(Source: Shutterstock.com)

[Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

Crude oil prices continue to get support from positive news about the vaccine for COVID-19, which is now starting to be rolled out across several countries and will soon start in the U.S. now that the FDA has provided approval for the vaccine. But despite the milestone of last week, oil prices are facing some near-term headwinds. Lockdowns are starting to occur again in western countries, including the U.S.

Because of the unfavorable developments, the gap between the real economy and the financial economy is widening—and this development also applies to the oil markets.

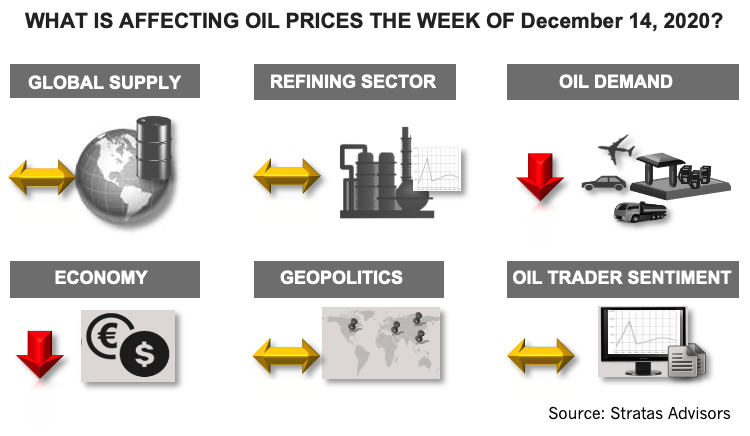

Global Supply—Neutral

Now that OPEC+ has agreed to add 500 thousand b/d of crude supply in January, instead of the previously planned 2.0 million b/d, the focus will be on compliance and the ability for members of OPEC+ to stay aligned during upcoming negotiations.

For the upcoming week, we see this variable continuing to being neutral for oil prices.

Geopolitics—Neutral

Uncertainty about the U.S. presidential election continues to fade away with the election of Joe Biden essentially ensured with President Trump and his legal team running out of options now that the U.S. Supreme Court decided to not hear the case brought by the attorney general of Texas.

Outside the U.S., the conflict between the west and Iran is not going away, although the position of the U.S. could change with the new administration.

For this week, we expect geopolitics will be a neutral factor for oil prices.

Economy—Negative

As pointed out above, western economies are under further pressure because of the ongoing uptick in COVID-19 infections – and the response of further expansion of shutdowns and social and mobility restrictions. Jobless claims in the U.S. have increased during three of the last four weeks and are at levels not seen since September.

For the upcoming week, because of the economic headwinds and the uncertainty of stimulus/recovery deal being reached, we are expecting this variable to be a negative factor for oil prices.

Oil Demand—Negative

Demand in the U.S. is stagnating and showing signs of weakness, and we expect that trend to continue with the expansion of business and social restrictions that is spreading across the country.

For the upcoming week, we expect this variable will be a negative factor for oil prices.

Refining Sector—Neutral

Refining margins continue to be affected negatively by the higher crude prices because product prices are lagging the increase in crude prices. The situation is being aggravated by oil prices being supported by factors other than market fundamentals.

For the upcoming week, we expect this variable will be a neutral factor for oil prices.

Oil Trader Sentiment—Neutral

During the prior week, traders of WTI increased their long positions, while decreasing their short position. The situation was similar for Brent crude. However, we expect the positive sentiment to wain in reaction to the news of expanding lockdowns and restrictions.

For the upcoming week, we expect that this variable will be neutral for oil prices.

About the Author:

Jaime Brito is vice president at Stratas Advisors with over 24 years of experience on refining economics and market strategies for the oil industry. He is responsible for managing the refining and crude-related services, as well as completing consulting.

Recommended Reading

Darbonne: Brownsville, We Have LNG Liftoff

2024-04-02 - The world’s attention is on the far south Texas Gulf Coast, watching Starship liftoffs while waiting for new and secure LNG supply.

Oil Prices Edge Lower on False Report of Israeli Ceasefire, Sustained OPEC Cuts

2024-02-01 - Oil prices fell 2% on the false speculation that Israel and Hamas had tenatively agreed to a ceasefire, but losses were subsequently pared.

Midstream Builds in a Bearish Market

2024-03-11 - Midstream companies are sticking to long term plans for an expanded customer base, despite low gas prices, high storage levels and an uncertain political LNG future.

Venture Global, Grain LNG Ink Deal to Provide LNG to UK

2024-02-05 - Under the agreement, Venture Global will have the ability to access 3 million tonnes per annum of LNG storage and regasification capacity at the Isle of Grain LNG terminal.

DUG GAS+: Chesapeake in Drill-but-don’t-turn-on Mode

2024-03-28 - COO Josh Viets said Chesapeake is cutting costs and ready to take advantage once gas prices rebound.