Stratas Advisors also doesn’t expect OPEC+ announce any significant changes in supply at their upcoming meeting on Aug. 3 considering the weakness in the economies of the U.S. and China, the firm said in it latest oil price forecast. (Source: Shutterstock.com)

Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

The price of Brent crude ended the week at $103.97 after closing the previous week at $103.20. The price of WTI ended the week at $98.62 after closing the previous week $94.70.

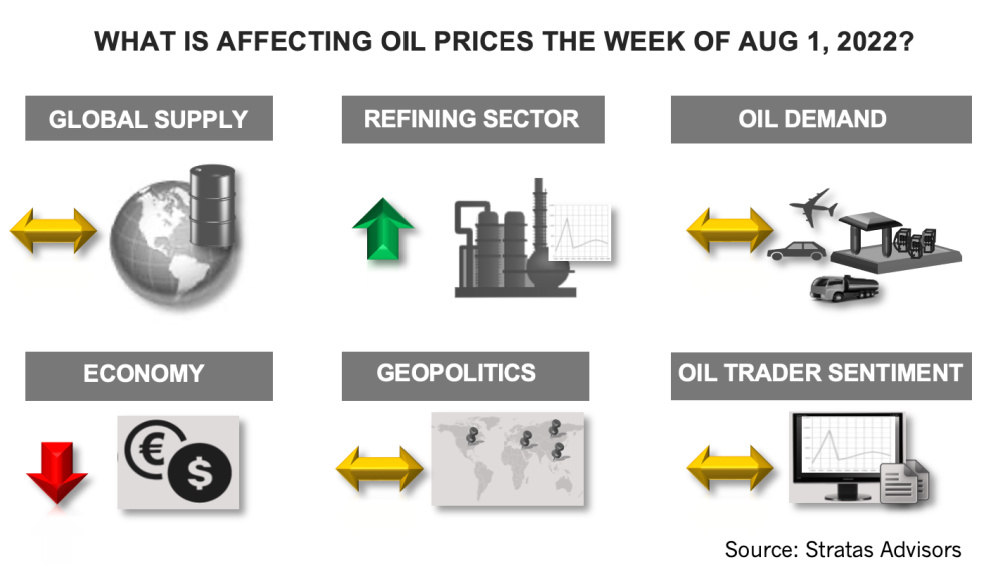

The latest GDP numbers for the U.S. confirm our view that the U.S. economy has been slowing down. The GDP data show that the GDP declined at an annual rate of 0.9% during the second quarter after declining at an annualized rate of 1.6% in the first quarter. Despite the economic slowdown, the U.S. Federal Reserve moved forward with the expected interest rate increase of 0.75%. Oil demand in the U.S. continues to be tepid. The latest weekly report from Energy Information Administration (EIA) indicates that gasoline demand in the U.S. increased to 9.25 million bbl/d from the previous week of 8.52 million bbl/d. In comparison, for the same period of the previous year, gasoline demand was 9.33 million bbl/d. Based on the four-week average, current gasoline demand is running 740,000 bbl/d less than for the same period of 2019, which represents a difference of 7.75%. Diesel demand in the U.S. increased to 3.75 million bbl/d from the previous week of 3.7 million bbl/d. In comparison, for the same period of the previous year, diesel demand was 4.36 million bbl/d. Based on the four-week average, diesel demand is running 17,000 bbl/d less than for the same period of 2019, which represents a difference of 0.45%. Jet fuel demand increased to 1.77 million bbl/d from 1.64 million bbl/d of the previous week. In comparison, for the same period of the previous year, jet fuel demand was 1.65 million bbl/d. Based on the four-week average, jet fuel demand is running 208,000 bbl/d less than in 2019, which is about 11% less.

China’s economy is also showing weakness. China’s economy continues to be affected by COVID-19, as indicated by the recently announced official purchasing managers’ index (PMI) for July. The PMI for manufacturing declined to 49 from 50.2 in June when the manufacturing PMI increased from 49.6 and was the first expansion since February. Further weakness is indicated by the index for new orders declining by 2 points. Additionally, the non-manufacturing PMI declined to 53.8 from 54.7 in June—and the composite PMI declined to 52.5 from 54.1. (Readings above 50 indicate expansion, while readings below 50 indicate contraction). China’s economy is also being hampered by weakness in the property sector, which represents about 25% of China’s overall economy. The difficulties associated with the property sector are highlighted by Evergrande, one of the largest property developers in China, which is struggling to restructure its $300 billion in liabilities. While China’s official growth target for 2022 is 5.5%, Stratas Advisors has been forecasting a GDP growth rate of 4.31%

In contrast, the EU reported economic growth of 4% in comparison to the previous year and 0.6% in comparison to the first quarter. The economic growth occurred even though Germany’s economic growth was flat during the second quarter. While the region grew it is still facing the challenge of elevated inflation, which was 8.9% in July along with future energy challenges.

A significant development on the sanctions front is that the Europe is delaying plans to lock Russia out of the Lloyds of London maritime insurance market. As reported by the Financial Times, the sanctions approved by the U.K. in July only prohibit insurance for vessels shipping Russian oil to the U.K. (taking effect at the beginning of next year) and does not ban insurance on oil shipments from Russia to other countries. While the EU insurance ban remains with no new insurance allowed on vessels shipping Russia oil and existing insurance becoming invalid after Dec. 5, the EU is allowing European companies to deal with some Russia state-owned entities, including Rosneft. The EU has taken steps “to avoid any potential negative consequences for food and energy security around the world.” In previous weekly notes, we have put forth our view that the insurance ban would be counterproductive.

Members of OPEC+ are scheduled to meet on Aug. 3. We are expecting that OPEC+ will not announce any significant changes in supply considering the weakness in the economies of the U.S. and China, and that the EU and the U.S. are wavering with respect to sanctions on Russia’s oil-related exports.

For the upcoming week, we are expecting that oil prices will be under pressure from the weakening economic outlook—and from a technical perspective with the recent price movement resembling a descending triangle, which is a bearish chart pattern.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Report: Crescent Midstream Exploring $1.3B Sale

2024-04-23 - Sources say another company is considering $1.3B acquisition for Crescent Midstream’s facilities and pipelines focused on Louisiana and the Gulf of Mexico.

For Sale? Trans Mountain Pipeline Tentatively on the Market

2024-04-22 - Politics and tariffs may delay ownership transfer of the Trans Mountain Pipeline, which the Canadian government spent CA$34 billion to build.

Energy Transfer Announces Cash Distribution on Series I Units

2024-04-22 - Energy Transfer’s distribution will be payable May 15 to Series I unitholders of record by May 1.

Balticconnector Gas Pipeline Back in Operation After Damage

2024-04-22 - The Balticconnector subsea gas link between Estonia and Finland was severely damaged in October, hurting energy security and raising alarm bells in the wider region.

Wayangankar: Golden Era for US Natural Gas Storage – Version 2.0

2024-04-19 - While the current resurgence in gas storage is reminiscent of the 2000s —an era that saw ~400 Bcf of storage capacity additions — the market drivers providing the tailwinds today are drastically different from that cycle.