The increased tensions between the U.S. and Russia could provide an incentive for Russia to destabilize the OPEC+ framework, by pushing for greater production increases. (Source: President of Russia Vladimir Putin by Gevorg Ghazaryan / Shutterstock.com)

[Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

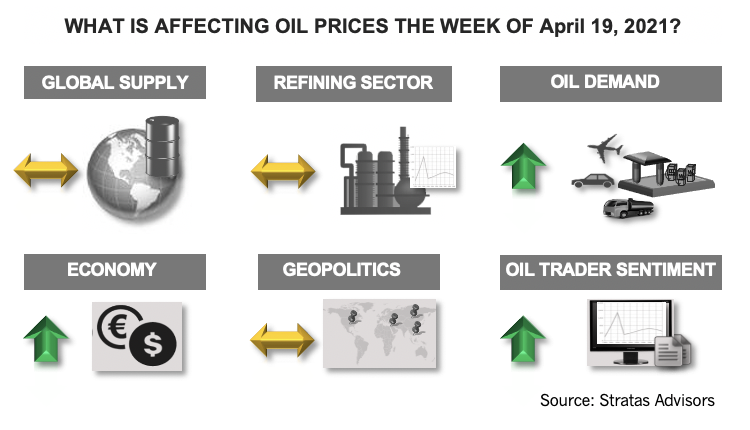

The price of Brent crude ended the week at $66.77 after closing the previous week at $63.05. The price of WTI ended the week at $63.13 after closing the previous week at $59.34. The increase in crude oil prices reversed the downward trend that had been in place since March 11 of this year, during which time the price of Brent crude declined by 9.45%. Additionally, the reversal is consistent with our forecast that included recovering oil prices during the second quarter.

The increase in prices was supported by the improving demand picture, as indicated by the International Energy Agency and the research arm of OPEC increasing their global demand forecasts for 2021, with both forecasts moving closer to the forecast of Stratas Advisors that was posted earlier this year. The price increases were also supported by the Energy Information Administration reporting the second straight week of significant drawdown in U.S. crude inventories. The level of crude inventories in the U.S. are now lower than for the same period of the previous year. Additionally, oil traders reversed course and start adding to their net long positions again.

At this point, it appears that the recovery of the global economy and the oil markets are well on the way with the expectation that oil demand will outpace global supply during second-quarter 2021. While there are concerns about inflation (which we think has been overhyped) the main risk from a demand perspective remains associated with COVID-19. While the rollout of the vaccine supports optimism, there are still risks, as evidenced by the uptick in cases in India and the ongoing struggles in countries like Brazil.

From the supply-side perspective the situation also looks to be on a stable path with the OPEC+ framework remaining in place after the recently agreed production increases. There are remaining risks, however, because of the unique relationship between oil markets and geopolitics. The associated risks were highlighted last year when U.S. imposed sanctions on a Russian oil trading entity because of its alleged activities pertaining to the Venezuelan regime. In part, because of these sanctions, Russia took a hardline when negotiating with OPEC in response to the declining oil demand associated with COVID-19-related lockdowns. The result was oil prices plummeting below $30 in early April 2020, which ultimately forced OPEC and Russia to resume negotiations, and agree to a production cut of 9.7 million bbl/d. As such, the heightened tensions between the U.S. and Russia, and the decision by the Biden Administration to expel several Russian diplomats from U.S. soil, and the response by Russia to expel U.S. diplomats is noteworthy for the oil markets. The increased tensions between the U.S. and Russia could provide incentive for Russia to destabilize the OPEC+ framework, by pushing for greater production increases, which could trigger other producers to take the same position. That said, for Russia to adopt such an approach would require Russia to weigh the benefits associated with increased production and greater market share against risks of lower oil prices.

The other potential geopolitical development that could affect oil supply pertains to the growing linkages between China and Iran, including expanding imports by China of Iranian oil and condensate. This development could be a greater risk than the risk associated with Russia because both China and Iran would benefit from increased supply from Iran, while not being affected by any of the negative market factors. However, the strategy is not without risk, because the U.S. would feel compelled to respond. Furthermore, the U.S. is continuing to strengthen its alliance with other Asian countries, including Australia, India and Japan, in part, to counter China. The alliance was highlighted this past week by the meeting between President Biden and Japan’s Prime Minister, during which they openly stated the need to align actions to counter China’s expanding presence in the region. The tensions with China also include Europe, which has been struggling to arrive at a trade agreement with China.

While the major economies—and the oil markets—seem to be moving toward an improving and more stable state, the recent set of geopolitical developments highlights that there are always risks associated with the oil markets—and that these risks extend beyond supply/demand fundamentals.

About the Author:

John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Eni, Vår Energi Wrap Up Acquisition of Neptune Energy Assets

2024-01-31 - Neptune retains its German operations, Vår takes over the Norwegian portfolio and Eni scoops up the rest of the assets under the $4.9 billion deal.

NOG Closes Utica Shale, Delaware Basin Acquisitions

2024-02-05 - Northern Oil and Gas’ Utica deal marks the entry of the non-op E&P in the shale play while it’s Delaware Basin acquisition extends its footprint in the Permian.

California Resources Corp., Aera Energy to Combine in $2.1B Merger

2024-02-07 - The announced combination between California Resources and Aera Energy comes one year after Exxon and Shell closed the sale of Aera to a German asset manager for $4 billion.

DXP Enterprises Buys Water Service Company Kappe Associates

2024-02-06 - DXP Enterprise’s purchase of Kappe, a water and wastewater company, adds scale to DXP’s national water management profile.

Pioneer Natural Resources Shareholders Approve $60B Exxon Merger

2024-02-07 - Pioneer Natural Resources shareholders voted at a special meeting to approve a merger with Exxon Mobil, although the deal remains under federal scrutiny.