Stratas Advisors also thinks that the Russia-Ukraine conflict makes a nuclear deal with Iran even more unlikely. (Source: Shutterstock.com)

Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

The price of Brent crude ended the week at $94.56 after closing the previous week at $93.54. The price of WTI ended the week at $91.94 after closing the previous week at $91.66.

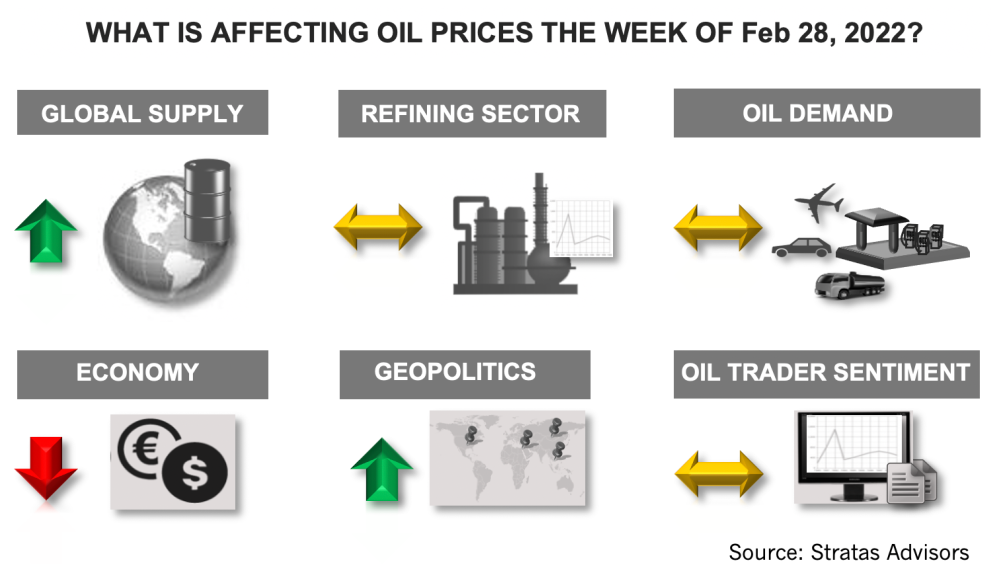

The conflict between Russia and Ukraine is a major geopolitical event and the situation remains fluid with uncertainties for the short-term, as well as the long-term. In the short-term it looks like that U.S. and allies want oil and gas from Russia to continue to flow. However, there is likely to be shifts in trade flows with more of Russia’s energy exports going east and less going to the west. We also think that the Russia-Ukraine conflict makes a nuclear deal with Iran even more unlikely. While recent negotiations have provided some hope for some that an agreement will be reached, we remain skeptical that an agreement will be reach anytime soon. Iran is insisting on the removal of all sanctions before resuming compliance with the 2015 agreement. This demand cannot be met by the Biden Administration because a retreat of this nature does not have widespread support in the U.S. A new agreement will be made even more difficult because Iran is unlikely to accept an agreement with the Biden Administration that is not effectively a treaty, which will need to gain two-third approval from the U.S. Senate. Without a formal treaty, the next administration can reverse course, as did the Trump Administration. This requirement was highlighted by a group of 33 Republican Senators warning President Biden that would not support any agreement that did not involve Congress reviewing and voting on the terms. The Russia-Ukraine conflict is only going to harden the Republican opposition. Furthermore, Iran may view the situation in Ukraine as a reason to pursue nuclear capabilities.

From a longer-term perspective, the world is moving to a multi-polar world that will include countries not aligned with any of the major geostrategic powers. Additionally, the world is likely to be less stable than for the previous 30 years with less international cooperation and more concerns about access to energy and other resources. Critical questions with respect to energy—What does the changing geopolitical landscape mean for decarbonization and the shift away from oil and gas? Will a multi-polar world mean that each region (and country) will be more inclined to pursue the options that are aligned with its own energy needs and energy assets?

Prior to the initiation of the Russia-Ukraine conflict, it was our view that the price of Brent crude would moderate and fall below $90, if the situation involving Ukraine was resolved without a major conflict. Conversely, if there was a significant disruption to Russian exports of crude oil and refined products (which are in the order of 6.5 million barrels overall and around 3.0 million bbl/d just in terms of export to Europe) we expected oil prices to spike well above $100/bbl. Additionally, the impact on prices would last longer than was the case with the first Gulf War and the second Gulf War. During those conflicts, oil prices spiked, but then fell back quickly once the market realized that sufficient oil would still be supplied. During the first Gulf War, which lasted from Aug. 2, 1990 through Feb. 28, 1991, the oil market had significant level of spare supply capacity. During the second Gulf War, Iraqi production was already being sanctioned, so there was little impact on oil supply. The current situation is much different because of the magnitude of the potential loss of supply and that the oil market is in a much tighter supply/demand situation. At this point, neither scenario applies because Russia is still able to export oil and gas—but there is increased uncertainty and transactions are more difficult because of the financial sanctions. This combination of factors will keep the price of Brent crude above $90.00—while not resulting in significant price spikes.

The biggest downside risk to oil prices remains an economic disruption, which has increased with the imposition of the sanctions on Russia and the potential for unintended consequences. The sanctions also complicate decision-making for the U.S. Federal Reserve and other central banks with respect to rate increases. While the central bankers are looking to tighten monetary policies to address inflation concerns, the central bankers now need to consider the impact of isolating Russia from the global banking system and the potential impact on availability of food, energy, and other critical inputs.

About the Author:

John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Romito: Net Zero’s Costly Consequences, and Industry’s ‘Silver Bullet’

2024-04-22 - Decarbonization is generally considered a reasonable goal when presented within the context of a trend, as opposed to a regulatory absolute.

Energy Transition in Motion (Week of April 19, 2024)

2024-04-19 - Here is a look at some of this week’s renewable energy news, including the latest on global solar sector funding and M&A.

Eversource to Sell Sunrise Wind Stake to Ørsted

2024-04-19 - Eversource Energy said it will provide service to Ørsted and remain contracted to lead the onshore construction of Sunrise following the closing of the transaction.

Exclusive: Building Battery Value Chain is "Vital" to Energy Transition

2024-04-18 - Srini Godavarthy, the CEO of Li-Metal, breaks down the importance of scaling up battery production in North America and the traditional process of producing lithium anodes, in this Hart Energy Exclusive interview.

High Interest Rates a Headwind for the Energy Transition

2024-04-18 - Persistent high interest rates will make transitioning to a net zero global economy much harder and more costly, according to Wood Mackenzie Head of Economics Peter Martin.