Stratas Advisors is forecasting that the price of Brent crude oil will average $93.13, but that there is more downside risk than upside risk to the forecast, stemming mainly from uncertainty about global and major economies. (Source: Shutterstock)

The price of Brent crude ended the week at $81.58 after closing the previous week at $86.31. The price of WTI ended the week at $77.87 after closing the previous week at $82.52.

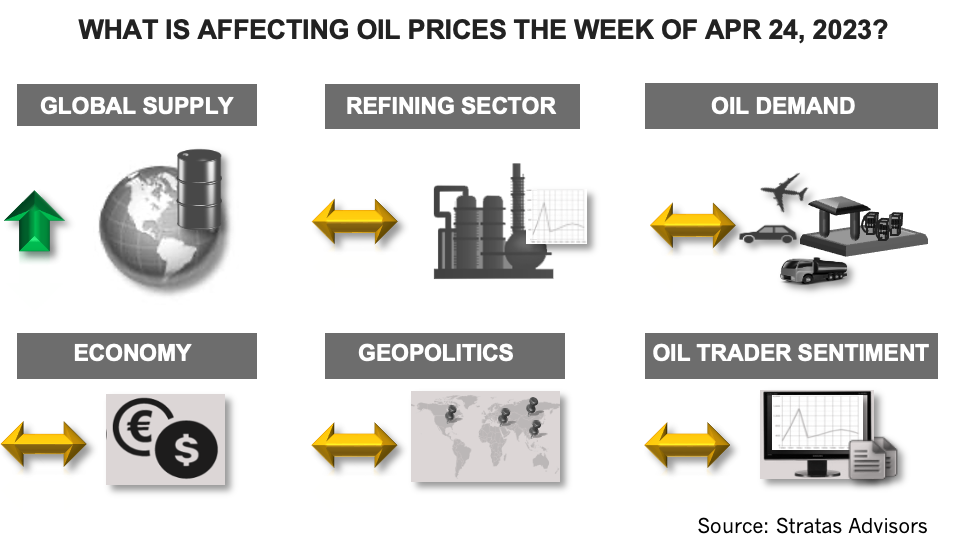

As we reiterated last week, while we are forecasting that the price of Brent crude oil will average $93.13, it is our view that there is more downside risk than upside risk to the forecast, stemming mainly from uncertainty about global and major economies – the U.S., EU and China.

Following the positive news about U.S. inflation the previous week (the consumer price index increased last month by 0.1% and by 5% on an annual basis, which was the smallest since June 2021), the initial U.S. Purchasing Managers Indexes (PMIs) for April improved from March. The composite PMI increased to 53.5 from 52.3 in March, the PMI for the service sector increased to 53.7, while the manufacturing PMI increased to 50.4 from 49.2. (Note: reading above 50 indicates expansion and below 50 indicates contraction). The GDP nowcast from the Atlanta Federal Reserve for 1Q stands at 2.5%.

Europe’s economy also showed some positive signs with the Eurozone’s April PMIs for services increasing to 55.7 from 53.7 in March. The manufacturing PMI, however, decreased to 45.5 from 47.3 in March. Additionally, inflation in Europe remains higher than in the U.S., and its seems that the ECB will need to increase rates further – and more so than the U.S. Federal Reserve, which is close to the end of its cycle of rate increases.

China’s economy is growing moderately since the removal of the zero-COVID policies. While the March PMI for services increased to 57.80 from 55.00 in February, the manufacturing PMI decreased from 51.60 to 50.00. Consequently, the composite PMI only increased to 54.50 from 54.20. China’s economy is not having to deal with inflation but is facing debt-related issues.

From a fundamental perspective, refining margins in the U.S. have decreased for five consecutive weeks and did so last week with gasoline and diesel spreads both narrowing because of product prices decreasing more than crude prices. Based on the 4-week average, crude inputs are running 0.251 MMbbl/d less than in 2019 and by 0.101 MMbbl/d than in 2022. However, based on the average of the last four weeks, exports of crude oil from the U.S. are running at 4.28 MMbbl/d, which compares to 3.18 MMbbl/d during the previous year – and 2.59 MMbbl/d in 2019. Additionally, European and Asian refining margins increased last week with gasoline and diesel spreads widening.

One factor putting downward pressure on oil prices is additional releases from the Strategic Petroleum Reserve (SPR) with 1.61 million released each of the last three weeks. Earlier in December 2022, the Biden Administration announced plans to start refilling the SPR during 1Q of this year. Despite the announcement of the repurchase, we have been holding to the view that no meaningful volumes will be repurchased during much of 2023.

We are also not expecting that oil prices will get much support from the sanctions on Russian oil exports. There is some thought that Russia will be facing new challenges with the U.S. Office of Foreign Assets Control (OFAC) recently issuing an alert to ship owners, insurers, brokers and commodity traders about the possible evasion of the Russian oil price cap. Russia has taken steps to mitigate the impact of the price cap, including the expansion of its fleet of ships. Additionally, for the price of Russian oil to be above price cap – the price of non-sanctioned oil will be elevated, and the market will be tight in terms of supply. These dynamics will make it more difficult to enforce the price cap, especially when western economies are still facing inflation pressures, and China and India are dependent on oil imports to keep their economies growing.

The additional production cuts of 1.16 MMbbl/d associated with OPEC+ that are to start in May, however, will push the market into deficit based on our forecast of oil demand increasing by 2.11 MMbbl/d in relation to 2022. As such, we are expecting that price of Brent will stabilize around $80 and will start moving upward as we enter the summer months.

For a complete forecast of refined products and prices, please refer to our Short-term Outlook.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Marathon Chasing 20%+ IRRs with Los Angeles, Galveston Refinery Upgrades

2024-02-01 - Marathon Petroleum Corp. is pursuing improvements at its Los Angeles refinery and a hydrotreater project at its Galveston Bay refinery that are each boasting internal rate returns (IRRs) of 20% or more.

The One Where EOG’s Stock Tanked

2024-02-23 - A rare earnings miss pushed the wildcatter’s stock down as much as 6%, while larger and smaller peers’ share prices were mostly unchanged. One analyst asked if EOG is like Narcissus.

Some Payne, But Mostly Gain for H&P in Q4 2023

2024-01-31 - Helmerich & Payne’s revenue grew internationally and in North America but declined in the Gulf of Mexico compared to the previous quarter.

Kimmeridge Fast Forwards on SilverBow with Takeover Bid

2024-03-13 - Investment firm Kimmeridge Energy Management, which first asked for additional SilverBow Resources board seats, has followed up with a buyout offer. A deal would make a nearly 1 Bcfe/d Eagle Ford pureplay.

M4E Lithium Closes Funding for Brazilian Lithium Exploration

2024-03-15 - M4E’s financing package includes an equity investment, a royalty purchase and an option for a strategic offtake agreement.