Simulation of Marco (offshore Louisiana) and Laura (near Cuba) on Aug. 24. (Source: earth.nullschool.net; Additional images courtesy of Shutterstock.com)

[Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

The price of Brent crude was essentially flat in comparison with the previous week with Brent closing at $44.35. WTI experienced similar price action closing at $42.34.

For this week we are expecting crude prices to trend upward. Furthermore, we are expecting the Brent-WTI differential will narrow during the week—stemming from WTI gaining support from the hurricanes headed toward the U.S. Gulf Coast.

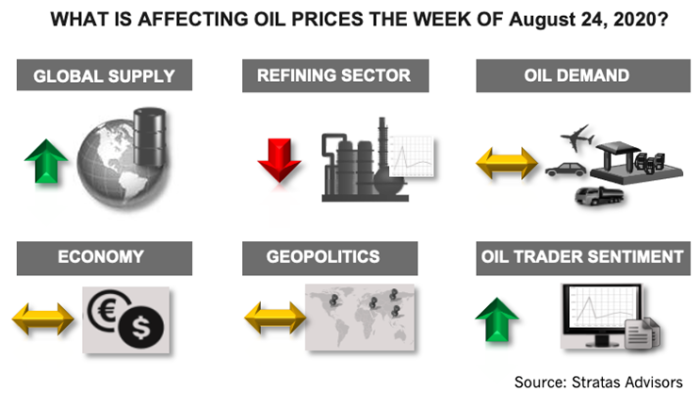

Global Supply—Positive

Participants in the OPEC+ agreement gathered last week to review global fundamentals and the way the extended cartel has implemented the agreed cuts. It was a meeting with no surprises, with Iraq and Nigeria acknowledging their overproduction and defining a way to offset this volume over the next few months, while the rest of the members presented higher commitment levels.

For this week, however, we expect crude supply will be positive factor for prices, because of the potential impact that the Gulf Coast hurricanes could cause in offshore infrastructure, which would reduce crude U.S. production in the Gulf of Mexico for several days.

RELATED:

Hurricane Laura Poses Biggest Threat to US Oil in 15 Years (Updated 10 a.m. CT Aug. 25)

Twin US Gulf Coast Storms Stir Deep Production Cuts by Energy Giants (Updated 8:35 p.m. CT Aug. 24)

Geopolitics—Neutral

There are range of geopolitical factors that relevant for the oil markets—including tensions between the U.S. and China, as well as developments related to Venezuela, the Middle East and Russia. For this week, however, geopolitics is not expected to have any specific effect on oil prices and to be a neutral factor.

Economy—Neutral

An increase in U.S. jobless claims, negative news about economic recovery in Europe and the rebound in COVID-19 in Asia (including India, but also now affecting South Korea and others) highlight the challenges being faced by the global economy. It is likely that additional stimulus programs will be needed between now and the end of the year to keep the economies from reversing the recovery and avoid a financial crisis stemming from households and businesses struggling to service debt.

For this week we expect that the economy will be a neutral factor with respect to oil prices.

Oil Demand—Neutral

The recovery in global oil product demand has remained relatively robust for some time now, but when compared to the last five weeks, the concerns of the increased infections in several key markets is finally having an evident impact on oil fundamentals. For instance, India’s statistics last week showcases record-low crude imports, on the heels of both reduced refining operations and lower demand. While COVID-19 has been wreaking havoc in countries as diverse as Ukraine and Colombia—the market will place more weight on Indian struggling to contain the pandemic.

For this week, we expect demand to be a neutral factor with respect to crude prices.

Refining sector—Negative

Despite the volatility of the demand recovery across the world, refining margins have been relatively stable since the end of May. This not good news for the industry, however, as this stability has occurred while refining margins are still at a low level. Only complex refineries in the world have seen positive refining margins for the last several weeks, whereas simpler refiners, particularly in Europe continue to see negative margins because of weak demand and low prices for refined products. The ensuing lower refining utilization rates are putting downward pressure on oil prices.

Further pressure on the refining sector will come from the impact of the two hurricanes heading toward the U.S. Gulf Coast – which will forecast some refineries to reduce throughput or even shut down temporarily. As such, for this week we expected the refining sector to have a negative impact on the oil prices.

Oil Trader Sentiment – Positive

There was a slight Open Interest decline on the Nymex Light Sweet contracts, for both futures and options combined, but participants increased their activity in both the RBOB and ULSD contracts, as Open Interest for both increased 5% versus the prior week. We see that the potential disruption coming from the arrival of hurricanes Marco and Laura to the USGC as a potential for increased participation for the products contract, and therefore we see a positive contribution of this variable for crude prices.

About the Author:

Jaime Brito is vice president at Stratas Advisors with over 24 years of experience on refining economics and market strategies for the oil industry. He is responsible for managing the refining and crude-related services, as well as completing consulting.

Recommended Reading

Solar Panel Tariff, AD/CVD Speculation No Concern for NextEra

2024-04-24 - NextEra Energy CEO John Ketchum addressed speculation regarding solar panel tariffs and antidumping and countervailing duties on its latest earnings call.

NextEra Energy Dials Up Solar as Power Demand Grows

2024-04-23 - NextEra’s renewable energy arm added about 2,765 megawatts to its backlog in first-quarter 2024, marking its second-best quarter for renewables — and the best for solar and storage origination.

BCCK, Vision RNG Enter Clean Energy Partnership

2024-04-23 - BCCK will deliver two of its NiTech Single Tower Nitrogen Rejection Units (NRU) and amine systems to Vision RNG’s landfill gas processing sites in Seneca and Perry counties, Ohio.

Clean Energy Begins Operations at South Dakota RNG Facility

2024-04-23 - Clean Energy Fuels’ $26 million South Dakota RNG facility will supply fuel to commercial users such as UPS and Amazon.

Romito: Net Zero’s Costly Consequences, and Industry’s ‘Silver Bullet’

2024-04-22 - Decarbonization is generally considered a reasonable goal when presented within the context of a trend, as opposed to a regulatory absolute.