(Source: Shutterstock.com)

[Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

In the last two weeks we saw announcements regarding the closure of a refinery in the Philippines, as well as the Martinez and Gallup assets, in the U.S. West Coast. Adding to this, Phillips 66 announced last week that their San Francisco refinery will be converted to a biofuels-producing facility.

We are expecting to see more announcements pertaining to the rationalization of refining capacity, as companies have to report on third-quarter performance—and the need to prioritize cash flows for the remainder of the year and through 2021.

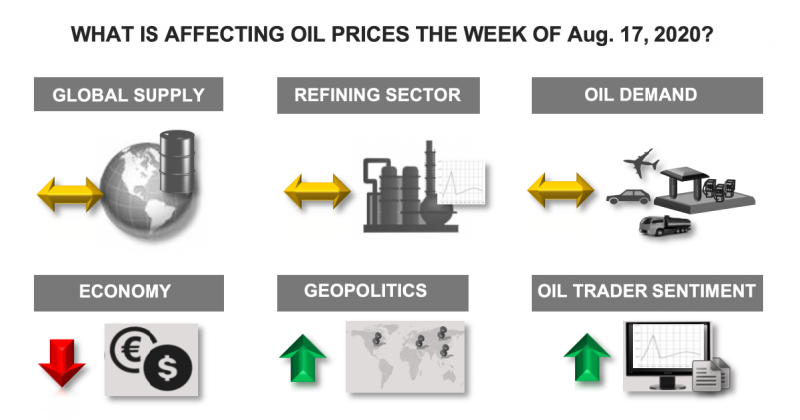

Global Supply—Neutral

Increased production stemming from the reduction in cuts associated with OPEC+ continues to arrive to the market during August.

However, production in the US declined in the previous week by some 300,000 bbl/d, and with respect to the previous year for the same time-period has decreased by 1.6 million bbl/d. Additionally, the production of last week is 2.4 million bbl/d below the peak production that occurred in March of this year. Furthermore, the oil rig count declined for the third week in a row, according to Bake Hughes Co.

The level of commercial crude stocks in the U.S. also continues to decline after reaching a peak in the mid-June. Since that time, the commercial crude inventories have declined by approximately 27 million barrels.

Geopolitics—Positive

As mentioned last week, it was very likely to see events unfolding in the runup to the Presidential elections. The U.S. Department of Justice just announced that it seized four vessels in route to Venezuela. Although no details were given regarding the location of these ships, the development will definitely increase tensions across different dimensions: between the U.S. and Iran, between the U.S. and Venezuela, and the U.S. and those countries with assets or interests in Venezuela, including Russia or China.

Therefore, for this week we expect this variable will have a positive effect oil prices.

Economy—Negative

The lack of a new economic stimulus package in the U.S. weighs negatively on the U.S. economy. So far, Congress has not reached a middle ground mainly because of differences pertaining to the amount of jobless economic support and aid for states. It is possible the continuation of negotiations could take at least three weeks.

Therefore, we see a negative market perception, which translates into a negative factor for oil prices this week.

Oil Demand—Neutral

Demand in different markets, including the U.S. and Asia continues to recover, as economic activities gain traction, despite some worrisome COVID-related developments across the globe. U.S. total product demand has consistently increased over the last six weeks and it is now only 6% away from reaching the five-year average for this time of the year.

Negative news from important markets like India, however, cast a shadow over a potentially positive view for this week, as additional lockdown measures have been implemented in some Indian provinces.

Product inventories in the Singapore also provide a mixed outlook. Inventories of light distillate decline by 1.3 million barrels last week, but still are nearly 50% higher than for the same time-period of the previous year. Inventories of middle distillates are also significantly higher in comparison with last year.

As such, we view this variable as neutral for this week, given the mixed outlook for global oil demand.

Refining sector—Neutral

Despite the recent announcements of refinery closures in the U.S. and Asia, there is also evidence of an important increase in refinery operations across different Asian countries, including Japan and China, which indicates that the reopening continues to underpin demand recovery.

The strongest argument comes from China, where the year-on-year refinery production is more than 10% higher than last year’s, thanks to robust demand, even in a context of severe floods impacting several regions in the country. The level of China’s refining activity is consistent with China’s plan to import additional volumes of U.S. crude in August and September.

For this week, we expect that the refining sector will be a neutral factor for crude prices.

Oil Trader Sentiment—Positive

Open Interest in the Light Sweet Nymex contract increased around 30% over the last week, which is atypical, but might mean trading participants are starting to take long positions in the run up to a potential scalation of geopolitical events over the next couple of months. This contrasts with the open interest for both the RBOB and Distillate contracts, which remained relatively flat vs. last week.

Because of this increased participation, we expect oil trader sentiment to be a positive factor this week for oil prices.

About the Author:

Jaime Brito is vice president at Stratas Advisors with over 24 years of experience on refining economics and market strategies for the oil industry. He is responsible for managing the refining and crude-related services, as well as completing consulting.

Recommended Reading

Report: Crescent Midstream Exploring $1.3B Sale

2024-04-23 - Sources say another company is considering $1.3B acquisition for Crescent Midstream’s facilities and pipelines focused on Louisiana and the Gulf of Mexico.

For Sale? Trans Mountain Pipeline Tentatively on the Market

2024-04-22 - Politics and tariffs may delay ownership transfer of the Trans Mountain Pipeline, which the Canadian government spent CA$34 billion to build.

Energy Transfer Announces Cash Distribution on Series I Units

2024-04-22 - Energy Transfer’s distribution will be payable May 15 to Series I unitholders of record by May 1.

Balticconnector Gas Pipeline Back in Operation After Damage

2024-04-22 - The Balticconnector subsea gas link between Estonia and Finland was severely damaged in October, hurting energy security and raising alarm bells in the wider region.