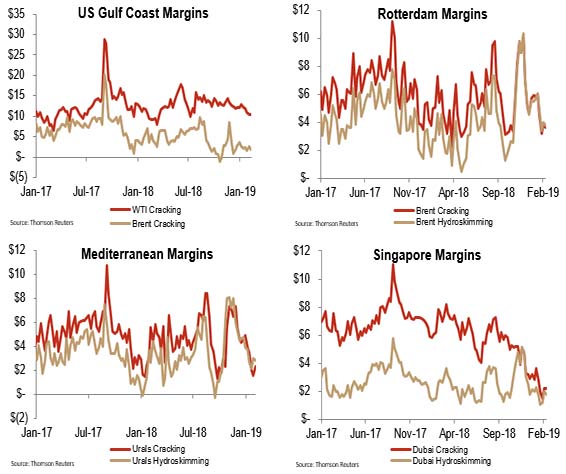

Refining Margins: Neutral

How We Did

Recommended Reading

Hess Midstream Announces 10 Million Share Secondary Offering

2024-02-07 - Global Infrastructure Partners, a Hess Midstream affiliate, will act as the selling shareholder and Hess Midstream will not receive proceeds from the public offering of shares.

Hess Midstream Subsidiary to Buy Back $100MM of Class B Units

2024-03-13 - Hess Midstream subsidiary Hess Midstream Operations will repurchase approximately 2 million Class B units equal to 1.2% of the company.

Plains All American Names Michelle Podavin Midstream Canada President

2024-03-05 - Michelle Podavin, who currently serves as senior vice president of NGL commercial assets for Plains Midstream Canada, will become president of the business unit in June.

Matador Completes NatGas Connections in Delaware Basin

2024-03-25 - Matador Resources completed natural gas pipeline connections between Pronto Midstream to San Mateo Midstream and to Matador’s acreage in the Delaware Basin.

Targa Resources Ups Quarterly Dividend by 50% YoY

2024-04-12 - Targa Resource’s board of directors increased the first-quarter 2024 dividend by 50% compared to the same quarter a year ago.