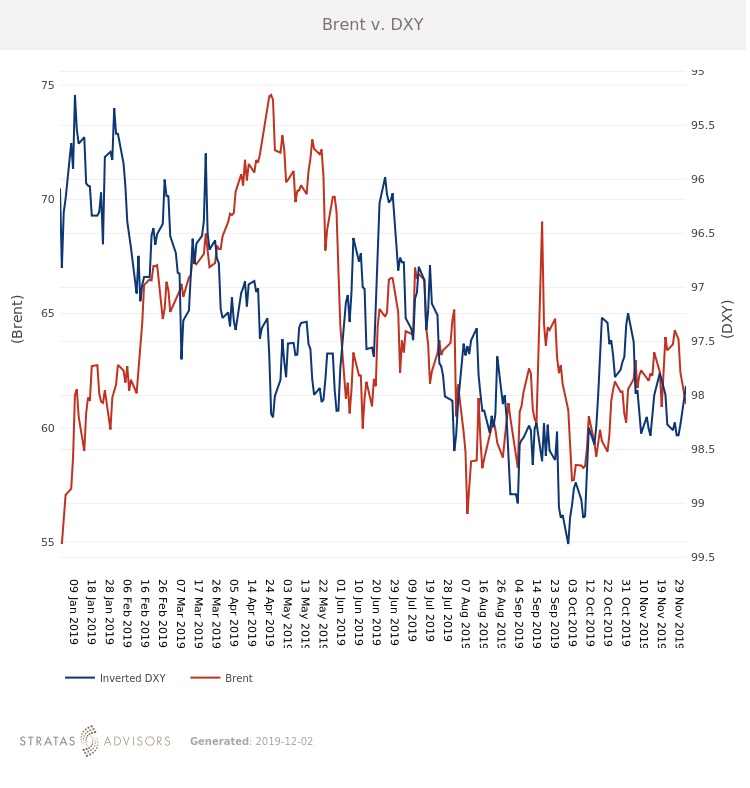

Brent gained significantly more than WTI last week, rising $1.03/bbl to average $63.66/bbl. WTI rose $0.28/bbl to average $57.43/bbl. For the week ahead, Stratas Advisors expect volatile prices in light of the OPEC+ meeting. Prices are likely to average lower than last week at $62.50/bbl unless OPEC surprises with a larger than expected production cut.

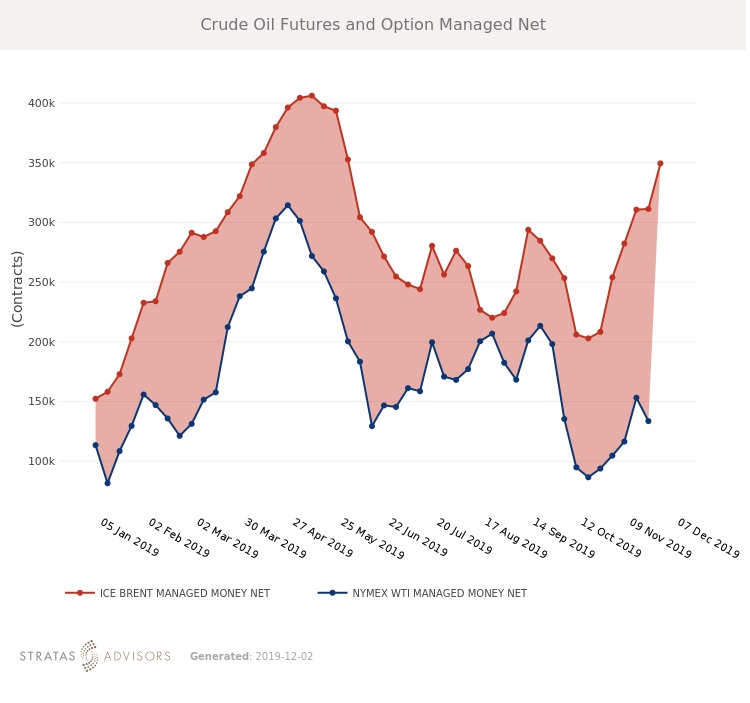

Rumors are swirling that Saudi Arabia is pushing to add up to another 500 mb/d to current production cuts, in part to support the upcoming Saudi Aramco IPO. Reports from unnamed sources that Saudi Arabia is working to build consensus on the cuts pushed prices up on Monday, and will lead to additional volatility this week. Unless Saudi Arabia is willing to take on the majority of the burden of additional cuts, we think it unlikely that the group agrees to an adjustment. Several countries continue to sell above their quotas and compliance will certainly come up in advance of deeper cuts. The most likely outcome continues to be an extension until June 2020 with the possibility of further adjustment.

Also Monday morning, President Trump announced that he was reimposing tariffs on all steel and aluminum imports from Brazil and Argentina. This adds more complexity to the United States’ myriad trade disputes. Congress has still not ratified the USMCA, and seems unlikely to before the New Year. December 15 additional tariffs are scheduled to go into effect against China. Beijing is already insisting that current tariffs be rolled back in order to sign a Phase One trade deal, and if new tariffs go into effect talks could be quickly derailed.

Geopolitical Unrest – Neutral

Global Economy – Neutral

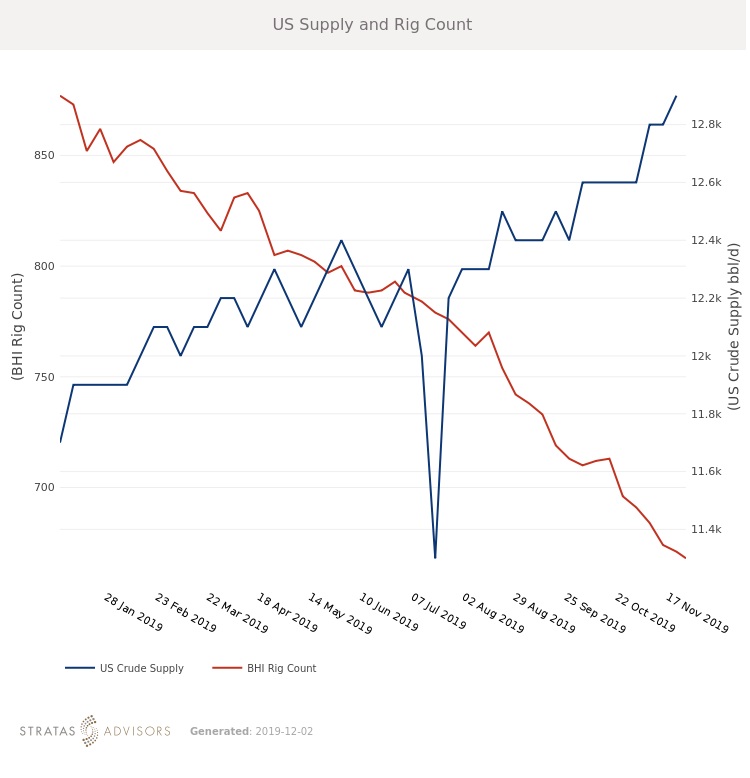

Oil Supply – Negative

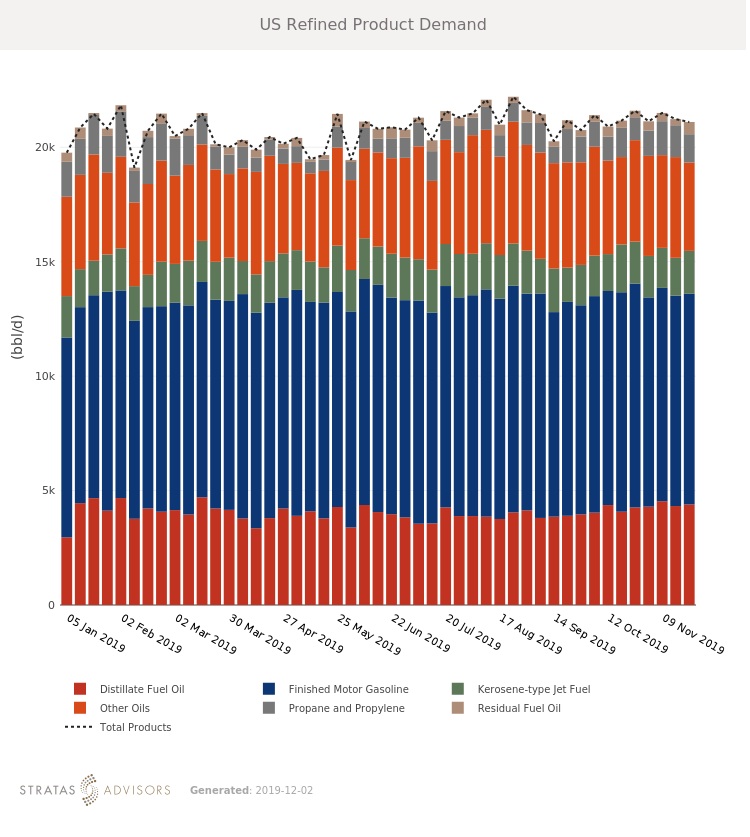

Oil Demand – Neutral

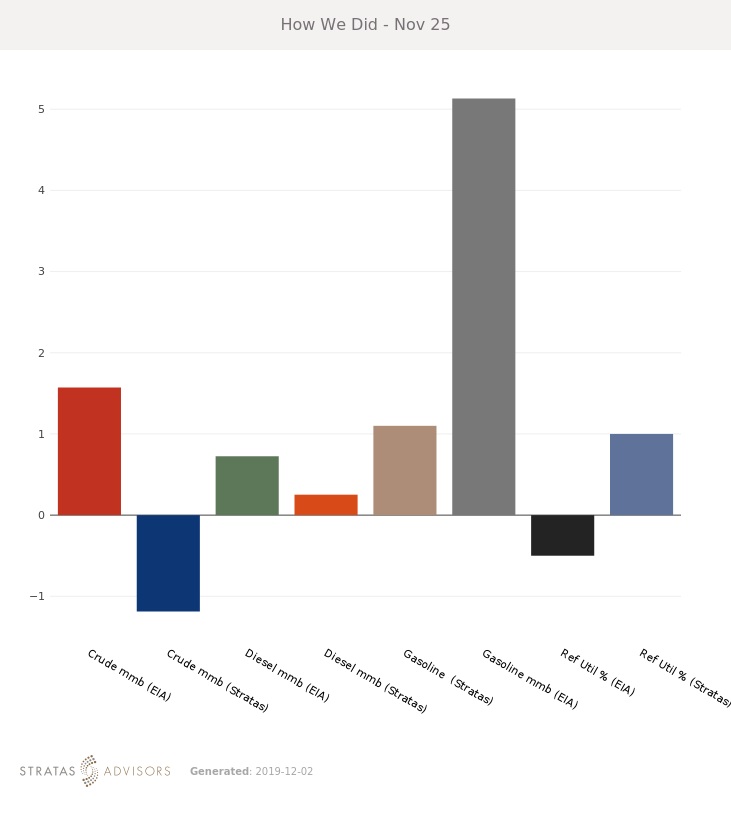

How We Did

Recommended Reading

US Gas Rig Count Falls to Lowest Since January 2022

2024-03-22 - The combined oil and gas rig count, an early indicator of future output, fell by five to 624 in the week to March 22.

Chevron Hunts Upside for Oil Recovery, D&C Savings with Permian Pilots

2024-02-06 - New techniques and technologies being piloted by Chevron in the Permian Basin are improving drilling and completed cycle times. Executives at the California-based major hope to eventually improve overall resource recovery from its shale portfolio.

TPH: Lower 48 to Shed Rigs Through 3Q Before Gas Plays Rebound

2024-03-13 - TPH&Co. analysis shows the Permian Basin will lose rigs near term, but as activity in gassy plays ticks up later this year, the Permian may be headed towards muted activity into 2025.

US Drillers Cut Oil, Gas Rigs for Fourth Week in a Row-Baker Hughes

2024-04-12 - The oil and gas rig count, an early indicator of future output, fell by three to 617 in the week to April 12, the lowest since November.

US Drillers Cut Oil, Gas Rigs for Second Time in Three Weeks

2024-02-16 - Baker Hughes said U.S. oil rigs fell two to 497 this week, while gas rigs were unchanged at 121.