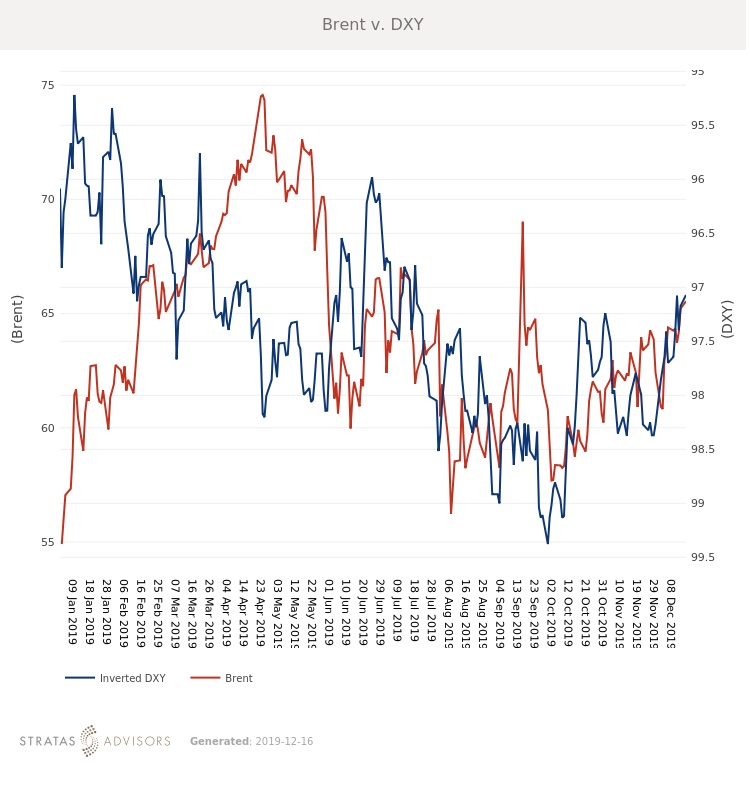

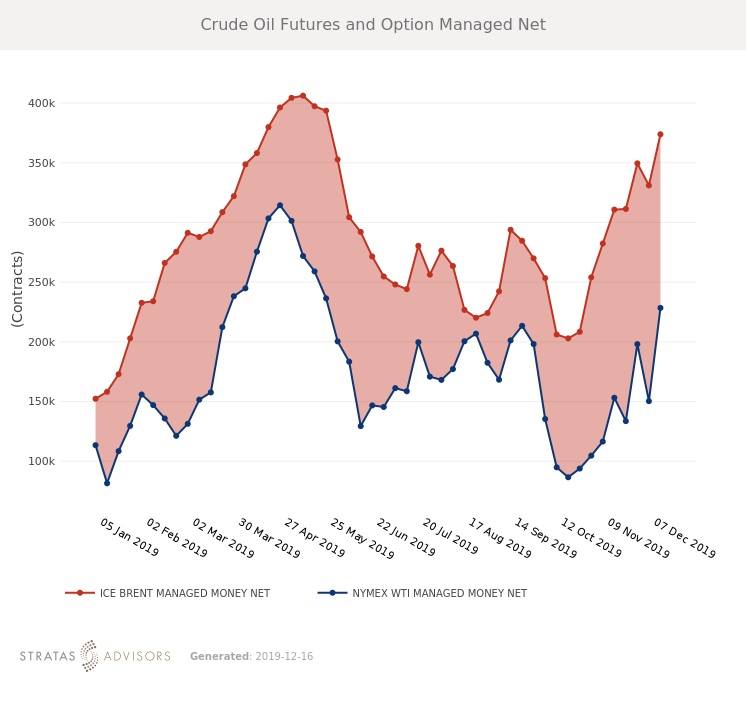

Brent gained $1.78/bbl last week to average $64.29/bbl, while WTI gained $1.63/bbl to average $59.25/bbl. Trade agreements were front and center last week, with significant progress made on Brexit, U.S.-China, and USMCA. For the week ahead, Stratas Advisors foresee more strength pushed by the U.S.-China phase one agreement announced on Friday. Stratas Advisors expect Brent to average $65/bbl in the week ahead.

Markets continue to await full details on the U.S.-China phase one trade deal, but unless the details come out much worse than expected prices should hold steady. Prices are likely to trade fairly range-bound over the week after last week saw several major economic questions semi-answered. The weeks ahead could see some weakness as excitement around the trade deal wanes and also because of lower activity due to the holidays.

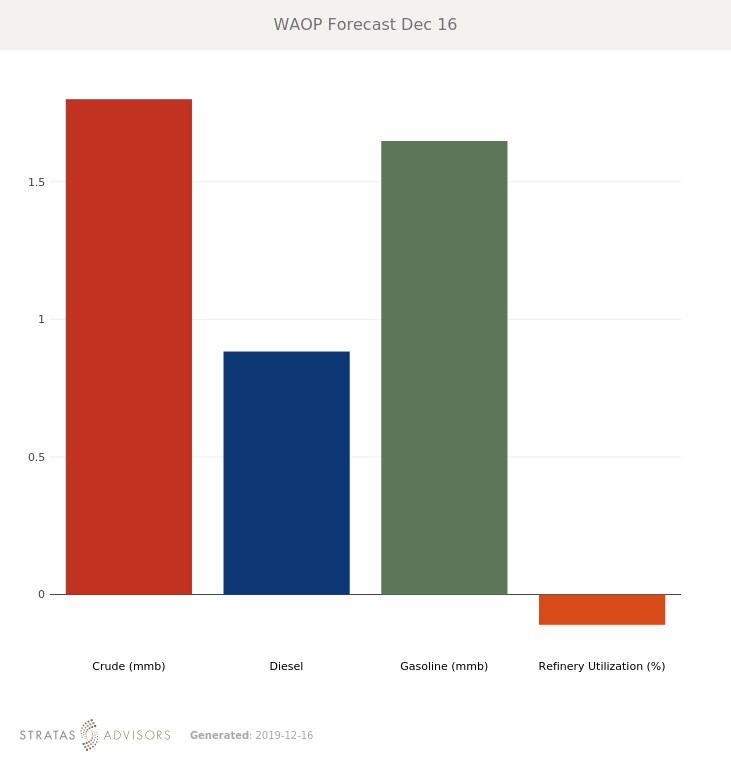

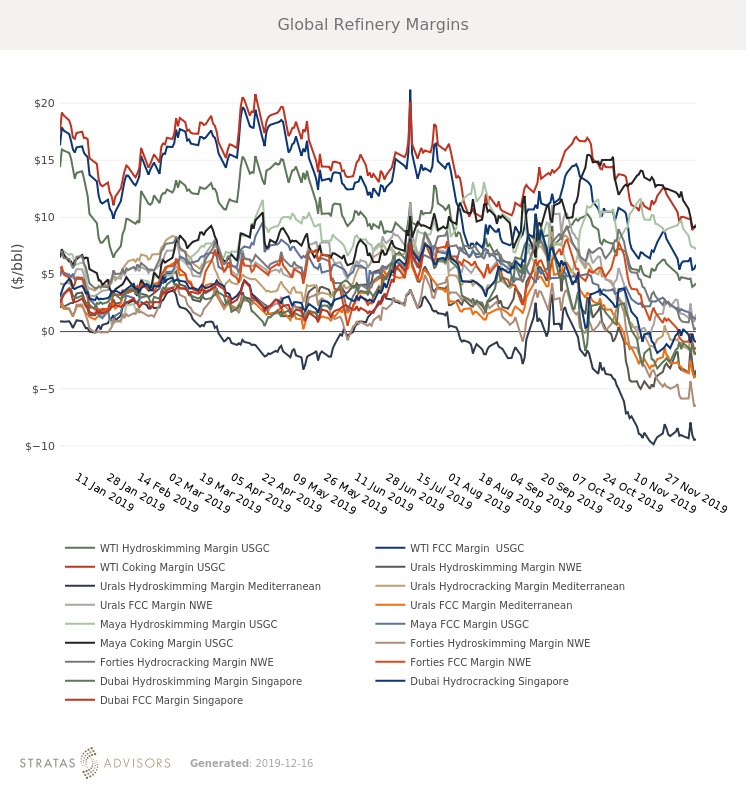

Crude and product stocks in the U.S. and Europe are ending the year close to the five-year average. In the United States gasoline stocks are elevated, in part as a byproduct of strong distillate production. Refining margins in Europe and Asia have weakened considerably during the last several weeks, and crude runs are likely to fall. This could pressure spot prices in those regions, especially Europe.

Geopolitical Unrest – Neutral

Global Economy – Positive

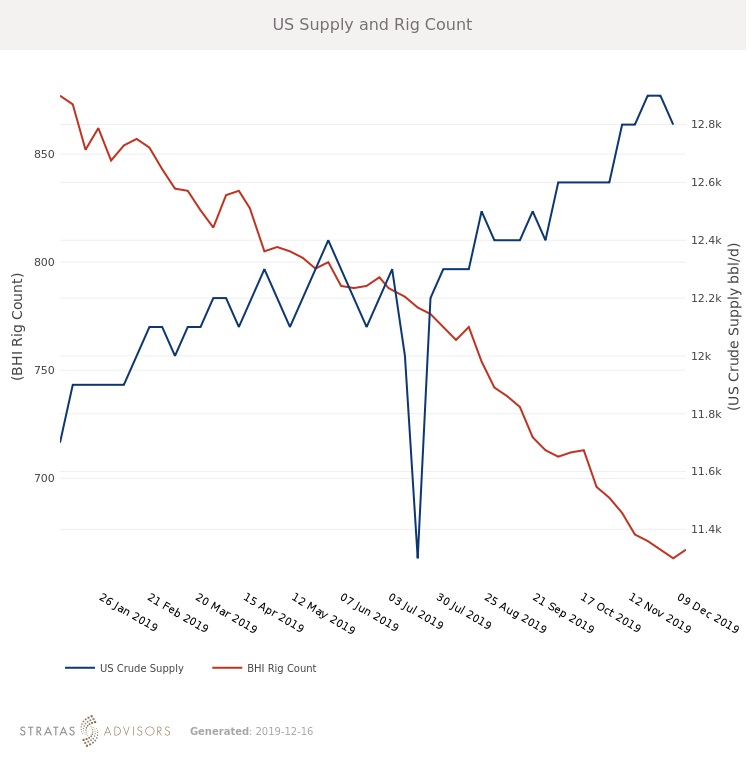

Oil Supply – Positive

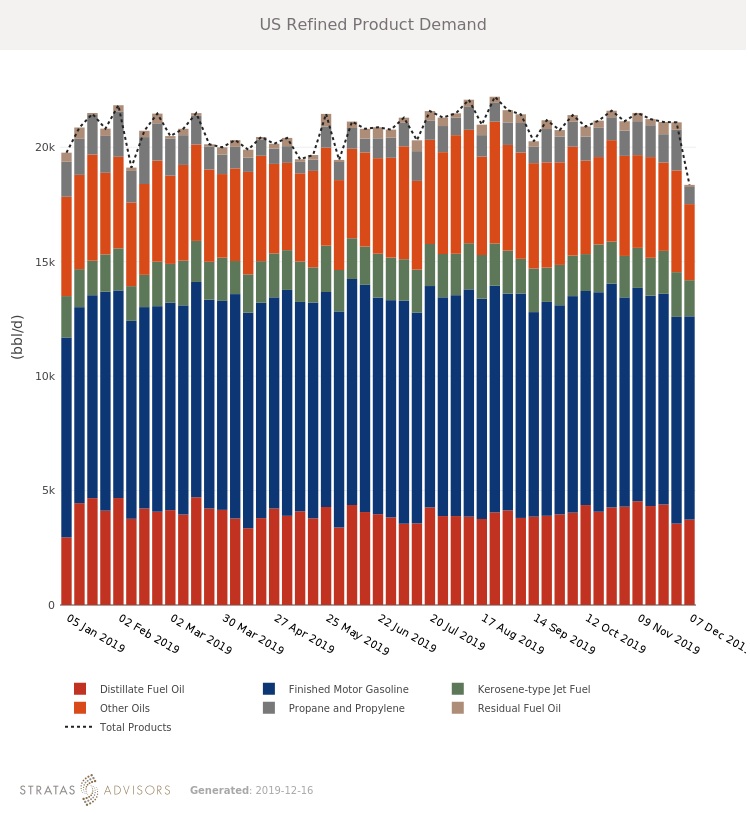

Oil Demand – Negative

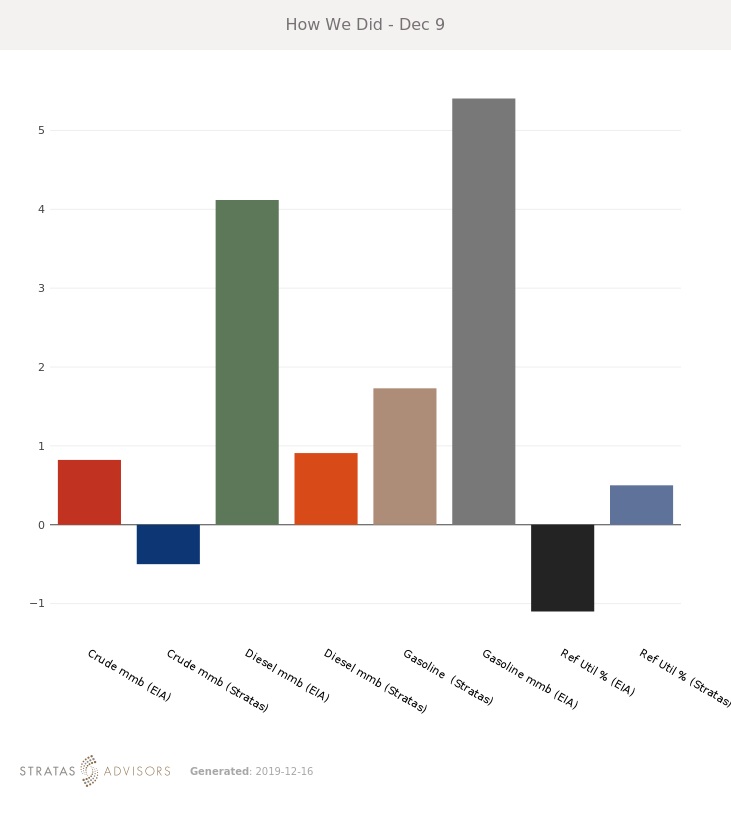

How We Did

Recommended Reading

DUG GAS+: Chesapeake in Drill-but-don’t-turn-on Mode

2024-03-28 - COO Josh Viets said Chesapeake is cutting costs and ready to take advantage once gas prices rebound.

Antero Poised to Benefit from Second Wave of LNG

2024-02-20 - Despite the U.S. Department of Energy’s recent pause on LNG export permits, Antero foresees LNG market growth for the rest of the decade—and plans to deliver.

Heard from the Field: US Needs More Gas Storage

2024-03-21 - The current gas working capacity fits a 60 Bcf/d market — but today, the market exceeds 100 Bcf/d, gas executives said at CERAWeek by S&P Global.

US Natgas Prices Hit 5-week High on Rising Feedgas to Freeport LNG, Output Drop

2024-04-10 - U.S. natural gas futures climbed to a five-week high on April 10 on an increase in feedgas to the Freeport LNG export plant and a drop in output as pipeline maintenance trapped gas in Texas.

US NatGas Futures Hit Over 2-week Low on Lower Demand View

2024-04-15 - U.S. natural gas futures fell about 2% to a more than two-week low on April 15, weighed down by lower demand forecasts for this week than previously expected.