With crude prices heading downward again, the question is if crude prices will approach the lower level of the channel that crude prices have been moving within and, if so, will prices break through the lower support level? (Source: Hart Energy; Shutterstock.com)

Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

The price of Brent crude ended the week at $106.65 after closing the previous week at $111.6. The price of WTI ended the week at $102.07 after closing the previous week at $106.54.

With crude prices heading downward again, the question is if crude prices will approach the lower level of the channel that crude prices have been moving within—which in the case of Brent crude is around $95.00—and if so, will prices break through the lower support level? The price of Brent crude has gone through three cycles since February 25 with each cycle resulting in a lower high before the price of Brent crude retreated to the lower support level.

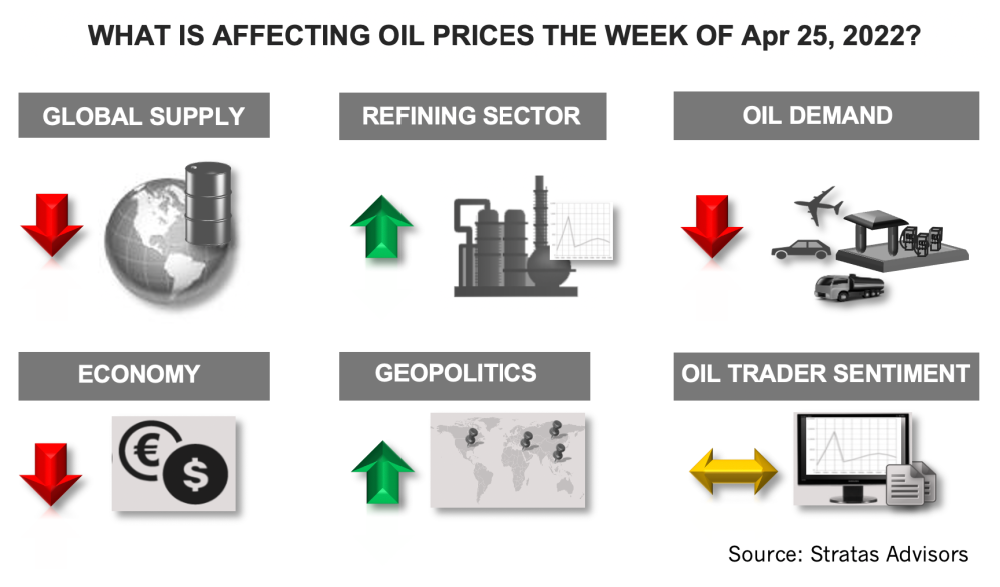

For the upcoming week, the factors driving crude prices offer a mixed bag, but more negative than positive:

- Crude supply will continue to be a negative factor. Additional supply coming from the Stratic Petroleum Reserves along with the Caspian Pipeline Consortium pipeline being back at full capacity (~1.4 million bbl/d) with the second mooring becoming operational after being out of service because of storm damage suffered back in March. Furthermore, Russia has been able to increase exports from the Baltic and Black Sea to Asia with the volume approaching 800,000 bbl/d (from levels in January of around 100,000 bbl/d) with India taking more than half of the increased volumes. Russian crude exports to Europe via ships also increased in April with exports reaching 1.40 million bbl/d, which is around 250,000 bbl/d higher than in March. Additionally, increasing level of crude exports from Russia are being shipped without an identified destiny and a planned route. Some volumes of Russian crude oil are also being transferred to larger ships at sea where the Russian crude oil is mixed with other crude oil.

- Geopolitics will continue to be a positive factor. The Russia-Ukraine conflict is now focused in eastern and southern Ukraine with some uncertainty remaining about the how far the conflict will extend with respect to Odessa and the western border of Ukraine. Regardless, it now looks like there is little hope of a negotiated settlement at least for the next several weeks. With the French elections being over and with Maron winning reelection, attention will return to the possibility of the EU placing sanctions on imports of Russian crude and oil products. It is likely that the sanctions will focus initially on tanker shipments of crude oil and oil products with pipeline shipments being addressed later. Additionally, a transition period will be included with the implementation of the sanctions—of at least one month. However, since the sanctions will need to be approved by the 27 member states of the EU, we are expecting that extensive negotiation will be required and that it will take additional time beyond April 27 to arrive at an agreement—and the final agreement will include a longer transition period. For instance, Germany has previously stated its intentions of eliminating oil-related imports from Russia by the end of the year.

- The global economy will be a negative factor. The economies of the U.S., Europe and Japan have held up reasonably well during the first quarter of this year. However, China’s economy has been hampered by the lockdowns associated with COVID-19. Additionally, the lockdowns in China have affected exports because of manufacturing and logistical disputations. The Russia-Ukraine conflict is also negative for the economic growth because of the resulting higher prices for energy and food. Furthermore, consumers are looking at the future with increased pessimism, which is indicated by the consumer confidence falling to the lowest level in decades in the U.S. and the U.K. There is also more downside risk than upside risk with the threat of spikes in commodity prices and physical shortage growing the longer the conflict continues.

- Oil demand will be a negative factor. For 2022, we are expecting that demand will be less than our initial forecast by some 0.650 million bbl/d, which translates into demand growing by around 3.00 million bbl/d, in comparison to 2021. Moreover, there is further downward risk to the demand forecast because of the possibility of a significant economic downturn.

- Refining is a positive factor. Product crack spreads are relatively wide and product inventories are at lower levels. The outlook for middle distillates looks especially promising with favorable supply/demand conditions from a global perspective. Some of the positivity, however, stems from reduced refining throughput in Russia and in China, coupled with refining closures that took place during the midst of COVID-19.

- The sentiment of oil traders is a neutral factor. Oil traders have not been adding to their net long positions. Since the middle of January of this year, net long positions have declined and compared to one year ago are significantly lower.

While the factors affecting oil prices for the upcoming week are more negative than positive, the one caveat is that we forecast oil prices will quickly reverse course and start back toward $115.00 if the EU surprises with an announcement of sanctions on Russian oil.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

New Fortress Starts Barcarena LNG Terminal Operations in Brazil

2024-03-01 - New Fortress’ facility consists of an offshore terminal and an FSRU that will supply LNG to several customers.

Imperial Expects TMX to Tighten Differentials, Raise Heavy Crude Prices

2024-02-06 - Imperial Oil expects the completion of the Trans Mountain Pipeline expansion to tighten WCS and WTI light and heavy oil differentials and boost its access to more lucrative markets in 2024.

Majors Aim to Cycle-proof Oil by Chasing $30 Breakevens

2024-02-14 - Majors are shifting oilfields with favorable break-even points following deeper and more frequent boom cycles in the past decade and also reflects executives' belief that current high prices may not last.

Exclusive: Andrew Dittmar Expects Increased Public M&A in 2024

2024-02-15 - In this Hart Energy LIVE Exclusive, Andrew Dittmar, Enverus Intelligence's senior vice president, compares 2023 consolidation to what he expects in 2024, including more public to public deals.

Exxon, Vitol Execs: Marrying Upstream Assets with Global Trading Prowess

2024-03-24 - Global commodities trading house Vitol likes exposure to the U.S. upstream space—while supermajor producer Exxon Mobil is digging deeper into its trading business, executives said at CERAWeek by S&P Global.