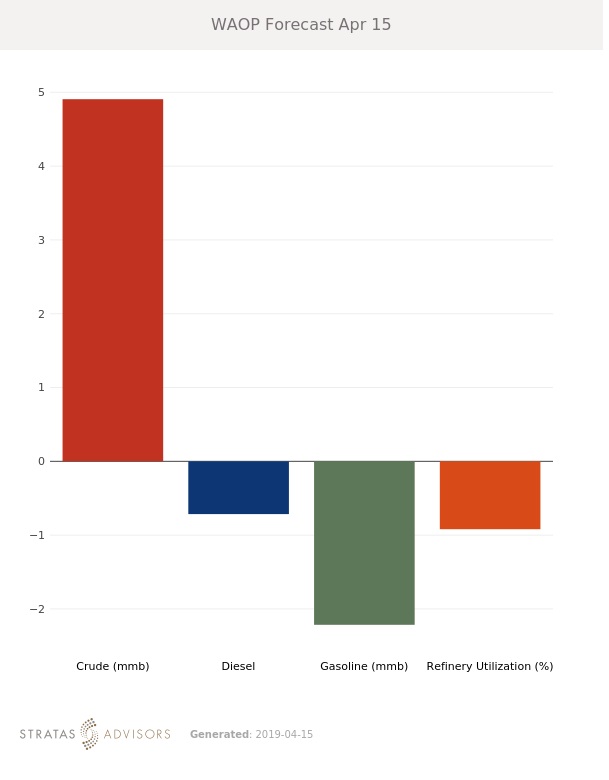

In the week since our last edition of What’s Affecting Oil Prices, Brent rose $1.68/bbl last week to average $71.16/bbl, almost perfectly in line with our expectations. WTI rose $1.73/bbl to average $64.09/bbl. For the week ahead we expect that Brent and WTI are running out of steam, and could see a contraction. We expect Brent to again average around $71/bbl and be generally rangebound.

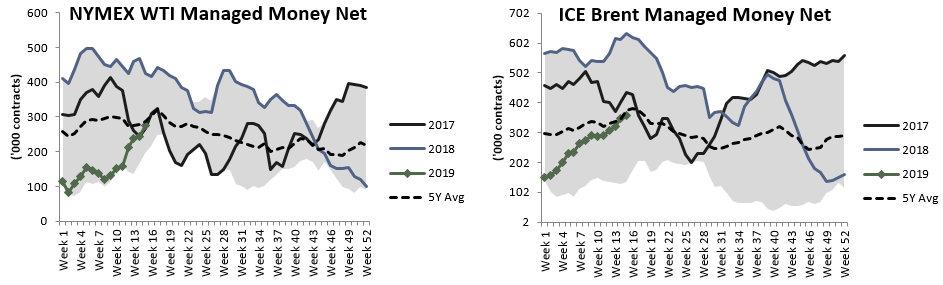

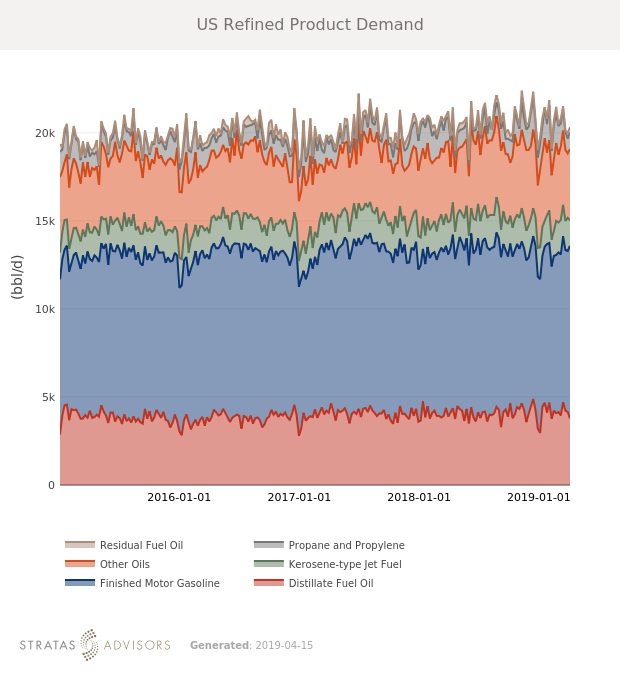

While the recent lift in prices has certainly been based in reality, risks to the downside continue to accumulate, and optimism can only take markets so far. Demand appears to be meeting expectations, but the probability of a significant upside surprise is still relatively minimal. Positioning also indicates that traders could begin to engage in profit taking, as the ratio of long to short positions in crude and gasoline has become skewed.

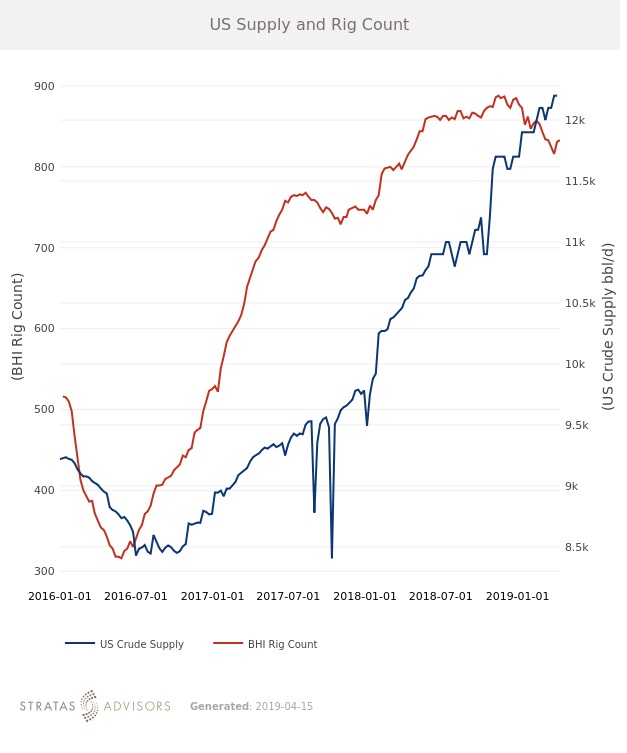

On the supply side, rumors that the OPEC deal will not be extended in June are becoming more common, with Russia posing a particular problem. While similar reports have emerged in advance of almost every meeting since the deal was struck, they do still bear watching. The supply agreement has existed in one form or another for three years now and some members have voiced impatience and concern about losing market share. Additionally, the U.S. has extended sanctions (some oil-related, some now) against several of the OPEC+ agreement members. Combined with rising U.S. supply, market share concerns could be stronger at this upcoming meeting than any time prior. While we expect cuts to persist, our current global forecast assumes that OPEC production does increase in the latter half of the year; due either to the deal being phased out or simple cheating.

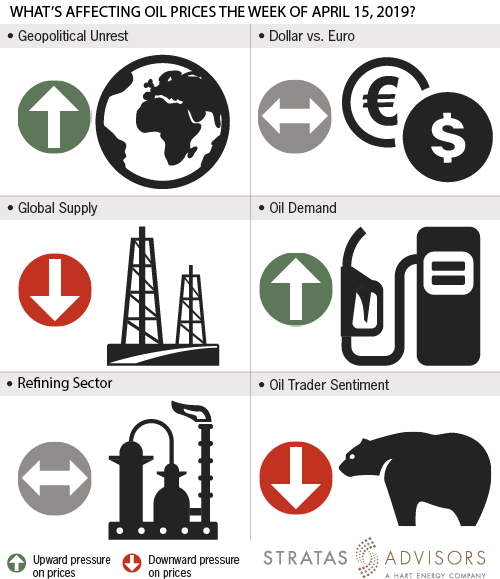

Geopolitical: Positive

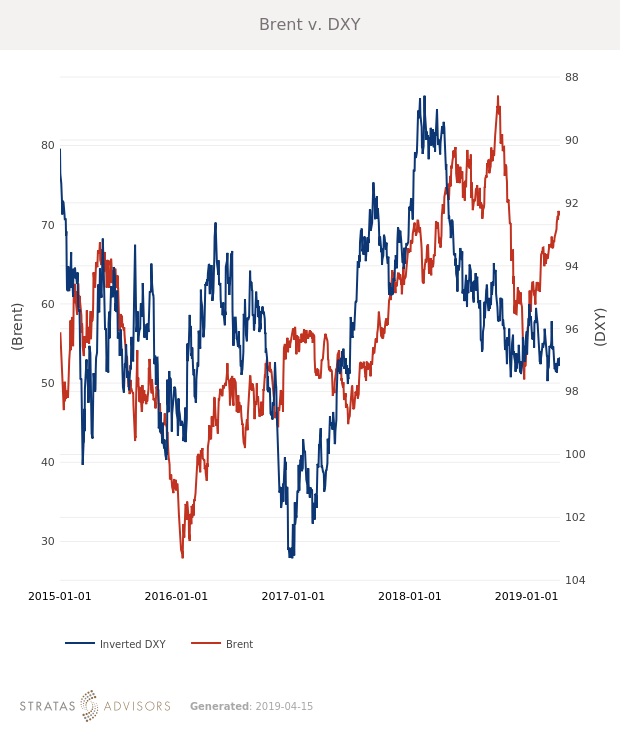

Dollar: Neutral

Trader Sentiment: Negative

Supply: Negative

Demand: Positive

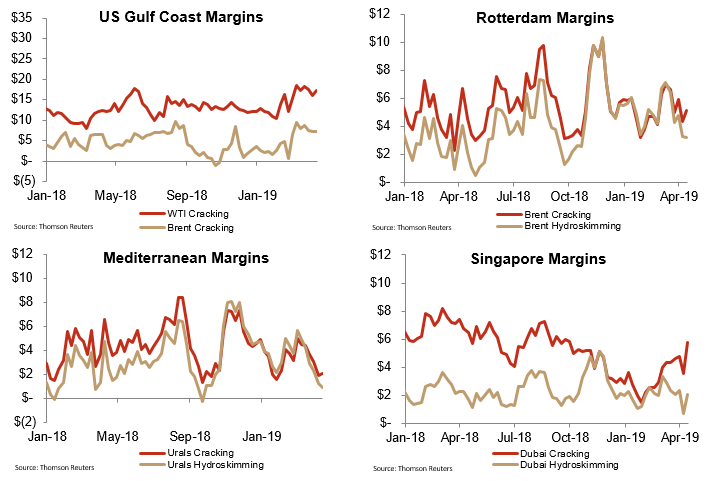

Refining Margins: Neutral

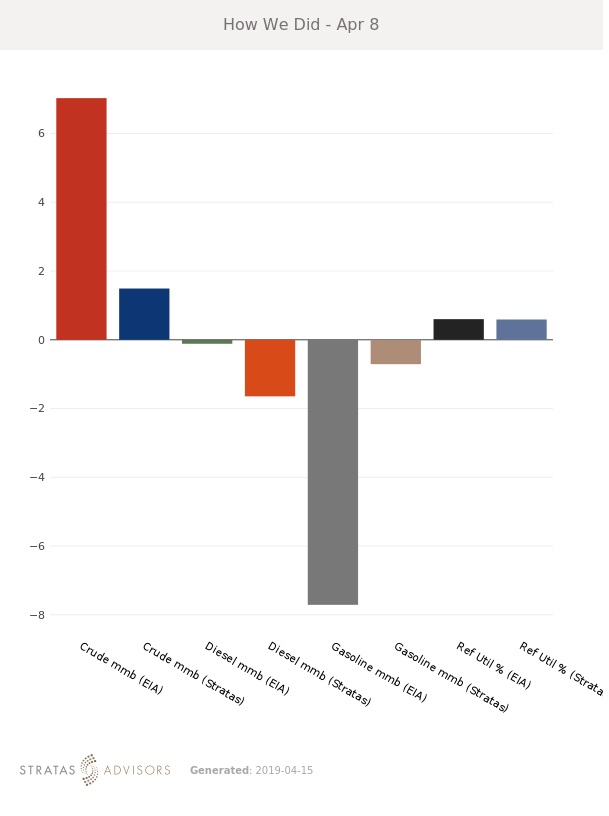

How We Did