For the first time in five weeks, the traders of WTI crude increased their net long positions. The increase stems from traders maintaining their long positions while reducing their short positions. (Source: Shutterstock.com)

Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

The price of Brent crude ended the week at $100.99 after closing the previous week at $96.72. The price of WTI ended the week at $93.06 after closing the previous week at $90.77.

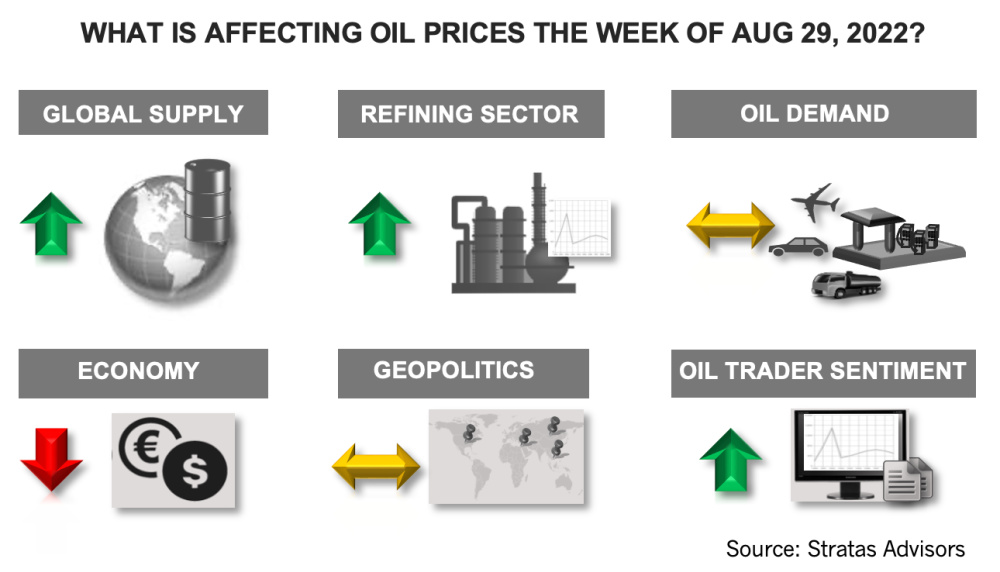

In our note of Aug. 8, we put forth our view that oil prices would rebound from the decline in prices and that the price of Brent crude would return to the channel between $100 and $120. And last week the price of Brent broke above the lower limit, but still is lingering right at the 200-day moving average. Furthermore, there are factors that are putting downward pressure on oil prices.

- Oil demand continues to look weak in the U.S. The latest weekly report from Energy Information Administration (EIA) indicates that gasoline demand in the U.S. decreased to 8.43 million bbl/d from the previous week of 9.35 million bbl/d. In comparison, for the same period of the previous year, gasoline demand was 9.57 million bbl/d. Based on the 4-week average, current gasoline demand is running 831,000 bbl/d less than for the same period of 2019, which represents a difference of 8.57%. Diesel demand in the U.S. decreased to 3.89 million bbl/d from the previous week of 3.93 million bbl/d. In comparison, for the same period of the previous year, diesel demand was 4.10 million bbl/d. Based on the four-week average, diesel demand is running about on par with the same period of 2019. Jet fuel demand remained at unchanged from the previous week at 1.60 million bbl/d. In comparison, for the same period of the previous year, jet fuel demand was 1.40 million bbl/d. Based on the four-week average, jet fuel demand is running 301,000 bbl/d less than in 2019, which is about 16% less.

- On Aug. 26, the Chairman of the U.S. Federal Reserve, Jerome Powell, stated in a speech that U.S. Federal Reserve will continue to attack inflation aggressively and that there is a significant risk to shifting back to more accommodating monetary policy too soon. As such, future interest rate hikes and higher rates for longer are likely. A concern we have been voicing for several months is the U.S. Federal Reserve overreacting to the inflation data, in part, because many factors underlying the elevated inflation are not factors that can be addressed by monetary policy—unless the Federal Reserve is willing to push the economy into a recession. Nothing in the speech by the Chairman alleviates our concerns—and in fact, the speech increases our concerns.

- In response to the speech, the U.S. dollar continued strengthening as indicated by the U.S. Dollar Index increasing from 108.12 at the end of the previous week to close the week at 108.80. The strong US dollar is putting further pressure on the economies of other countries because it is making dollar-denominated commodities more expensive.

- Europe is facing challenging times while making plans to replace imports of natural gas from Russia. Recently, Stratas Advisors published an analysis of the EU’s ability to reach the REPowerEU 100 Bcm Target to Pivot Away from Russian Supply. Our analysis indicates that by late 2022, the EU could face a significant supply shortage, requiring a combination of a drawdown in natural gas storage, as well as the implementation of aggressive demand-side and rationing measures as a last resort to ensure energy security in the short term.

On the other hand, there are factors offering support for oil prices.

- The U.S. Energy Secretary Jennifer Granholm recently encouraged U.S. refiners to build product inventories proactively and to forego exports. Additionally, she implied that if there is a lack of compliance by the refiners the administration will take emergency measures. Such a policy will put further pressure on the price of oil products from a global perspective.

- The crude supply picture is not getting any better, as indicated by U.S. oil production decreasing to 12.0 million bbl/d from the previous week of 12.1 million bbl/d. The EIA report also indicated that U.S. crude inventories decreased by 3.28 million bbl/d. Since the beginning of the year, inventories in the Strategic Petroleum Reserve (SPR) have been drawn down by 141 million barrels. In comparison, commercial inventories have increased by only 3.82 million barrels.

- Regardless of a draft Iranian nuclear deal and further negotiations, we think it remains very difficult for the Biden Administration to sell such a deal to members of congress and voters and to critical allies.

- For the first time in five weeks, the traders of WTI crude increased their net long positions. The increase stems from traders maintaining their long positions while reducing their short positions. Traders of Brent crude also increased their net long positions by adding to their long positions, while reducing their short positions.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

What's Affecting Oil Prices This Week? (April 15, 2024)

2024-04-15 - While concerns about the stability of oil supply are increasing, Stratas Advisors does not expect oil supply to be disrupted – unless there is further escalation in the Middle East.

Paisie: Economics Edge Out Geopolitics

2024-02-01 - Weakening economic outlooks overpower geopolitical risks in oil pricing.

Paisie: Crude Prices Rising Faster Than Expected

2024-04-19 - Supply cuts by OPEC+, tensions in Ukraine and Gaza drive the increases.

Kissler: The Challenge for Oil is Falling Demand, Despite Heightened Middle East Conflicts

2024-02-09 - Even though demand is the bigger weight on traders’ minds right now, Red Sea attacks and the U.S.’ “shadow war” with Iran still have the potential to impact the global oil supply, and consequently, prices.

What's Affecting Oil Prices This Week? (April 22, 2024)

2024-04-22 - Stratas Advisors predict that despite geopolitical tensions, the oil supply will not be disrupted, even with the U.S. House of Representatives inserting sanctions on Iran’s oil exports.