Despite pronounced weakness at the end of the week, Brent and WTI traded generally sideways last week. Brent fell $0.20/bbl to average $73.65/bbl while WTI was flat on an average basis, despite a volatile week. While the recovery is far from complete, the Brent-WTI differential has widened slightly over the past several weeks, a trend we expect to continue as Suncor (NYSE: SU) continues to bring back online its damaged Syncrude facility. We expect Brent to average $74.50/bbl in the week ahead.

A slew of U.S. sanctions again Iran come back into full effect today, although many of the primary energy related sanctions will not be officially back in place until November. Despite the later deadline, many refiners are already sourcing crude from alternate suppliers. South Korea remains a potentially significant opportunity for American crude exports. This week could see further rhetoric from Iran about lost oil supplies, and OPEC not being responsible for filling the supply gap.

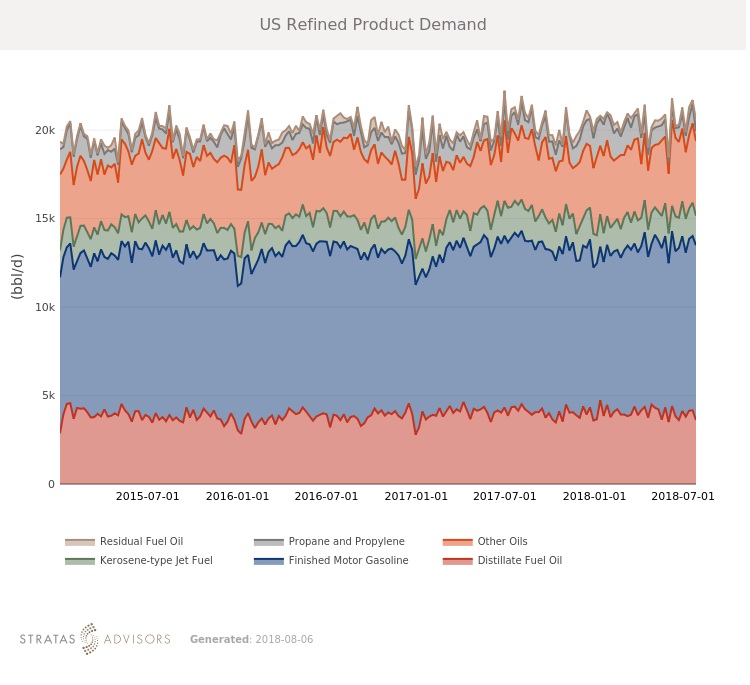

Visible weekly product stocks remain generally at or below five-year averages, a boon for crude demand and margins. Strong runs will continue through the summer, supporting prices. While concerns around the economic impact of tariffs are valid, the physical impact of these tariffs on fuel will likely not be felt for several months.

Geopolitical: Neutral

Geopolitics will be a neutral factor in the week ahead although with some U.S. sanctions against Iran being officially reinstated, both sides could exchange fiery rhetoric.

Dollar: Neutral

The dollar will be a neutral factor in the week ahead as fundamental and sentiment-related drivers continue to have more impact on crude oil prices.

Trader Sentiment: Neutral

Trader sentiment will be a neutral factor in the week ahead after markets were generally pleased with earnings results and future spending plans.

Supply: Positive

Supply will be a positive factor in the week ahead. A slew of U.S. sanctions again Iran come back into full effect today, although many of the primary energy related sanctions will not be officially back in place until November. Despite the later deadline, many refiners are already sourcing crude from alternate suppliers.

Demand: Positive

Demand will be a positive factor in the week ahead. Visible weekly product stocks remain generally at or below five-year averages, a boon for crude demand and margins. Strong runs will continue through the summer, supporting prices. While concerns around the economic impact of tariffs are valid, the physical impact of these tariffs on fuel will likely not be felt for several months.

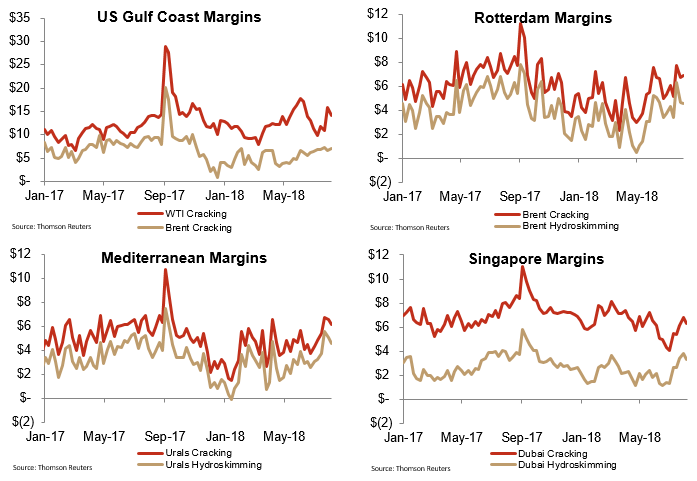

Refining: Positive

Refining will be a positive factor in the week ahead, supported by strong product demand.

Recommended Reading

Waha NatGas Prices Go Negative

2024-03-14 - An Enterprise Partners executive said conditions make for a strong LNG export market at an industry lunch on March 14.

Summit Midstream Launches Double E Pipeline Open Season

2024-04-02 - The Double E pipeline is set to deliver gas to the Waha Hub before the Matterhorn Express pipeline provides sorely needed takeaway capacity, an analyst said.

Kinder Morgan Sees Need for Another Permian NatGas Pipeline

2024-04-18 - Negative prices, tight capacity and upcoming demand are driving natural gas leaders at Kinder Morgan to think about more takeaway capacity.

Enbridge Announces $500MM Investment in Gulf Coast Facilities

2024-03-06 - Enbridge’s 2024 budget will go primarily towards crude export and storage, advancing plans that see continued growth in power generated by natural gas.

Williams Beats 2023 Expectations, Touts Natgas Infrastructure Additions

2024-02-14 - Williams to continue developing natural gas infrastructure in 2024 with growth capex expected to top $1.45 billion.